This Quiet Monopoly Pays Out a 5% Yield

One Stock to Own Forever

When I was a kid, a forest fire engulfed our neighborhood.

If you had been sitting on our back deck that day, you would have seen a tower of smoke one mile high and flames flickering from the tops of trees. You could hear of the crackling sound of burning timber as the inferno worked its way up the street.

My mother answered the front door to find a fireman in his full kit. “Ma’am,” he explained, “You have 10 minutes to leave your house.”

That set off a frantic race to pack the car. But it also raised an unexpected problem: what exactly do you take when you have minutes to go through everything you own? Your photo albums? Your family heirlooms? We all have irreplaceable belongings with no real substitute. Even if you have insurance, most of us would consider these items priceless.

You see the same thing in the business world. In the same way we consider some documents and pictures irreplaceable, you also have many assets with significant value and no possible stand-in.

Take the electric grid, for example. Once you have one built, it simply doesn’t make sense to install a second set of power lines into everyone’s house. Add the fact that the utility company provides the juice for our lights, heating, and computers and it really becomes hard to find a possible substitute. That allows these businesses to earn thick profit margins and pay out ongoing dividends to shareholders.

You can find other irreplaceable assets, too: ports, railroads, toll bridges, and river dams, to name a few. Investors have longed prized these businesses for their outsized profits and reliable cash flows. These firms not only earn better-than-average returns, but they come with a layer of protection from inflation, market downturns, and economic uncertainty.

Today, I want to highlight one such irreplaceable asset: Grupo Aeroportuario del Pacifico (NYSE:PAC). The company operates 12 airports along the west coast of Mexico, which would be next to impossible to replicate. And thanks to this entrenched market position, management has paid out steady, growing dividends to shareholders for years.

Needless to say, I’ve had this business on my watchlist for quite some time. Historically, though, shares have always traded for a premium. But thanks to looming trade war fears, Mr. Market has finally valued this stock at a bit more of a reasonable price. And for readers, that has given us a chance to scoop up this wonderful business at a rare bargain (or at least reasonable) price.

The Business

In Mexico, 35 privatized airports control 95% of all passenger traffic. The government split these operations among Grupo Aeroportuario del Pacifico, Grupo Aeroportuario del Sureste (NYSE:ASR), and Grupo Aeroportuario del Centro Norte (NASDAQ:OMAB), and the Mexico City International Airport. A 50-year concession agreement with the Mexican government effectively gives these companies a monopoly in the respective markets in which they operate.

The government granted Pacifico 12 properties along the west coast, accounting for about one in four flights across the country. These high-quality locations allow the company to tap into a diversified base of air traffic. Pacifico enjoys robust revenue for U.S. tourists visiting Tijuana, Los Cabos, and Puerto Vallarta. The firm also earns steady fees from business travels going through Guadalajara, Mexico’s second-largest city. To pad its bottom line further, Grupo Aeroportuario del Pacifico acquired Jamaica’s Montego Bay Airport in 2015, which serves as a hub for much of the Caribbean.

It costs $326.5 million per year to run the company’s business. That includes costs like the $35.6 million paid out in salaries to the company’s 1,280 employees. Other costs include $27.1 million in maintenance; $14.9 million in utilities; and $17.1 million in safety, security, and insurance.

But overall, this $326.5 million figure is how much it costs to handle about a quarter of Mexico’s air passenger traffic each year. That’s more than it costs to run the 4.6-million-person country of Liberia.

If we think about things on a per passenger basis, the company needs to make $8.00 per traveler in order to make a profit. So how do they do that? Well, Pacifico earns a lot of money catering to travelers. On each passenger that arrives at their airports, the company makes $0.37 from parking, $0.20 from advertising, $0.21 from the VIP lounges, and $0.12 from and convenience stores. Pacifico also earns a cut from the numerous businesses operating on their properties (i.e. restaurants, car rentals, duty-free stores, time rentals, ground transportation, etc.). These businesses add another $2.50 in revenue per passenger.

