These Two Words Can Help You Identify Top Dividend Stocks

A Simple Lesson on Finding Top Dividend Stocks

Here’s one of the best pieces of advice for spotting top dividend stocks that I have ever received.

“You want to know the two most important words when it comes to identifying wonderful businesses? ‘Recurring revenue.’ Run-of-the-mill firms always chase the one-off sales. The best companies, in contrast, get their customers to pay them every single month.”

For those who have never heard the term before, recurring revenue consists of predictable sales that roll in on a regular schedule. It’s something a business can count on with a relatively high degree of certainty.

For example, think of the monthly bill you pay to your cell phone company. Or maybe you pay an annual membership fee to a gym.

In the world of business, it can make all the difference.

So-so companies only make their money from one-time deals. That leaves them on a constant treadmill to chase down new clients. The second they stop running, so too does their income stream.

Businesses with recurring revenue, however, don’t face this problem. As long as they keep existing clients happy, sales continue to roll in month after month. That’s why analysts prize these companies and they often represent some of the best investment opportunities.

Adobe Inc (NASDAQ:ADBE) provides a textbook example.

For years, the company sold boxed versions of its popular “Photoshop” design software for as much as $2,500 a pop. But in 2013, management transitioned to a subscription model. Adobe would charge customers between $10.00 and $50.00 a month for access to its products.

Some users didn’t like the idea. Many protested against the concept of coughing up never-ending charges for Photoshop, when previously they could pay a one-time fee.

But the new model worked. Adobe soothed customer blowback by incorporating extra features into the subscription prices. And the lower upfront cost attracted scores of new users.

All of which translated into explosive returns for Adobe shareholders. Between 2012 and 2019, the company’s full-year earnings per share jumped from $2.35 to $6.07. And over that same period, the stock posted a total gain of 1,420%.

Ecolab Inc. (NYSE:ECL), one of the best dividend stocks in the world, presents another great example.

The company runs on a kind of “razors and blades” business model. It sells sanitation, water filters, and pest control equipment to companies at cost. Then afterward, Ecolab sells them the chemical supplies needed to operate this equipment—at a huge markup.

You don’t need an MBA to see the benefit of this approach. Every time a business runs out of hand soap or sanitizer, it has to place a new order with Ecolab. That results in a steady stream of recurring revenue that rolls in like clockwork month after month.

Better still, it can be costly to switch to a rival supplier. Replacing existing equipment requires paying money up front, not to mention the cost of retraining employees on a new system. That allows Ecolab to raise prices year after year without any fear of losing customers.

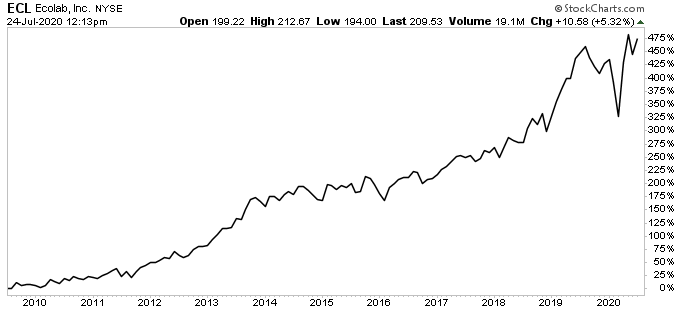

Once again, for shareholders, this has resulted in outstanding returns. Over the past decade, Ecolab’s dividend has tripled in size. And since 2009, this top dividend stock has posted a total return, including distributions, of 475%.

Chart courtesy of StockCharts.com

Once you start digging through the list of the best dividend stocks, the theme of recurring revenue comes up again and again: Costco Wholesale Corporation (NASDAQ:COST) (club memberships), McCormick & Company, Incorporated (NYSE:MKC) (spices), and Procter & Gamble Co (NYSE:PG) (household products) are three more examples.

The takeaway here is simple. Why would you want to own shares in a business that is running on a constant treadmill to generate sales each year?

Sometimes as investors we get caught up in financial metrics like price-to-earnings (P/E) ratios, book value, operating margins, etc. Of course, I’m not saying those metrics are unimportant, but sometimes it’s best not to overcomplicate things.

Top dividend stocks all tend to share a handful of core characteristics. If you boil things down to a few criteria, you can quickly identify wonderful businesses almost at a glance.

And if you’re checking out companies with recurring revenue streams, you’re probably on the right track.