Why 8.6%-Yield USA Compression Stock Could Provide More Gains

High Demand for Energy Is Set to Boost USAC Stock

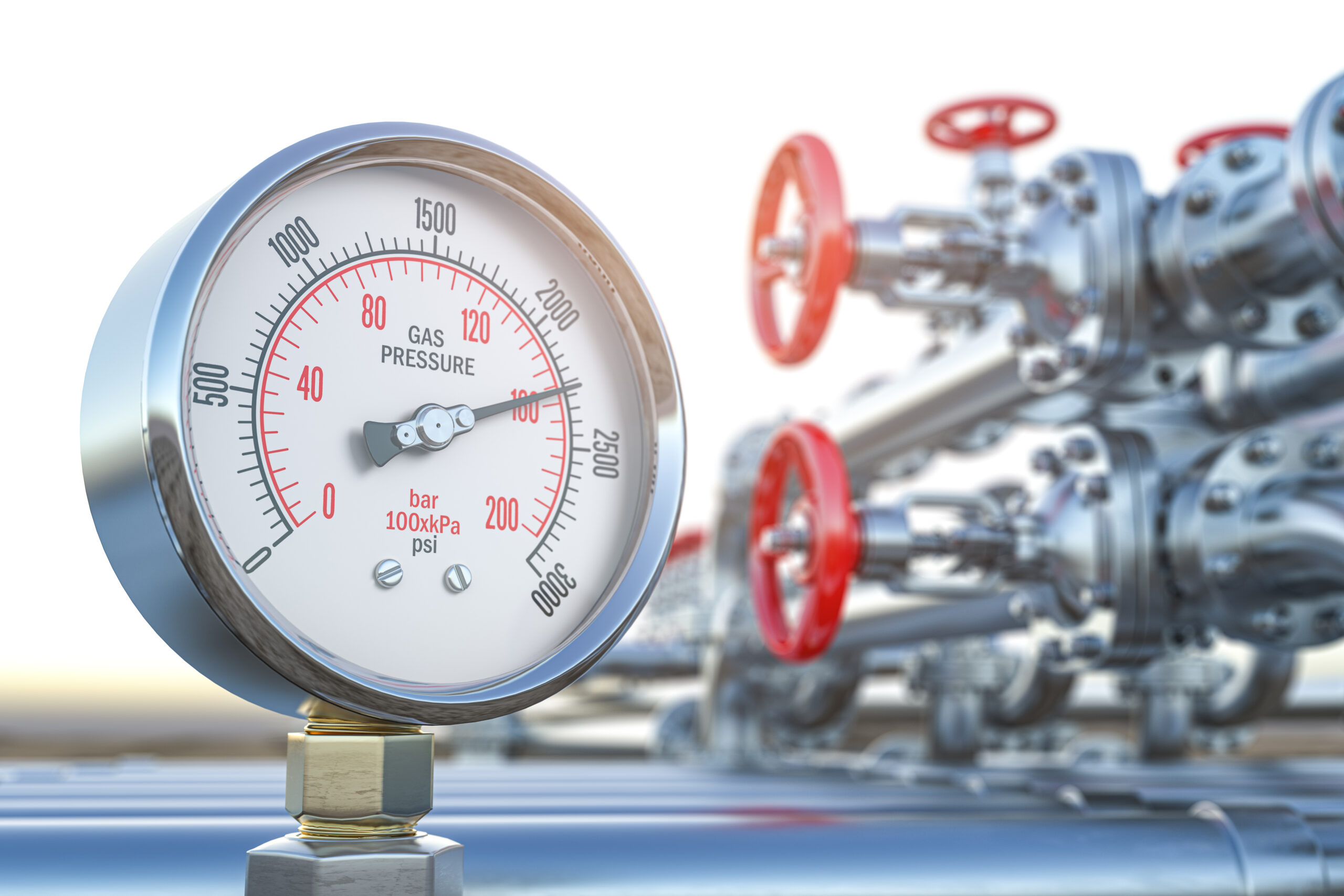

Since oil and natural gas prices can be volatile, many energy stock prices are, too. One industry that tends to do well no matter what price energy is trading at or where we are in the economic cycle is oil and gas equipment and services.

One notable company in that industry is USA Compression Partners LP (NYSE:USAC), a provider of natural gas compression services.

