Westlake Chemical Partners Stock: 8.3%-Yielder Declares 33rd Consecutive Dividend

Why Investors Should Watch WLKP Stock

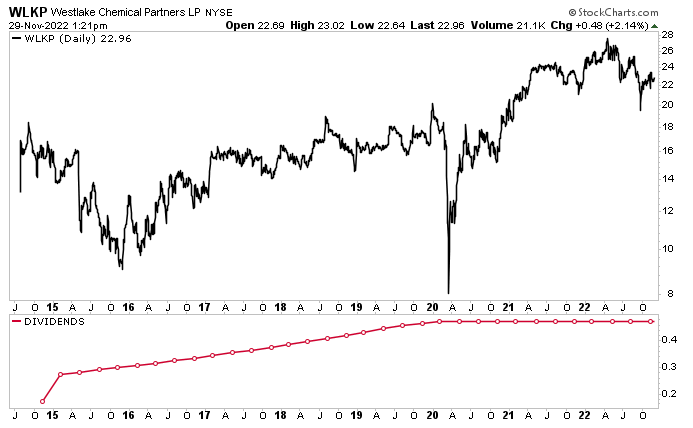

Westlake Chemical Partners LP (NYSE:WLKP) was, until 2022, doing quite well on the stock market. Westlake Chemical Partners stock is up by roughly 13% from its record pre-pandemic level and 118% since hitting an all-time low in March 2000.

While WLKP stock has been trending steadily higher since the start of 2016, it has been trading sideways in 2022. It’s down by 14% over the last six months and 7.8% year-to-date. In the midst of ongoing stock market volatility, Westlake Chemical Partners stock has found support at $22.50 and resistance at $27.50

That’s not a big surprise, really. It has more to do with macroeconomic headwinds than anything going on at Westlake Chemical Partners. Thanks to the long-term strength of the chemical company’s market position and the provisions in its sales agreements, it’s able to create stable, fee-based cash flow. Westlake Chemical Partners then uses that cash to provide its shareholders with reliable, ultra-high-yield dividends.

Wall Street expects WLKP stock to break through its resistance level over the coming quarters and rally to new highs. Analysts have provided a 12-month share-price forecast for Westlake Chemical Partners LP of $26.50 to $29.00. This points to potential gains in the range of 15% to 26%.

Before the COVID-19 pandemic forced companies to be judicious with their cash, Westlake Chemical Partners LP had been raising its dividends every quarter since it went public in 2014. In the last quarter of 2014, Westlake Chemical Partners stock paid out $0.1704 per unit. Management raised the distribution over the following 21 consecutive quarters to a high of $0.4714 at the start of 2020. Over those six years, Westlake Chemical Partners increased its quarterly payout by 176%.

Westlake Chemical Partners LP has maintained its quarterly distribution at $0.4714 per share since then. In late October, management again approved a quarterly distribution of $0.4714 per unit. This represents Westlake Chemical Partners LP’s 33rd consecutive quarterly distribution to its unitholders.

While some dividend hogs might not be happy with that move, at least the company didn’t slash or pause its dividend. And once the stock market finally bottoms and fears of a recession subside, investor optimism should return and WLKP stock will likely resume hiking its quarterly distribution.

Although Westlake Chemical Partners stock’s dividend hasn’t increased since the pandemic, there is room for growth. Westlake Chemical Partners’ payout ratio is 86.5%, which is below the 90% threshold I like to see. This provides management enough financial wiggle room to raise its distribution.

Chart courtesy of StockCharts.com

About Westlake Chemical Partner LP

Westlake Chemical Partners is a limited partnership formed by Westlake Chemical Corp (NYSE:WLK) to operate, acquire, and develop ethylene production facilities. The operations are conducted through OpCo, a partnership formed between Westlake Chemical Corp and Westlake Chemical Partners LP. (Source: “About Us,” Westlake Chemical Partners LP, last accessed December 1, 2022.)

Westlake Chemical Partners’ assets include three ethylene production facilities in Calvert City, KY and Lake Charles, LA. The company converts ethane into ethylene and then ships it through its 200-mile pipeline.

Ethylene is often called the world’s most important chemical; it’s considered a leading indicator of growth in the manufacturing sector. Ethylene is a building block in the production of plastic. The chemical is developed into four different compounds, which are then turned into numerous products.

- Polyethylene is used to make food packaging, bottles, bags, and other plastic goods

- Ethylene oxide/Ethylene glycol gets weaved into polyesters and becomes antifreeze for airplane engines and wings

- Ethylene dichloride is transformed into a vinyl product that’s used in pipes, siding, medical devices, and clothing

- Styrene is a synthetic rubber used in tires and foam insulation.

Because of this, Westlake Chemical Partners LP’s products are always in demand. The company has a protective provision in its sales agreement with Westlake Chemical Corp that provides a fixed margin of 95% on its products.

This allows Westlake Chemical Partners to generate stable fee-based cash flow, report solid financial results, and maintain a sustainable distribution level.

Solid Q3 Results

For the third quarter ended September 30, Westlake Chemical Partners reported net income attributable to the partnership of $14.8 million, or $0.42 per share. That’s a 15.6% increase over the $12.8 million, or $0.36 per share, in the same period of last year. (Source: “Westlake Chemical Partners LP Announces Third Quarter 2022 Results,” Westlake Chemical Partners LP, November 3, 2022.)

The company’s cash flow from operating activities was $115.5 million in the third quarter of 2022, up from $99.5 million in the third quarter of 2021.

The company’s master limited partnership (MLP) distributable cash flow in the third quarter of 2022 was $16.7 million, a 28% increase over the third-quarter 2021 MLP distributable cash flow of $13.0 million. The increase in MLP distributable cash flow (and the associated trailing 12-month coverage ratio) was primarily attributable to higher production and net income at OpCo.

“The Partnership’s performance in the third quarter of 2022 reflects the ratable and long-term strength of our market position and the protective provisions of our sales agreement with Westlake,” said Albert Chao, Westlake Chemical Partners LP’s president and CEO. “We are well positioned to continue to deliver solid distributions as a result of the sales agreement that provides a fixed margin on 95% of our production.” (Source: Ibid.)

The Lowdown on Westlake Chemical Partners Stock

A leader in a lucrative niche industry, Westlake Chemical Partners LP is an outstanding company that provides WLKP stockholders with reliable, ultra-high-yield dividends. The company’s multiyear track record of raising its dividends came to a halt during the COVID-19 pandemic, but it has continued to report solid financial results.

Management noted that they’re optimistic about the ethylene market in 2023 and said the company “will continue to benefit from the insulative attributes of the agreement with Westlake.” This should fuel stock market returns and predictable cash flows to Westlake Chemical Partners stockholders. It also bodes well for the likelihood of distribution hikes in 2023.