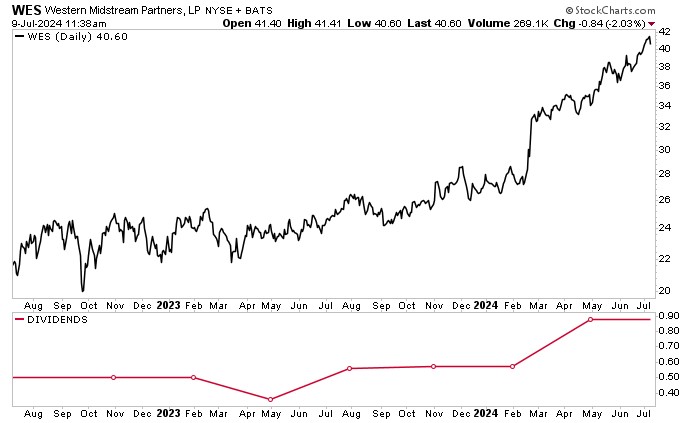

Western Midstream Stock: Bullish 8.4%-Yielder Up 45% in 2024

Western Midstream Stock Hits Record High

There are a few reasons to like Western Midstream stock…but, first, let me provide a little background.

There are three stages of oil and gas operations: upstream, downstream, and midstream. “Upstream” refers to oil and natural gas production, while “downstream” refers to the refining of oil into gasoline, diesel, jet, and other fuels.

These kind of stocks can really fluctuate based on the price of crude oil and supply and demand.

A midstream company like Western Midstream Partners LP (NYSE:WES), which stores and transports oil and gas from wellhead to refineries, doesn’t care what the price of crude is. They’re the toll keepers of the energy industry, and get paid whether the drillers make money or not.

Pipeline profits aren’t hit by asset bubbles or stock market crashes. Volatile energy prices have almost no impact on earnings. Because the company earns a fee for each barrel shipped, cash flows are steady like bond coupons.

Best of all, midstream companies have little competition. No other method of transportation can move crude from point A to point B cheaper than a pipeline.

Western Midstream Partners L.P is involved in gathering, compressing, treating, processing, and transporting natural gas. It gathers, stabilizes, and transports condensate, natural gas liquids (NGLs) and crude oil, and gathers and disposes of the water produced. It also buys and sells natural gas, NGLs, and condensate. (Source: “First-Quarter 2023 Review,” Western Midstream Partners LP, May 8, 2024.)

The company’s core assets provide midstream services for customers in two of the most active and productive basins in the U.S.: the Delaware Basin in West Texas and New Mexico and the Denver-Julesberg (DJ) Basin in northeastern Colorado.

Western Midstream’s infrastructure includes:

- 21 gathering systems

- 69 processing & treating facilities

- 7 natural-gas pipelines

- 12 crude-oil/NGL pipelines

- 14,000 pipeline miles

While energy prices can be volatile, 95% of the company’s gas contracts are fee-based and 100% of its liquids contracts are fee-based. This provides Western Midstream with direct commodity exposure protection.

Record First-Quarter 2024 Net Income

For the first quarter ended March 31, 2024, Western Midstream announced that total revenue increased 20% year over year to $887.7 million. (Source: “Western Midstream Announces First-Quarter 2024 Result,” Western Midstream Partners LP, May 8, 2024.)

The company reported record first quarter net income attributable to limited partners of $559.5 million, or $1.47 per share, almost triple the $198.9 million, or $0.52 per share, recorded in the same period last year.

Western Midstream Partners reported record first-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $608.4 million, up 6.6% from $570.6 million in the first quarter of 2023.

During the quarter, the company closed all five previously announced non-core asset sales for total proceeds of $794.8 million.

Subsequent to the end of the first quarter, Western Midstream completed the start-up of its Mentone III natural gas processing plant in West Texas, increasing natural-gas-processing capacity at the complex by 300 million cubic feet per day (MMcf/d) to approximately 1.9 billion cubic feet per day (Bcf/d).

Commenting on the results, Michael Ure, company president and chief executive officer, said, “”The first quarter was very successful for WES as we generated the highest quarterly Net income and Adjusted EBITDA in our partnership’s history. These records were primarily driven by increased throughput across all operated assets and across all products.”

Ure added, “We also set new gathering records for natural-gas and produced-water throughput in the Delaware Basin, and we continued to experience natural-gas and crude-oil and NGLs throughput growth in the DJ Basin.”

Western Midstream’s 2024 Guidance

Thanks to the partnership’s strong results and increased throughput expectations, management expects Western Midstream to achieve the high end of its previously announced 2024 adjusted EBITDA and free cash flow (FCF) guidance ranges.

- Adjusted EBITDA of between $2.2 billion and $2.4 billion

- FCF of between $1.05 billion and $1.25 billion

Western Midstream Stock Hikes Distribution 52%

Its 95% fee-based gas contracts and 100% fee-based liquids contracts provide Western Midstream with both direct exposure protection and predictable income. This helps the company provide investors with a reliable, growing base distribution and special or enhanced distributions.

In April, the partnership’s board declared a quarterly cash base distribution of $0.8750 per share, or $3.50 on an annualized basis, for a current forward yield of 8.45%. This represents a 52% increase over the prior annual rate of $2.30 per unit. (Source: “Western Midstream Announces First-Quarter 2024 Distribution And Earnings Conference Call,” Western Midstream Partners LP, April 18, 2024.)

WES Stock at Record Levels

Record earnings, strong guidance, and a growing base dividend represent everything investors need to help juice Western Midstream stock.

On July 5, WES stock hit a new intraday record high of $41.73.

As of this writing, Western Midstream stock is up 17% over the last three months, plus it has climbed 45% year to date, and advanced 64% year over year. Despite the big market-crushing gains, there’s every reason to believe that Western Midstream stock could hit additional fresh highs over the coming quarters.

Chart courtesy of StockCharts.com

The Lowdown on Western Midstream Stock

Western Midstream Partners LP remains a great energy company, reporting record financial results and natural-gas throughput. Moreover, Western Midstream stock recently increased its quarterly base distribution by 52%.

The outlook remains equally impressive, with management expecting the company’s full-year adjusted EBITDA and FCF to be at the higher end of its guidance ranges. This could force management to increase Western Midstream stock’s distribution again over the coming quarters.