Industry tailwinds point to continued growth for the company’s business, dividends, and share price.

According to the U.S. Energy Information Administration (EIA), U.S. natural gas consumption hit a new record high on January 16, with 141.5 billion cubic feet (Bcf) consumed that day. This topped the previous record set on December 23, 2022. (Source: “U.S. Natural Gas Consumption Established a New Daily Record in January 2024,” U.S. Energy Information Administration, February 6, 2024.)

That record may not last long, though. The International Energy Agency (IEA) predicts that lower natural gas prices and higher demand this winter will result in a return to high growth in global gas consumption in 2024. (Source: “Gas Market Report: Q1-2024,” International Energy Agency, last accessed February 12, 2024.)

The IEA projects that natural gas demand will grow by 2.5% in 2024, up from 0.5% growth in 2023. Last year’s lackluster performance can be blamed on warmer winter weather.

The higher demand for energy will result in increased demand for oil and gas equipment services from companies like USA Compression Partners LP.

The Austin, Texas-based company is one of the country’s largest independent providers of natural gas compression services. It provides its services under fixed-term contracts to oil and gas companies, including independent producers, processors, gatherers, and transporters of natural gas and crude oil.

USA Compression focuses on providing midstream natural gas compression services to infrastructure applications in high-volume gathering systems, processing facilities, and transportation applications.

The best part is that, regardless of where oil and gas prices are, natural gas companies always need their infrastructure serviced.

Due to distance and friction, natural gas loses pressure as it moves through pipelines. Compression ensures that the gas continues to move smoothly through pipelines. Compressors are also used at above-ground and underground natural gas storage facilities.

This essential service has helped USA Compression generate stable cash flows during all commodity cycles. Why? In addition to helping grill hamburgers and steaks, natural gas is the largest source of electricity in the U.S., as well as a major source of heating around the world.

Another Quarter of Record Results

After reporting record first-quarter, second-quarter, and third-quarter results, is it really a surprise to learn that USA Compression Partners capped off 2023 with another quarter of record results?

For the fourth quarter of last year, the company reported record-high total revenues of $225.0 million. (Source: “USA Compression Partners Reports Fourth-Quarter 2023 Results and Provides 2024 Outlook,” USA Compression Partners, LP, February 13, 2024.)

In the fourth quarter of 2023, the company’s net income was $12.8 million; its adjusted earnings before income, taxes, depreciation, and amortization (EBITDA) were a record-high $138.6 million; its distributable cash flow was a record-high $79.9 million; and its distributable cash flow coverage was a record-high 1.48 times.

USA Compression Partners LP Has Never Missed or Lowered a Dividend

USA Compression stock is a great stock for dividend hogs, having paid dividends for 44 consecutive quarters. The company has never missed or cut a distribution. (Source: “Distributions & Splits,” USA Compression Partners, LP, last accessed February 12, 2024.)

Since its initial public offering (IPO) in 2013, USA Compression has returned in excess of $1.6 billion in cash to its unitholders.

USAC stock currently pays dividends of $0.525 per unit, for a yield of 8.69% (as of this writing). That’s more than twice the current U.S. inflation rate of about 3.2%.

USA Compression Stock Hit Fresh Record High

More often than not, a stock’s high yield comes at the expense of a low share price, since dividend yield and share price have an inverse relationship. That isn’t the case with USAC stock, though.

USA Compression stock hit a new record intraday high of $26.93 on January 24. The stock has given up some ground since then, but it continues to trade near that level. Trading at $24.15 as of this writing, USAC stock is up by:

- 23% over the last six months

- Eight percent year-to-date

- 27% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on USA Compression Partners LP

USA Compression Partners LP provides essential natural gas compression services to energy companies across geographically diverse areas. This helps it generate secure, stable cash flows, which allows it to provide investors with durable returns on their capital.

USA Compression’s record fourth-quarter 2023 results continued the company’s trend of “outstanding financial and operational results,” fueled by high demand for the company’s services. The results included consecutive-quarter record-setting revenues, adjusted EBITDA, distributable cash flow, and distributable cash flow coverage.

The outlook for USA Compression is robust. Management forecasts that the large-horsepower compression market will continue to be tight, since crude oil and natural gas production is expected to grow in the key basins in which the company operates.