WMT stock Dividend 2017: Wal-Mart Yield, Dates, Splits, Prediction, and Everything You Need to Know

Is WMT Stock Worth Your Investment?

Wal-Mart Stores Inc (NYSE:WMT) is the largest retailer in North America and has a presence around the world, including China, Canada, Mexico, and the U.K. It operates over 10,000 stores, which consist of discount department stores, wholesale clubs, and supermarkets. However, WMT stock has been flat over the past year; is this a great opportunity to pick up shares?

The retail sector is seeing a dramatic change, with more customers now making their purchases online, thanks to the convenience of having goods delivered rather than having to visit a physical location.

Companies that are not willing to adapt to the change will see a negative impact on their earnings and their financial statements. This will also affect those that own the shares of these businesses.

So before considering an investment in the retail sector, it is important to understand the whole company and its corporate strategy based on its past and present actions.

With shares being flat over the past years; does this mean that Walmart is sticking to the traditional business model of physical stores and ignoring the growth in e-commerce? Also, WMT stock pays a dividend; will it be affected negatively in the future?

Below are answers to these questions, as well as a look at WMT stock as a whole. Here is an index of the topics in this article:

- Wal-Mart Stores Inc Forecasted Earnings Per Share

- Stock Dividend Data for WMT Stock

- Wal-Mart Stores Inc Dividend Growth History

- Current Dividend Policy

- Ex-Dividend Dates

- Dividend Reinvestment Program

- Stock Split History

- Will WMT Stock Split in 2017?

- Wal-Mart Stock Predictions For 2017

#1. Wal-Mart Stores Inc Forecasted Earnings Per Share

Earnings for a company are reported on a quarterly basis, with the expectation being that they will grow as time passes. However, do not compare current earnings to the previous quarter; instead, take the quarterly earnings and compare them to the same period a year prior. This is done because there will be times that a business’ sales get a seasonal boost or slow down, no matter the sector.

Whether earnings are being compared quarterly or annually, the trend is necessary knowledge. That way, you are aware of and can account for the likes of one-time charges, foreign exchange capital losses, and times where weather conditions impacted sales.

The above applies to Wal-Mart as well. Sales in August saw a rise because of the back-to-school period, with the trend continuing to the end of the year, which includes the holiday season.

Forecasted earnings are also very important and are estimated by analysts that follow the company and its industry peers very closely.

Below are the earnings reported for fiscal year 2017 and analysts’ forecasts. The forecasted earnings are taking from all analysts that follow the company and averaged out.

| Earnings Period | Fiscal Year 2017 (Representing Actual Earnings for 2016 ) | Fiscal Year 2018 (Representing Estimated Earnings for 2017) |

| Quarter 1 | $0.98 | $0.96 |

| Quarter 2 | $1.07 | $1.07 |

| Quarter 3 | $0.98 | $0.97 |

| Quarter 4 | $1.30 | $1.32 |

| Total Annual Earnings | $4.33 | $4.32 |

According to the above chart, analysts expect that earnings will be down $0.01, or that they will be pretty much flat. Keep in mind that, for shareholders, flat earnings are better than negative ones.

There are two reasons for this expectation. One is that the Wal-Mart is currently closing stores in international markets that are proving to be unprofitable, and this action carries a one-time cost. The other is capital spending on the e-commerce side of the business. It’s no surprise, given growth from this side of the business is in the double-digits, compared to single-digit growth from brick-and-mortar locations.

One method of growing the online side of the business was the purchase of e-commerce company Jet.com, Inc. in 2016. Both businesses sell a lot of the same products, which is a benefit, and Jet.com’s senior managers could benefit other areas of the business. (Source: “Walmart Completes Acquisition of Jet.com, Inc.,” Wal-Mart Stores, Inc, September 19, 2016.)

Analysts have taken notice of these actions by management. Below are Wal-Mart’s forecasted earnings for the next four years.

| Year of Fiscal Forecasted Earnings | Total Amount of Annual Estimated earnings |

| 2018 | $4.32 |

| 2019 | $4.54 |

| 2020 | $4.92 |

| 2021 | $5.64 |

Forecasted earnings are on an upward trend, which is expected by investors. Over this period, estimated earnings are expected to grow 30%. This is a very positive outlook from analysts on the company overall.

