Tallgrass Energy LP: Can You Trust This Oil Pension Check’s 13.6% Yield?

Is Tallgrass Energy LP’s Yield Safe?

Low interest rates have squeezed incomes for retirees. And based on the outlook of many economists, those yields will likely remain meager for many years to come.

One solution: “Oil Pension Checks.” My colleague Jing Pan coined the term to describe the payouts from a select group of energy companies. Thanks to a little-known tax law, many of these names pay out safe, double-digit yields.

Tallgrass Energy LP (NYSE:TGE) is a member of that club. The company earns steady income by shipping, storing, and processing energy commodities across the country. And given that management pays out most of these profits to shareholders, Tallgrass Energy stock yields an impressive 13.6%.

But is such a big payout safe? A high yield is often a red flag, so any smart income investor will research the financials before buying shares. So let’s dig into the numbers.

Tallgrass stands in fine financial health, with plenty of liquidity and a manageable debt maturity profile.

By my measure, the company has $3.60 in liabilities for every dollar generated in earnings before interest, taxes, depreciation, and amortization (EBITDA). That leverage ratio sits well below its industry peers, which typically have twice as much debt.

More importantly, Tallgrass management has locked in most of these liabilities at low interest rates with long-term contracts. So if yields begin to rise, larger interest payments won’t bite into cash flow. That makes it easier for shareholders to sleep at night.

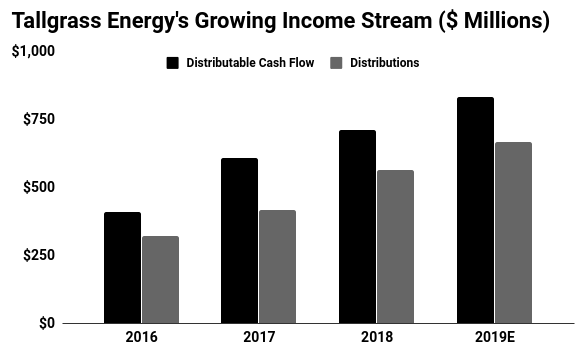

This conservatism applies to the company’s income statement, too. Last year, Tallgrass generated $711.5 million in distributable cash flow. From this total, management paid out $564.5 million to shareholders. (Source: “Tallgrass Energy Announces Fourth Quarter & Full Year 2018 Results and 2019 Guidance,” Business Wire, January 31, 2019.)

This comes out to a payout ratio of 79%. Generally I like to see businesses pay out 90% or less of their earnings as dividends, just to leave a little wiggle room in the event of a downturn. So Tallgrass Energy’s modest distribution sits well within my comfort zone.

In fact, don’t be surprised to see this payout get boosted further. In July, on the back of strong financial results, management announced their 16th consecutive quarterly dividend increase. (Source: “Tallgrass Energy Increases Quarterly Dividend and Announces Date for Second Quarter 2019 Financial Results,” Tallgrass Energy LP, July 11, 2019.)

Given the firm’s double-digit earnings growth and modest payout ratio, Tallgrass has plenty of room for future dividend hikes.

(Source: “Investors,” Tallgrass Energy LP, last accessed August 21, 2019.)

So what could go wrong here? Ironically, the biggest risk is the very thing that makes this company so attractive: growth projects.

Thanks to America’s shale boom, Tallgrass has plowed billions of dollars into expanding its pipeline network. Future cash flows depend on those projects coming in on time and on budget. While the company has a great track record in this regard, shareholders need to keep a close eye on these deals.

Interest rates also present a risk. If yields rise too high, traders dump dividend stocks for fixed-income securities. That could trigger a sharp, unexpected plunge in the price of Tallgrass Energy stock.

That said, the Federal Reserve seems to have taken interest rate hikes off the table. And given Tallgrass Energy LP’s conservative financial profile, any rate increase likely wouldn’t hurt the company’s dividend payments.

In other words, this 13.6% yield looks safe for now.