Texas Instruments Stock: Why the Dividend Stock May Keep Rallying

I typically advise our readers to shy away from red-hot momentum stocks, especially large ones. The Texas Instruments dividend stock, for instance, is up a whopping 48% over the past year, easily outpacing the Dow’s return (at the time of writing) of 28%. That return is even more impressive considering Texas Instruments Incorporated‘s (NASDAQ:TXN) massive market cap of about $75.0 billion.

But while I’m not exactly crazy about the Texas Instruments stock price action, there is one particular aspect of the company that I absolutely drool over: its free cash flow.

Regular readers know that I’m obsessed with finding companies that spit out healthy free cash flow. Why? Because free cash flow gives management the ability to boost shareholder value through fat dividends and healthy share repurchases. In fact, cash flow is a far better gauge of a firm’s health and profitability than traditional accounting earnings.

On that basis, Texas Instruments (TXN stock) is both very healthy and very profitable, maybe so much so that this dividend stock is worth purchasing even at these elevated levels.

Let’s take a look at what’s driving those cash flows.

Automotive Motives

TXN stock is moving for very good reason: operations are strong. In the fourth quarter, revenue increased seven percent over the year-ago period to $3.41 billion, easily besting the consensus by $90.0 million. Meanwhile, earnings per share (EPS) clocked in at $1.02, soundly topping expectations by $0.20. (Source: “TI reports 4Q16 and 2016 financial results and shareholder returns,” Texas Instruments Incorporated, January 24, 2017.)

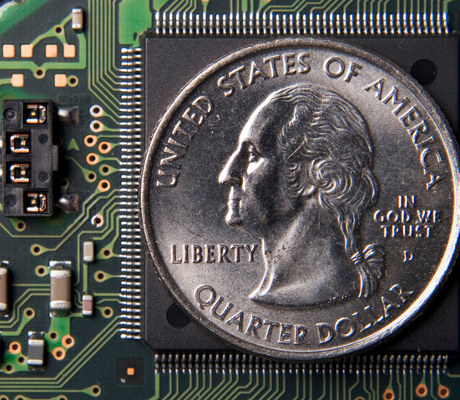

The better-than-expected results were driven once again by solid demand for automotive chips. Additionally, the third-quarter improvement management saw within the industrial market continues. That’s especially good news given the company’s razor-sharp focus in recent years to drive market share gains within both industrial and automotive–the two semiconductor markets that management believes will grow the fastest and provide the most longevity.

Industrial and automotive combined accounted for about 51% of Texas Instruments’ 2016 revenue, up from 44% just two years ago, suggesting that the company is gaining solid momentum where it counts. Companies have a tendency to allocate precious capital towards exciting new growth markets, but oftentimes, their high-risk nature ultimately just ends up destroying value.

In Texas Instruments’ case, I think the management is moving exactly where it needs to in order to safely drive growth in Texas Instruments stock.

Wafer-Thick Margins

Of course, not all of Texas Instruments’ end markets are performing quite so well, as demand in the personal electronics space was down slightly from a year ago.

Still, the company’s gross margin expanded an impressive 400 basis points over the year-ago period to 62.5%. Moreover, operating margins in Texas Instruments’ two main divisions, Analog and Embedded Processing, also both improved nicely.

The company-wide efficiency was driven largely by both higher revenue and lower manufacturing costs. Furthermore, the positive trend of decreasing depreciation costs, combined with the ongoing ramp-up of a higher-margin 300-millimeter wafer, continues to greatly benefit Texas Instruments’ bottom line.

So all told, I’d say TXN stock fairly reflects the company’s strong operating performance as of late, as well as a solid near-term outlook.

In fact, management now sees first-quarter EPS of $0.78–$0.88 on revenue of $3.17 billion–$3.43 billion, nicely ahead of Wall Street’s view of $0.75 and $3.17 billion, respectively.

“[G]rowth in our industry in 2016 was moderate again this year,” said outgoing Chief Financial Officer Kevin March. “However, our advantages in manufacturing of technology, portfolio grade to market reach and diverse and long-lived product positions, enabled important milestones in the year.” (Source: “Texas Instruments (TXN) Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, January 24, 2017.)

Highly Generous Cash King

Now let’s get onto those robust cash flows that I touched on earlier.

While it’s great to know that this dividend stock is performing well, it’s even more comforting to know that management shares the wealth with shareholders–all of it. See, management consistently states that its main objective is to return all of Texas Instruments’ free cash flow to shareholders through dividends and stock repurchases.

In fact, it has become a rallying cry of sorts for the company: “Long term, we believe the ability to generate cash, and specifically free cash flow growth is what matters most to any business,” writes Texas Instruments on its investor relations page. “We also believe that free cash flow will be valued only if it is productively reinvested in the business or returned to shareholders.” (Source: “Investor overview,” Texas Instruments Incorporated, last accessed February 14, 2017.)

Now can you see why I like the company so much?

For the full-year 2016, free cash flow clocked in at $4.08 billion, $3.8 billion of which was returned to shareholders. And in Q4, Texas Instruments paid out $499.0 million in dividends and repurchased $475.0 million of shares.

That kind of capital return commitment is made even more impressive by both the size and growth rate of the company’s free cash flow.

Thanks in large part to its leading market position in various chip segments and margin-enhancing manufacturing expertise, Texas Instruments regularly posts monstrous free cash flow margins in the range of 25% to 30%. Moreover, that same free cash flow has grown at an average annual rate of about 12% since 2004, supporting consistent dividend hikes in the process.

In 2016, managed boosted its quarterly dividend a huge 32%, representing Texas Instruments’ 13th straight year of dividend increases. Additionally, the company has delivered uninterrupted dividends to shareholders since its first payment in 1962.

With strong operating trends working in Texas Instruments’ favor, as well as a relatively low payout ratio of 48%, I wouldn’t expect the dividend to shrink anytime soon.

The Bottom Line on TXN Stock

TXN stock remains a serious candidate for my dividend stock portfolio.

The company’s cost-efficient scale and proprietary analog designs continue to fuel remarkably healthy and stable free cash flow, while a diverse range of end markets provide strong growth tailwinds going forward. More importantly, management’s commitment to returning 100% of Texas Instruments’ free cash flow, through dividends and repurchases, all but ensures that shareholders will actually benefit from any company success.

So although TXN stock’s recent run-up and price-to-earnings margin of 25 isn’t ideal for us value hunters, a forward dividend yield of 2.7% might be reasonable enough to take a bite.