This Dividend Stock Has Returned 27,900%

Traits of Top Dividend Stocks

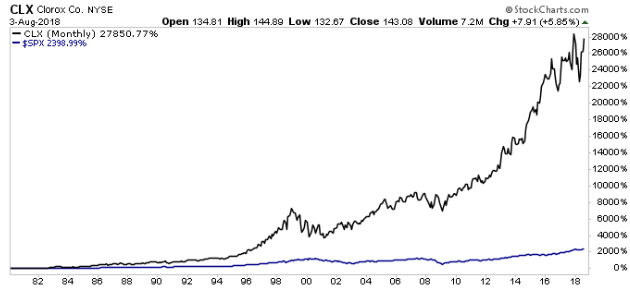

Take a look at the chart below. It shows the returns of one of the most successful companies in the country. Since 1980, shares in this business generated a total return, including dividends, of 27,900%.

What stock could this possibly be? Well, let’s think about our options. It must have been innovative, revolutionary, and groundbreaking. It must have also been involved with one of the biggest trends of the 20th century.

Biotech? Semiconductors? The Internet? No, it’s actually household products giant Clorox Co (NYSE:CLX).

Chart courtesy of StockCharts.com

In a recent report, Credit Suisse Group AG (SWX:CSGN) published the financial returns of every major American industry between 1900 to 2010. Over that time period, it found that $1.00 invested in the typical American industry grew to $38,255. On an annual basis, that comes out to a compounded return of 9.5% per year. (Source: “Credit Suisse Global Investment Returns Yearbook 2015,” Credit Suisse Group AG, January 30, 2015.)

This aggregate number, however, hides a wide disparity in returns between different businesses. An investment in the coal industry, for instance, only returned four percent annually through 2010. In contrast, shipping stocks grew investor capital at a nine-percent compounded annual clip over this period.

But one industry stands in a league of its own: household and personal products. Between 1900 and 2010, this industry generated a compounded annual return of almost 11% per year. During one of the most innovative centuries in human history, the best investments turned out to be shampoo, bar soap, and cleaning supplies.

Household products giant Clorox Co has done especially well. Since the company’s initial public offering, shares have crushed the broader market. The firm represents one of the most successful investments in modern history.

Which raises the question, why? How can such a boring business generate such exciting returns?

For starters, many people fall prey to the “lottery effect.” In games of chance, we prefer a small chance of a big win. People don’t often opt for small steady gains.

In the world of stocks, this would be akin to searching for the next “hot” company. Early investors in businesses like Microsoft Corporation (NASDAQ:MSFT), Netflix, Inc. (NASDAQ:NFLX), or Amazon.com, Inc. (NASDAQ:AMZN) risked small amounts of capital to earn extraordinary returns. As a result, they tend to overvalue stocks with similar characteristics to previously successful companies.

Ironically, this preference for “lottery” payoffs is why boring options like CLX stock usually outperform. Low investor demand keeps valuations low, low valuations keep distribution yields high, and high dividend yields compound faster over time. This adds up to outstanding returns.

Many investors consistently overvalue the riskiest, most “exciting” segments of the stock market. They fall prey to the lottery effect, preferring a small chance at a big win; representative bias, like searching for the next “big” stock, or overvaluing stocks with characteristics similar to previously successful companies; or overconfidence.

The more boring the investment, the higher the returns tend to be. The same principle works in reverse. Most investors never come to terms with this concept, but it’s probably the most powerful.

Boring industries also spend less on innovation. Technology makes headlines because it promises something new. But innovation is expensive, which bites into returns. And even if you’re great at it, like Tesla Inc (NASDAQ:TSLA), you might stumble at some point.

Look at the products Apple Inc. (NASDAQ:AAPL) made 10 years ago; they’re totally irrelevant now. The company is scrambling on an innovation treadmill where it must run faster and faster just to stand in place.

What are the odds that today’s top tech giants will stay at the top of their game for the next 20 to 100 years? Not too good, in my opinion.

Boring industries like food, soap, toothpaste, and cigarettes are different. Because they don’t spend as much on research and development, they can pay out more money to shareholders. This allows investors to earn sizeable returns over long periods of time.

And this is the real key to building wealth. The trick to isn’t necessarily to earn high returns. Instead, it’s about earning modest returns over a long period of time.

Finally, keep in mind that the best profits, by and large, tend to come from the less desirable businesses. Trailer parks have higher yields than beachfront properties, auditors make more money than journalists, and payday lenders profit more than art galleries.

You don’t need an MBA to figure out why. Someone wants to become a journalist, while they only become an auditor for the money. So the money has to be good in the accounting business. You don’t need to earn a good salary in writing.

The same thing applies to the stock market. Nobody gets excited when you mention Clorox and cleaning supplies. As with so many things in business, less glamorous industries tend to earn higher returns.

I hope readers understand this fundamental principle of our investment approach. Each day, we look for wonderful, but not exactly the most exciting, dividend-paying stocks: companies like cigarette giant Altria Group Inc (NYSE:MO), toothpaste maker Colgate-Palmolive Company (NYSE:CL), and trash collector Waste Management, Inc. (NYSE:WM).

They might not make for the most gripping reads in your inbox. But in case after case, we see how the tried and true beats the hot and new. Clorox Co and CLX stock are just another example.