Now you might think this revenue per passenger is low, and you’d be right; Pacifico lags far behind other airports by retail revenue worldwide. By comparison, Washington Dulles Airport earns $5.68 per passenger, New Zealand’s Auckland Airport earns $7.71 per passenger, and the Paris Charles de Gaulle Airport earns $10.92 per passenger. London’s Heathrow ranks as the most profitable airport in the world by non-aviation revenue, owing to management’s retail genius; last year, the company collected $13.32 through sales and services on each traveler passing through the gates.

Pacifico will likely never match these other airports. For one, international terminals like Heathrow often serve as a connection for other flights. Passengers, therefore, spend a lot more time waiting in terminals (which leaves more time for spending money). The biggest airports also tend to cater to the wealthiest passengers, who tend to have the biggest travel budgets.

Pacifico’s management does have a plan to close that gap, though. Over the past few years, the company has introduced a number of measures to squeeze more dollars out of passenger pockets. For example, Pacifico has recently introduced check-in kiosks, digital boarding passes, and more efficient security procedures. This gets travelers into the waiting terminals faster and gives them more time to shop. At several facilities, passengers passing through baggage screening now have to pass through duty-free, which boosts sales by a considerable margin.

These efforts have really paid off. In 2011, Pacifico earned only $2.09 in non-aviation services per passenger. Last year, this figure jumped to $3.66 last year, representing a gain of nearly 75%. As management continues to invest in renovating existing facilities, those sales will likely continue to grow.

The rest of Pacifico’s revenue comes from flights. Each passenger pays $10.92 on average in takeoff and landing fees. These tolls cover the costs of things like gate space, check-in area, and runway time. Of course, this figure varies enormously by flight. A small jet flying out of the company’s small facility in Manzanillo will pay a lot less than a large carrier landing in Guadalajara. But this figure gives you a good idea of the profit potential from each plane coming and going.

What all of these numbers mean is that Pacifico grosses $14.58 on each traveler going through their business. That represents a pretty healthy profit over the $8.00 it costs to run those airports. Management uses most of those funds to fund expansion projects and pay interest on debts. The Mexican government also receives their cut. The vast majority on this income, however, gets paid out to shareholders as dividends.

The income stream continues to grow each year, too. Thanks to the country’s emerging middle class, Mexicans take more flights each year. The devaluation of the peso has also resulted in a surge of foreign tourists. Over the past decade, Grupo Aeroportuario del Pacifico has seen passenger traffic grow at a low-teen annual clip each year. In 2018, management expects 3.3 million more travelers to visit their airports. Multiply that figure by the company’s $14.58 average profit per passenger and you start to appreciate the growth potential in the airport business.

The Opportunity

Of course, competitors will take notice when your profit margins look this good. Lots of companies can earn such outrageous returns from time to time. And eventually, rivals tend to take a bite into those margins, making the true test of a wonderful business the ability to sustain those margins over a long period of time.

Airports represent irreplaceable assets. Most small- and mid-sized cities only have enough traffic to support one facility. A second airport would only split revenues between two companies, resulting in an unprofitable situation for everyone involved. So in many cases, Grupo Aeroportuario del Pacifico is the only game in town. If you want to fly into Tijuana, Los Cabos, or Puerto Vallarta, you have to pay this company a fee.

High costs also keep rivals out. If you and I wanted to get into business together, we could probably scrounge up a few hundred thousand dollars; that would probably be enough to open up a small restaurant or repair shop (the low barriers to entry explain why those businesses don’t make much money). Airports, by comparison, cost billions of dollars to construct. Only the most deep-pocketed investors can get into this game.

But even if you could cough up that kind of dough, you likely still couldn’t replicate Pacifico’s business. In many cases, governments constructed their airports years ago in the countryside, back when land was cheap. Today, towns and cities have sprung up around these facilities. The cost to buy out landowners and businesses would cost tens of billions of dollars. Other physical restrictions such as airspace, government regulations, and environmental rules also prevent any new entrants.

