WhiteHorse Finance Stock: 11.8%-Yield BDC Play at Record Highs

Why WHF Stock Is a Compelling Opportunity

Business development companies (BDCs) like WhiteHorse Finance Inc (NASDAQ:WHF) are a great way for average investors to get involved in the private credit market, an area once monopolized by venture capitalists.

There are a lot of small and midsized businesses that need private capital to grow their businesses. In 2020, the private credit market was $875.0 billion. At the beginning of 2023, it was $1.4 trillion. By 2027, it’s expected to grow to $2.3 trillion. (Source: “Understanding Private Credit,” Morgan Stanley, September 15, 2023.)

The private credit market has surged since the 2008 financial crisis and the subsequent introduction of rules for traditional lending institutions. Those restrictions left a void in the opportunities for smaller businesses to borrow capital.

That’s where BDCs, or what we at Income Investors like to call “alternative banks,” come in. Alternative banks are a financial lifeline for many small and medium-sized companies.

Like traditional financial institutions, BDCs borrow money at low interest rates and lend it out at higher interest rates. Moreover, because of special tax breaks, they’re a wonderful option for income investors.

Whereas traditional financial outfits have to pay the government between $0.25 and $0.35 in taxes on each dollar they make in profit, under federal guidelines, BDCs pay little or no corporate tax on their earnings. In exchange for this benefit, BDCs must distribute at least 90% of their ordinary taxable income to their shareholders.

As a result, alternative bank stocks pay out some of the highest dividend yields around.

About WhiteHorse Finance Inc

WhiteHorse Finance is a BDC that specializes in originating senior secured loans to the lower-middle market and growth capital industries. As of the end of the first quarter, about 99.8% of its loans were senior secured and 98.9% of its loans had floating interest rates. (Source: “Earnings Presentation: Quarter Ended March 31, 2024,” WhiteHorse Finance Inc, last accessed June 12, 2024.)

It’s important to know what the different types of loans mean for lenders. A BDC with a lot of senior debt stands first in line to get its money back. Mezzanine lenders get paid second. Meanwhile, preferred and equity investors usually receive only a fraction of their original investments back in the event of bankruptcy.

WhiteHorse Finance Inc typically invests between $5.0 and $25.0 million in companies with enterprise values between $50.0 and $350.0 million.

As of March 31, the company’s portfolio totaled investments of $697.9 million across 120 positions in 71 companies. Since its December 2012 initial public offering (IPO), it has invested $2.61 billion.

Some of the industries it invests in are air freight and logistics; application software; cable and satellite; commodity chemicals; data processing and outsourced services; and office services and supplies.

Another Quarter of Strong Net Investment Income

For the first quarter ended March 31, WhiteHorse Finance reported total investment income of $25.48 million, down by 0.6% from $25.63 million in the same prior-year period. (Source: “WhiteHorse Finance, Inc. Announces First Quarter 2024 Earnings Results and Declares Quarterly Distribution of $0.385 Per Share,” WhiteHorse Finance Inc, May 8, 2024.)

Its net investment income and core net investment income inched up in the first quarter by two percent year-over-year to $10.81 million, or $0.465 per share.

As mentioned earlier, at the end of the first quarter, the fair value of WhiteHorse Finance’s investment portfolio was $697.9 million. That’s compared to $696.2 million at the end of 2023. In the first quarter of 2024, the company’s portfolio had a weighted average effective yield of 13.7% on income-producing debt investments.

Commenting on the results, Stuart Aronson, WhiteHorse Finance Inc’s CEO, said, “I am pleased to report that WhiteHorse delivered another strong quarter of core net investment income well in excess of our regular dividend. ” (Source: Ibid.)

He added, “As the broader lending market has become more aggressive, WhiteHorse continues to underwrite at conservative terms. Our pipeline level remains high, with opportunities to invest in credits with compelling risk-return characteristics, due in part to our sourcing model, which allows us to source deals in areas of the market where there is less competition.”

1st-Quarter Distribution Raised to $0.385 Per Share

You’d like to think that, being an alternative bank, WhiteHorse Finance would be good at making money. And it is.

As a result, since the company went public in 2012, its net asset value (NAV) plus cumulative dividends have increased in all but one year. In 2012, its NAV plus cumulative dividends were $15.41 per share. By the end of 2023, that figure had almost doubled to $30.00 per share. (Source: “Earnings Presentation: Quarter Ended March 31, 2024,” WhiteHorse Finance Inc, op. cit.)

Of particular note, the company’s quarterly dividends have been at or above $0.355 per share since its 2012 IPO. It has also sometimes paid special dividends, most recently in 2020, 2021, 2022, and 2023.

For the first quarter of 2024, management declared a quarterly dividend of $0.385 per share, for an inflation-thumping yield of 11.79% (as of this writing).

WhiteHorse Finance Stock Hit New Record High

A high dividend yield is typically accompanied by a depressed stock price. After all, yield and share price have an inverse relationship. This isn’t the case with WhiteHorse Finance Inc, though. Its share price has been crushing the broader market lately.

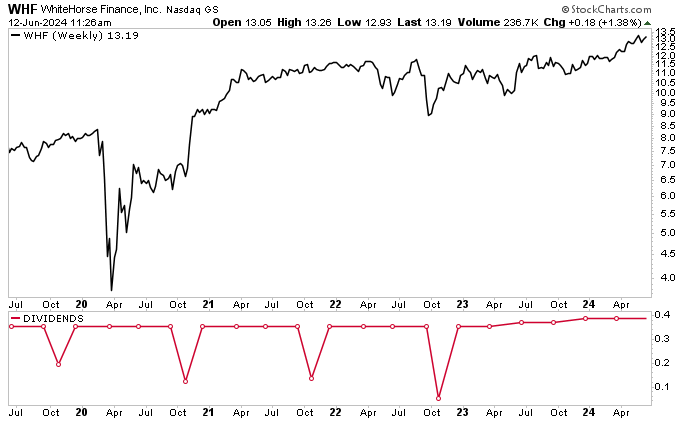

As of this writing, WHF stock is up by 15.5% over the last six months and 19.5% year-over-year. On May 28, it hit a new record high of $13.44 per share, and it continues to trade near that level.

Chart courtesy of StockCharts.com

The Lowdown on WhiteHorse Finance Inc

WhiteHorse Finance is a terrific BDC with a growing, diverse portfolio of investments. Virtually all of its loans are senior secured and have floating interest rates.

The company reported another quarter of strong core net investment income that was well in excess of its regular quarterly dividend.

Looking ahead, WhiteHorse Finance Inc has a big business pipeline; it’s able to source deals in areas of the market that are less competitive. This should help the company continue generating boatloads of cash and enable it to provide investors with reliable regular distributions and special dividends.