This should support a few things, including the dividend payment and share price, which should be bid higher based on the expected growth. This should help WMT stock get out its trading range, which it has been stuck in over the past year.

#2. Stock Dividend Data for WMT Stock

WMT Stock pays a quarterly dividend to its shareholders, in the months of April, June, September and January. Below is a more detaailed table of the stock dividend data for WMT stock.

| Dividend Yield | Annual Dividend Payment | Payout Ratio | Dividend Growth |

| 2.86% | $2.04 | 47% | 42 Years |

WMT stock is known as a dividend growth stock and the evidence is in the past 42 years of seeing an increase.

From the earnings that are generated, less than half is given to shareholders via a dividend payment.

#3. Wal-Mart Stores Inc Dividend Growth History

A dividend growth stock is one that that increases its dividend on a continuous basis. Every company uses a different frequency when reviewing their dividend policy. Some use an annual method, while others review it less frequently and have no growth pattern.

To determine if a stock would be considered a dividend growth stock, consider the dividend payment history. Even though the past does not represent future returns, prior actions should speak for themselves.

Dividend growth stocks have many other benefits for investors. For starters, since there is an obligation to pay out a dividend, management will ensure that earnings can support the payout. This helps inspire financial discipline, preventing the company from taking huge risks. The management team will ensure there is enough money in the bank to pay out the dividend.

As long as the dividend can continue to go higher, the yield on the average cost should increase as well. This would require being patient, keeping the stock within your investment portfolio. This also reduces the likelihood of seeing the dividend being cut or simply eliminated by the company.

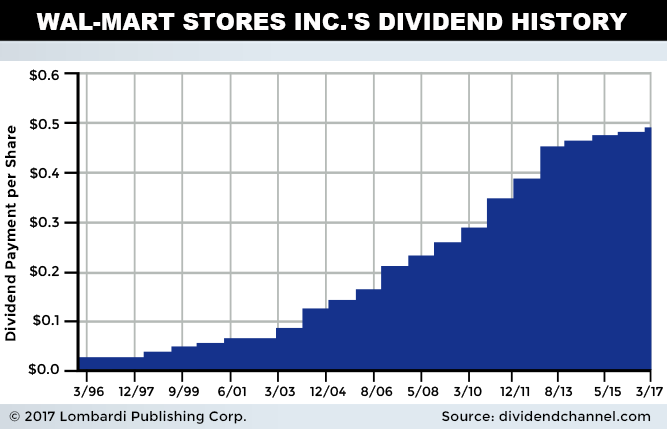

Now, let’s take a look at how WMT stock’s dividend has performed in the past. Reviewed every February, the first dividend was paid out in 1974, making 2017 the 44th year that the dividend has seen an increase.

This consistency from Wal-Mart has been recognized, as indicated by its membership in the S&P 500 Dividend Aristocrat Index. To be part of this index, there are two requirements: the company must be a Fortune 500 company and have increased its dividend for least 25 consecutive years.

Below, I focused on the past 20 years of the dividend growth for WMT stock. The dividend payments accounts for all stock splits that have taken place.

Back in 1996, the dividend payment per share was $0.026 per share, and today it is now $0.51 per share. This means the dividend saw growth of 1,861%. This is how powerful a dividend growth stock is when there is more time spent in the investment.

#4. Current Dividend Policy

Each company that pays out a dividend will have a different dividend policy in place. A dividend policy is a set of guidelines that are followed by the company when determining what to pay its shareholders. As such, it is important to consider past actions and management’s point of view of the policy itself.

If an administration says one thing and does something else, it’s obviously not a good thing, and indicates a chance of more surprises in the future. That’s why investors should stick to companies follow through on what they say.

When researching a dividend policy, the first thing to determine is the payout ratio, which is used to calculate the dividend payment as a percentage of earnings. In the case of Wal-Mart, the payout ratio is 47%.

The calculation divides the annual dividend payment per share ($2.04) by the annual earnings ($4.33 per share). So $2.04 ÷ $4.33 = 0.47, or 47% (0.47 x 100).

WMT stock’s payout ratio is in line with its 10-year range of 28% to 47%. Even though the current payout ratio is on the higher end of its historic range, there shouldn’t be any concerns, because Wal-Mart is known as a cash-flowing, mature company. Also, this conservative payout ratio lends to the idea of future dividend hikes, as does management’s track record.

