Get Paid Monthly by 13.5%-Yielding Prospect Capital Stock

Outlook for Prospect Capital Remains Robust

Interest rates have finally started to come down. And while that may be good for borrowers, it’s making it tougher for passive income investors to generate higher yields. That’s where business development companies (BDCs) like Prospect Capital Corporation (NASDAQ:PSEC) come in.

While larger public companies can turn to big banks or capital markets, it’s tougher for smaller companies to obtain financing. Enter BDCs. They’re closed-end investment companies that invest in small- and mid-sized private companies. BDCs are also required to provide managerial assistance to the companies in which they invest.

In addition to providing much-needed capital and direction to small- and medium-sized companies to grow their business, because of a financial loophole, BDCs pay no corporate tax if they distribute at least 90% of their taxable income to shareholders. This translates into big distributions, which makes BDCs like Prospect Capital a win-win situation for small businesses and investors.

New-York-City-based Prospect Capital is a leading provider of private debt and private equity to middle-market companies in the U.S. Prospect is actually one of the largest ($7.9 billion in total assets) and oldest (founded in 2004) publicly traded BDCs. (Source: “Investor Presentation,” Prospect Capital Corporation, June 30, 2024.)

Over its 20-year history, which includes being invested throughout the 2008 Financial Crisis and 2020 health crisis, Prospect has invested $20.9 billion across 423 investments (303 exited).

Its current portfolio includes 117 investments in 35 different industries, with a particular focus on those that are less cyclical. Of Prospect’s portfolio, 81% is comprised of first-lien, secured, or underlying secured assets.

This helps provide Prospect Capital with stable recurring revenue. A whopping 89% of its total investment income in the second quarter (ended June 30, 2024) came from interest income.

That track record is why financial institutions are more than happy to support Prospect Capital. In June, it completed an amended and extended credit facility with a new five-year maturity. As of August 27, the credit facility had $2.1 billion in commitments from 48 commercial banks, an increase of $168.0 million from March 31, 2024.

86th Consecutive Monthly $0.06 Dividend Declared

For the fourth quarter of fiscal 2024, ended June 30, 2024, Prospect Capital announced that net investment income increased nine percent on a sequential basis to $102.9 million, or $0.25 per share. Of the total investment income, 89% came from interest. (Source: “Prospect Capital Announces June 2024 Financial Results and Declares 86th Consecutive $0.06 Dividend,” Prospect Capital Corporation, August 28, 2024.)

The BDC’s net asset value (NAV) was mostly flat on a sequential basis at $3.71 million, or $8.74 per share.

Prospect also declared its 85th and 86th consecutive $0.06-per-share monthly distribution, for September and October. This works out to an annual distribution of $0.72 per share, for a current forward yield of 13.56%.

Since its 2004 initial public offering (IPO), Prospect has declared cumulative distributions of $21.12 per common share, totaling $4.3 billion. This represents 2.4 times the fourth-quarter NAV of $8.74 per share and 2.96 times its current share price.

Prospect Capital Stock Up 17%

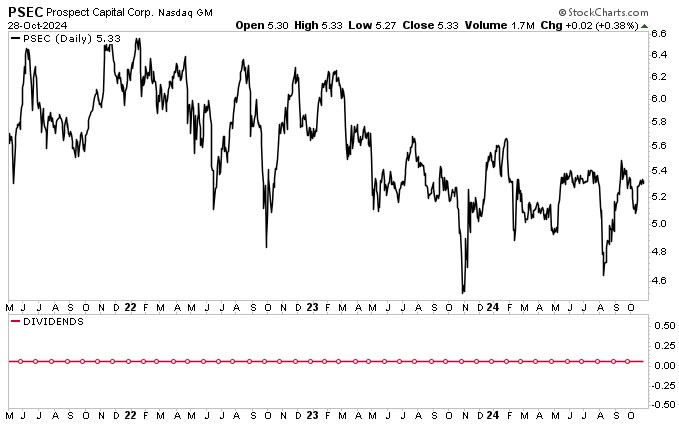

While Prospect Capital stock is up approximately 17% over the last year and down two percent in 2024, it’s been a bumpy ride. PSEC shares have been trading just above their $5.28 support level and below the $5.51 resistance level.

Aside from some near-term gains and losses, long-term stock market gains have been hard to come by. Some of that, of course, can be blamed on the higher interest rate environment

Higher interest rates are great for lenders, but interest rates that are too high can force businesses to hold off on expansion efforts. Fortunately, the lower interest rate cycle should result in more small- and medium-sized businesses coming in from the sidelines and more BDCs issuing debt, which should help energize their bottom lines and, hopefully, share prices.

Chart courtesy of StockCharts.com

The Lowdown on Prospect Capital Stock

Prospect Capital Corporation is one of the oldest and largest BDCs with a growing, diversified portfolio focused on less cyclical industries. Of its total investments, 81% are in the form of loans secured by a first lien or other secured debt. On top of that, for the quarter ended on June 30, 2024, 89% of the BDC’s total investment income was interest income on loans.

This helps provide Prospect with a reliable income stream, which supports its monthly distributions. In fact, Prospect Capital stock is a yield-oriented BDC that has paid a continuous, regular dividend to its investors since its inception.

Prospect Capital stock has declared dividends to common shareholders totaling $4.3 billion, or $21.12 per common share, since its 2004 IPO. It also just recently declared its 86th consecutive $0.06-per-share dividend to shareholders.