Pacifico’s only true competition is other forms of transportation: cars, trains, and buses. The nation’s poorest will continue to count on these modes of travel, but as more Mexicans have entered the middle class, air travel has become more popular. If you value your time at $25.00 or $50.00 an hour, it’s hard to justify adding an extra half day of traveling to your trip just to save a few bucks.

As a result, Pacifico’s business operates effectively as a monopoly. This puts them in a strong bargaining position to negotiate with airlines and passengers, who simply have no choice but to use their airports. Of course, the government puts a cap on landing and takeoff fees. But non-aviation businesses, like parking, advertisements, and other services, remain unchecked. As a result, Pacifico can crank out tidy profit margins year after year.

For proof, you only need to take a quick glance at the company’s financial statements. Last year, Grupo Aeroportuario del Pacifico earned $0.70 in earnings before interest, taxes, depreciation, and amortization on every $1.00 made in revenue. Over the past decade, the business has generated returns on invested capital between 15% and 20% annually. I can only think of a handful of firms in the world that make this much money.

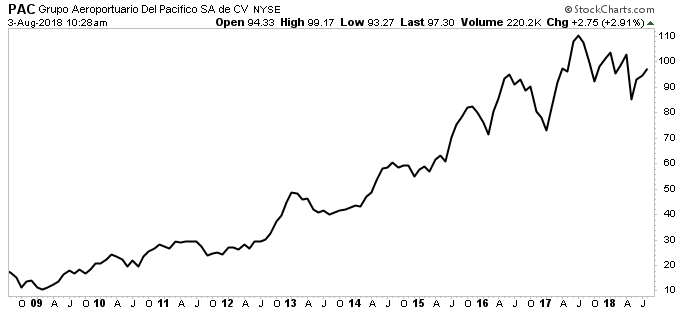

These wide profit margins have translated into outstanding returns for investors. Since 2009, Pacifico shares have generated a total return, including dividends, of 665%. This far outpaced the gains from the broader S&P 500 over the same period.

Chart courtesy of StockCharts.com

The Risks

With its market position cemented, I see three big risks for Grupo Aeroportuario del Pacifico: an economic slowdown, higher interest rates, and a weaker Mexican peso.

Air travel constitutes a cyclical business. As such, anything that could slow down in the Mexican economy will have an outsized impact on financial results. This includes higher oil prices, trade negotiations with the North American Free Trade Agreement (NAFTA), and international travel warnings. Pacifico is better positioned than most businesses, given that management can hike prices to offset lower passenger volumes. But year-to-year, the broader economy will have the biggest impact on returns.

The other two risks look much more mundane. Because Pacifico’s cash flows resemble bond coupons, the stock competes directly with fixed-income securities for capital. If interest rates rise, traders will sell their relatively risky shares for safer, higher-yielding bond investments. Pacifico also earns most of its profits (and pays out its dividends) in Mexican pesos. If the country’s currency drops, the value of these payments when translated into U.S. dollars will also decline. That said, I would look at any sell-off as a result of higher interest rates only as an opportunity to buy shares at an even cheaper price. And while I can’t predict where the peso will go next, currency fluctuations tend to even themselves out over time.

The Bottom Line

The most common questions I get from investors is, “What is the best stock to buy?” In my former life on the trading desk—as well as my current role as editor of Income Investors—I get asked this quite often. The real answer is, of course, “it depends.” But if I had to hang my hat on one idea, the only investment that can deliver reliable, outsized income would be this one specific group of stocks: irreplaceable assets.

When you own one of these businesses, you’re sitting on a true wealth-building operation. And in the case of Grupo Aeroportuario del Pacifico, you have an asset of significant value and no real replacements. I consider this stock one of the rare “beachfront properties” of the investment world. I would probably buy some shares, stick the certificates in a drawer, and collect the dividends for the rest of my life.