#5. Ex-Dividend Dates

So, how do you qualify for the dividend payment? Well, when investing in a company that pays a dividend, there are some important dates that should be considered. These are important because if a stock is not owned by a certain date, there is a possibility of not receiving the cash payment.

The three most important dates for a dividend payment is the ex-dividend date, the record date, and the payment date.

All the dividend dates are set by the board of directors of the company. Typically, most businesses declare their dividend a few weeks before it is set to be paid. In the case of Wal-Mart, the board of directors released one statement for all of the dividends for 2017.

Below is a chart of all the necessary dates:

| Ex-Dividend Date | Record Date | Payment Date | Payment Amount |

| March 8, 2017 | March 10, 2017 | April 3, 2017 | $0.51 |

| May 10, 2017 | May 12, 2017 | June 5, 2017 | $0.51 |

| August 09, 2017 | August 11, 2017 | September 5, 2017 | $0.51 |

| December 6, 2017 | December 8, 2017 | January 2, 2018 | $0.51 |

To explain further, let’s look at the second dividend payment, which has a deadline of June 5. The ex-dividend date is May 10, which is the most important date for Wal-Mart’s dividend. That’s because in order to receive the dividend payment on June 5, you must own shares by May 9 at the latest. Purchasing shares on May 10 or later will leave you ineligible for the June 5 dividend.

The record date is May 12, which is a date that the company uses to record all eligible shareholders that will receive the dividend payment. The company records the number of eligible shareholders and the total amount of the payout.

Then, on June 5, a dividend of $0.51 per share would be received. This payment will remain the same for the entire year.

#6. Dividend Reinvestment Program

While all shareholders receive the dividend payment, they have another option: a dividend reinvestment program (DRIP).

As noted above, Wal-Mart is a company that pays a cash dividend to its shareholders on a quarterly basis. Now, let’s say you don’t want the cash from the company and would rather receive more shares. This can be done using a DRIP.

The way it works is the dividend payment will be taken and used to purchase more shares of the company on the day the dividend was paid out.

An investor would only do this if they believe the dividend payment will continue to grow. That’s why a DRIP may look appealing for Wal-Mart; after all, it has been paying a dividend since 1974.

Also, investors that are bullish on the company would want to enroll in a DRIP since more capital would be contributed into the investment. There are a couple reasons for this. For one, there’s the compounding affect. As each dividend is paid and more time passes, more of a dividend payment would be received. And since WMT stock is also known as a dividend growth stock, the number of shares that can be purchased can seemingly only go up.

Investors take advantage of this because there is no commission. If you were you use the cash and purchase shares on your own every time a dividend was paid, it could become very costly and affect your bottom line negatively.

But DRIPs gives an investor control over how they want to receive of the dividend income. For instance, it is possible to receive half the dividend as a cash payment and use the rest to purchase more shares. And it’s doesn’t have to be an even 50/50 split, either.

And investors enrolled in a DRIP remove the risk of market timing. This strategy is known as “dollar cost averaging,” which simply means shares continue to be purchased at various prices.

When money from the dividend is purchased below the initial purchase price, it means that more shares are being acquired. The money in this case is going a lot further as a result, which is a long-term benefit. If the shares are bought at a higher price, it means that your overall investment is doing well, even though less shares are being purchased. Therefore, a DRIP is a win-win situation either way.

To enroll in the DRIP, you simply contact the broker that Wal-Mart uses. The requirement is that you must own a minimum of one share.

Why would a company offer this? Because it provides a stable shareholder base for WMT stock, since those that are enrolled in a DRIP are long-term investors and not looking to make a quick profit. This reduces the volatility that is seen from the stock.

#7. Stock Split History

Since WMT stock has a long history of being a public company, there have been other stock events that have affected investors. But before going through the history of WMT stock split, I will answer a few general questions.

To begin, what is a stock split? Well, it is when the board of directors decides to increase the number of shares. This move impacts the trading price of the security being changed, but in no way affects the market cap.

