TXO Partners Stock: 12.15%-Yielder Could Rise 43.9%

Soft Energy Prices Spell Opportunity

Oil prices continue to be driven by the tense situation in the Middle East and the condition of global supply and demand.

The price of the domestic West Texas Intermediate is hovering at $70.00 per barrel, but it could easily jump on an escalation in the Middle East. Oil prices could also rebound on global economic recovery and the Organization of Petroleum Exporting Countries (OPEC) continuously curbing production.

This provides a potential opportunity for TXO Partners LP (NYSE:TXO). The company acquires and explores for oil, natural gas, and natural gas liquid reserves in North America.

TXO Partners assets are found in the Permian Basin of West Texas and New Mexico and the San Juan Basin of New Mexico and Colorado. (Source: “Company Profile,” TXO Partners LP, last accessed October 21, 2024.)

In addition, the company has purchase agreements with Eagle Mountain Energy Partners and a private company set to close. The proposed deal would see TXO Partners acquire assets in Montana and North Dakota in exchange for $243.0 million in cash along with 2.5 million common shares of TXO stock. (Source: “TXO Partners, L.P. Announces Entry Into Definitive Agreements for Assets in the Greater Williston Basin,” TXO Partners LP, June 25, 2024.)

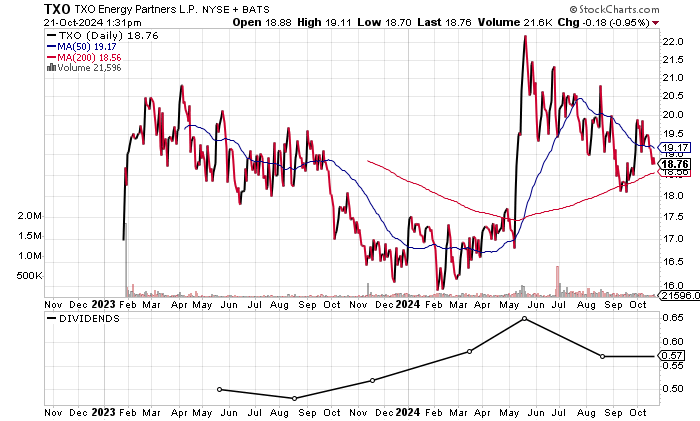

As of the time of writing, TXO Partners stock was down 20.4% from its 52-week high of $23.56 and 43.9% below the consensus one-year target estimate. This provides a contrarian opportunity.

To compensate for the risk, TXO stock currently pays out a forward dividend yield of 12.1%, which should appeal to contrarian income investors.

Chart courtesy of StockCharts.com

Strong Revenue Growth, But Consistency Needed

TXO Partners only has a financial history of four years, but the results have been good so far, with three straight years of growth.

The company’s revenues have grown 249.5% from 2020 to the record $380.7 million in 2024. The compound annual growth rate (CAGR) was an impressive 51.8% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2020 | $108.8 | N/A |

| 2021 | $228.3 | 109.9% |

| 2022 | $246.4 | 7.9% |

| 2023 | $380.7 | 54.5% |

(Source: “TXO Partners, L.P. (TXO),” Yahoo! Finance, last accessed October 21, 2024.)

The sole analyst on the company expects TXO Partners LP to report lower revenues of $3322.1 million in 2024 prior to rebounding 25.5% to $404.3 million in 2025. (Source: Yahoo! Finance, op. cit.)

So far, the company reported revenues of $57.3 million in the second quarter and $67.4 million in the first quarter. Combine this with the expected $190.9 million in the second half, and revenues could be around $315.6 million and near the consensus. Higher oil prices could help lift the revenues.

A look at the gross margins shows significant expansion to 62% in 2023, representing the second highest on record and positive for profitability and free cash flow (FCF).

| Fiscal Year | Gross Margins |

| 2020 | 54.8% |

| 2021 | 69.7% |

| 2022 | 48.2% |

| 2023 | 62.0% |

The bottom line points to generally accepted accounting principles (GAAP) losses in three of the four years.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | -$6.53 | N/A |

| 2021 | $2.10 | 132.2% |

| 2022 | -0$.26 | -112.4% |

| 2023 | -$3.44 | -1,223.1% |

(Source: Yahoo! Finance, op. cit.)

Adjusting for non-recurring expenses, TXO Partners earned a hefty $3.94 per diluted share in 2023. Unfortunately, analysts expect this to fall to $1.25 per diluted share in 2024 before rising to $1.94 with a high estimate of $2.51 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Moving to the funds statement, TXO Partners LP produced positive FCF in three of the four years. This has allowed the company to begin its dividend payments in May 2023.

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | $7.2 | N/A |

| 2021 | -$145.7 | -2,123.6% |

| 2022 | $73.1 | 150.2% |

| 2023 | $66.7 | -8.8% |

(Source: Yahoo! Finance, op. cit.)

The balance sheet is healthy with strong working capital, manageable total debt of $7.1 million, and ample cash of $76.0 million. The total debt to equity of 1.24% is extremely strong. (Source: Yahoo! Finance, op. cit.)

TXO Partners covered its interest payments via earnings before interest and taxes (EBIT) in 2021 and 2022. The relatively low interest expense shouldn’t be a problem to cover given its cash and FCF.

| Fiscal Year | EBIT | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | -$155.0 million | $8.2 | N/A |

| 2021 | $58.3 million | $5.9 | 9.9X |

| 2022 | $530,000 | $8.2 | 0.06X |

| 2023 | -$99.6 million | $4.4 | N/A |

(Source: Yahoo! Finance, op. cit.)

TXO Partners Stock: High Payout Ratio Suggests Some Uncertainty

TXO Partners stock is relatively new to the dividend game, making its initial payment of $0.50 per share in May 2023. This was followed by five dividend payments leading up to the recent August dividend of $0.57 per share.

TXO Partners stock’s last four dividend payments totaled $2.32. The August dividend implies a forward dividend yield of 12.1%.

It’s somewhat unclear where the dividend is heading given the lower expected earnings, but I believe it is safe given the company’s profitability, cash, and FCF.

TXO Partners stock’s payout ratio was a reasonable 57.9% based on the adjusted earnings in 2023. If the dividend remains the same, the payout ratio would rise to 182.4% based on 2024 earnings and 117.5% based on 2025 earnings. This is where the uncertainty lies.

The Lowdown on TXO Partners Stock

One significant positive for income investors interested in TXO Partners stock is the high insider ownership of 20.5%, which entices insiders to drive the share price higher. Moreover, insiders have been net buyers, adding a net 809,036 shares over the last six months. (Source: Yahoo! Finance, op. cit.)

The risk for income investors will be the size of the company’s future dividends. It could fall, but my view is that the dividend program will continue. Plus, TXO Partners stock has above-average price appreciation potential given the higher target price.