TerraForm Power Inc: Blue Skies for This 6% Yielder

TerraForm Power Inc’s Dividend Payout Poised for a Rebound

We all love a comeback story.

Steve Jobs. Tiger Woods. Mario Lemieux. These episodes tug at our heartstrings and make us believe anything is possible.

The same applies to the stock market. You can make a fortune buying shares of a damaged company on the verge of a turnaround. And by getting in early, investors can often lock in robust yields.

Case in point: TerraForm Power Inc (NASDAQ:TERP). The partnership’s parent company, SunEdison Inc., filed for bankruptcy in 2016 following a downturn in the renewable energy market. Rising costs, weak revenues, and a high debt load hurt TerraForm’s results further.

The business, however, has staged something of a comeback. New management, after Brookfield Asset Management Inc (NYSE:BAM) took a controlling stake in the firm, has energized the business. Last year, management outlined a three-part process to return to profitability, which focused on slashing costs, repairing the balance sheet, and boosting revenues from existing assets.

But can this six percent yield possibly be safe?

TerraForm’s turnaround plan has started to bear fruit.

Management generated an extra $2.0 million in incremental revenue as a result of its solar performance improvement plan. The company also amended existing agreements for its assets in Portugal and Uruguay, which should add another $4.0 million in sales per year. (Source: “TERRAFORM POWER REPORTS FIRST QUARTER 2019 RESULTS,” TerraForm Power Inc, May 9, 2019.)

Selling off low-quality assets, however, has done the most to boost profitability. Earlier this year, TerraForm transferred 10 of its 16 North American wind farms in North America to General Electric Company (NYSE:GE). Management expects to unload the remaining properties later this year. These actions will save the business more than $20.0 million per year.

TerraForm has also made progress in bolstering its balance sheet. Since Brookfield took over in 2017, management has refinanced over $1.6 billion in debt. By extending the maturities on existing loans, executives have locked in significant interest savings. (Source: “Corporate Profile,” TerraForm Power Inc, last accessed June 4, 2019.)

This represents a good first step. Next, TerraForm plans to use profits from operations to start paying down liabilities. By the end of this year, management aims to cut the partnership’s debt-to-cash flow ratio down to between four and five.

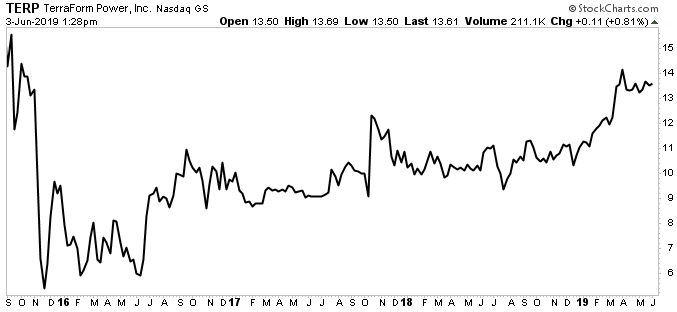

Chart courtesy of StockCharts.com

All of these initiatives have put the distribution on a firm foundation.

In 2019, management projects that the business will generate $1.07 per unit in cash available for distributions (CAFD). Today, TerraForm pays an annual distribution of $0.81 per share. (Source: “TERRAFORM POWER REPORTS FIRST QUARTER 2019 RESULTS,” TerraForm Power Inc, op cit.)

That comes out to a payout ratio of less than 76%. Generally, I like to see companies pay 90% or less of their earnings as dividends. So TerraForm’s distribution sits well within my comfort zone.

That payout will likely grow in the coming years. By 2022, management estimates that their strategy will boost CAFD to around $1.22 per share—which looks conservative, given the partnership’s recent string of strong quarters. Assuming that executives aim to keep their payout ratio between 75% and 85%, the distribution could grow significantly. (Source: “Corporate Profile,” TerraForm Power Inc, op cit.)

Bottom line: TerraForm Power Inc’s new management team seems to be doing all the right things to turn this business around. Income investors should take notice.