This is how it would work: let’s say a company stock is trading at $100.00 and an investor holds one share in their portfolio. Then, a three-for-one stock split is announced; the investor now owes three shares (one share x three multiple = three shares) as a result. The stock would then change in price down to $33.33 ($100.00 ÷ 3= $33.33). Before the stock split took place, the investor owned $100.0 worth of the companies stock, and after the stock split, the same value is held (three shares x $33.33 = $100).

Now you may be thinking, “why would a company go through all this, only for an investors’ net worth to have not changed?”

When a company is thinking about a stock split, they do so from the view of a small retail investor. If a stock is trading at a very high price, retail investors may simply stay away because they can’t afford shares, or at least as many needed to make the investment worth it. Retail investors tend to prefer stocks that are trading at a lower price because more shares can be purchases.

However, there is one big advantage to companies that tend to continue to split their stock: it is seen as a bullish indicator for those businesses. And as a stock price keeps increasing, the company will look to split the stock.

Now I will be going through the history of the WMT stock split and how investors would be affected today. Below is a chart detailing how many shares you would have over time, had you bought 100 shares at the time of the initial public offering (IPO).

| Stock Split Date (2-for-1) | Market Price on Split Date | 100 Shares at IPO (Each Stock Split Reflected) |

| October 1970 (IPO) | $16.50 | 100 |

| May 1971 | $47.00 | 200 |

| March 1972 | $47.50 | 400 |

| August 1975 | $23.00 | 800 |

| November 1980 | $50.00 | 1,600 |

| June 1982 | $49.88 | 3,200 |

| June 1983 | $81.63 | 6,400 |

| September 1985 | $49.75 | 12,800 |

| June 1987 | $66.63 | 25,600 |

| June 1990 | $62.50 | 51,200 |

| February 1993 | $63.63 | 102,400 |

| March 1999 | $89.75 | 204,800 |

Since the IPO back in 1970, there have been 11 stock splits in the company’s history. Let’s say you ended up participating in the IPO and purchased 100 shares. Since there has been many stock splits and each was done at a two-for-one ratio, you shares would have doubled with each split. If the shares were still owned today, you would have a total of 204,800 shares, assuming there were no shares added or removed during that period.

Stock splits also affect the average cost base of the company. Initially, at the IPO price, the average cost would be $16.50. The following year, there was a two-for-one stock split that occurred, meaning the average cost of the shares went down to $8.25 ($16.50 ÷ 2 = $8.25). This is important to know when selling shares for tax purposes, as a stock split would not result in a change in your payment to the IRS.

Since the stock is split, the dividend payment also gets split as a result. But at the end of the day, the payment will be the same.

#8.Will WMT Stock Split in 2017?

The last two splits were between the prices of $63.63 and $89.75. This is a good indicator of the company’s likely decision; when the stock is trading in this range, expect a stock split to be announced at any time. Over the 52 weeks, WMT stock has been trading in the range of $62.72 to $75.19, which supports this idea.

Note that the company is aware that investors look to WMT stock for their income needs, and that a stock split could attract more long-term investors.

#9. Wal-Mart Stock Predictions for 2017

Investing is done in the present, so before purchasing WMT stock, make sure the the current valuation makes sense. Also determine the future growth prospects of the business; after all, this would be one of the top reasons for even making an investment.

WMT stock is currently cheap based on its valuation and when compared to its industry peers. This is according to the stock’s price-to-earnings (P/E) ratio of 16.3 times; tthe sector’s is 20.7 times. This ratio takes the market price of the stock and divides it by the annual earnings of the company. Based on this valuation, WMT stock could see a boost, since its trading below its peers.

If you’re considering purchasing WMT stock, you would be doing so at an attractive valuation. The first thing to influence the P/E is the trading price of the stock; as the stock price increases, so does the ratio. With the earnings expected to grow 30% over the next few years, the stock price could move higher, as could (and perhaps should) the P/E margin.

Shares have been flat over the past year, but 2017 could be the year that they start to climb higher. If so, it will be due to the focus on e-commerce and on physical stores that are having a positive effect on financial statements. These, as well as the continued earnings and dividend growth, are all positive catalysts for WMT stock.

No matter what happens to the stock price, there is one thing guaranteed if you own shares in Wa-Mart: a dividend will be received. For patient investors, WMT is a great potential investment since you will get paid for your time and future growth should hit the top and bottom lines of the financial statements, which should also be reflected in the share price.