Could This Spark a Stock Market Crash?

The Federal Reserve is about to hike interest rates, which could trigger the next stock market crash.

At least, that’s according to the talking heads on Wall Street.

The central bank is scheduled to meet in a few weeks. Chairwoman Janet Yellen is widely expected to hike rates, especially now, given that the economy is back on track. With less cheap money flowing through financial plumbing, everything from stocks to bonds to commodities could get hammered.

Time to pack it in, folks. Sell your shares and dump your mutual funds. Some analysts predict higher rates could trigger a stock market crash of 20%, 35%, even 50%. The nuttier sections of the Internet say it’s time to go overboard on bullets and freeze-dried food.

That’s the conventional wisdom anyway. But is it true?

Not really. The truth is, the doubting divas don’t have history on their side on this one. To see what I’m talking about, let’s look at what happened the last few times the Federal Reserve raised rates.

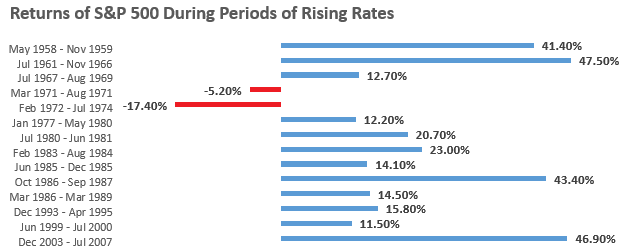

During the last rate hike cycle, stock prices actually rose. Between late 2003 and mid-2007, the S&P 500 soared 46.9%. It wasn’t until after the Fed stopped raising rates that the stock market crashed.

We saw the same thing play out during the tech bubble. Between mid-1999 and mid-2000, the stock market rose 11.5%. And once again, stocks didn’t plunge until after the Fed stopped raising interest rates.

I didn’t cherry-pick these two cases, either. In fact, stocks managed to go up during almost every period of rising interest rates over the past 60 years. Since 1958, the stock market has returned 20.1% during periods of rising rates.

No, those gains won’t knock your socks off. But importantly, they weren’t losses. History suggests, anyway, that higher interest rates are no reason to sell off stocks and stockpile canned food.

Source: Yahoo! Finance

How is this possible? How can stocks go up when the Fed “takes away the punch bowl?”

One reason is that higher interest rates usually come with a strong economy. During the boom times, deals get inked, cashiers stay busy, and dividends get bumped. While higher interest rates hurt stock prices, they’re more than offset by bulging corporate coffers.

Right now, the Fed is expected to hike interest rates in a few weeks. The consensus guess on Wall Street is that rates will be 0.75% by the end of the year. By late 2017, the target funds rate will be around 1.25%.

If they’re right (which is a big “if”), we’re not talking about a return to the bad ol’ 1970s. In the meantime, corporate profits are growing faster than executives can spend their windfalls. Companies in the S&P 500 are expected to pay out $1.3 trillion in dividends and buybacks next year. (Source: How The S&P 500 Will Spend $2.6 Trillion In Cash Next Year (Hint: Mostly On Stock Buybacks), ZeroHedge, November 19, 2016.)

Now don’t get me wrong here, I’m not saying the U.S. economy doesn’t have problems. Nor am I saying that share prices will go up just because they have done so in the past. We could have a stock market crash for all sorts of reasons.

All I want you to see is that higher interest rates are not the end of the world. No need to build a bunker with John Goodman and Mary Elizabeth Winstead.

In fact, rising interest rates could be a good thing. It’s a sign business is getting back to normal. Even if it crimps share prices today, higher yields will boost returns over the long haul.

The bottom line is that most investors think December will mark the end of the bull market. But history tells us that’s not necessarily true. Don’t forget that.