Stellus Capital Investment Stock: 10%-Yielder Hits Another Record High

SCM Stock Pays Monthly Dividends

President Donald Trump’s pro-business policies will be good for business development companies (BDCs).

How do we know?

In addition to lower corporate taxes, his administration includes Wall Street veteran Scott Bessent as secretary of the treasury.

In his new role, Bessent will no doubt push for financial deregulation and increased spending. This should make it easier and cheaper to borrow. This is the perfect environment for BDCs, which are vehicles for lending capital to America’s small- and medium-sized businesses.

Today, there are roughly140 BDCs with over $312.0 billion in assets under management, up from $23.0 billion in 2009. (Source: “About BDCs,” BDC Council, last accessed February 24, 2025.)

Why should income investors care about BDCs, or what we here at Income Investors like to call “Alternative Banks”?

Like real estate investment trusts (REITs), BDCs are legally required to distribute at least 90% of their taxable income to shareholders through dividends.

While the high-interest-rate environment posed a challenge for many BDCs, the lower interest rate cycle should result in more BDCs issuing debt, which should help juice their bottom lines.

And that’s where Stellus Capital Investment Corp (NYSE:SCM) comes in.

Houston-Texas-based Stellus Capital Investment is a BDC that specializes in investing in private middle-market companies in the U.S. and Canada, primarily through first-lien, second-lien, unitranche, and mezzanine debt financing, often with a corresponding equity investment. (Source: “Overview,” Stellus Capital Investment Corp, last accessed February 24, 2025.)

The BDC generally makes investments of between $20.0 million and $100.0 million in companies generating between $5.0 million and $50.0 million in earnings before interest, taxes, depreciation, and amortization (EBITDA).

To date, Stellus has completed over 350 investments. It currently has more than 80 active investments with $3.4 billion in assets under management.

Some of the sectors the BDC invests in include aerospace and defense, consumer products and services, distribution, financial services, food and beverage, health care, industrial services, media and entertainment, and software and technology.

Some of the companies Stellus Capital Investment has invested in include ad.net., Atkins Nutritionals, Dr.Scholl’s, J.R. Watkins, Petmate, and Vision Media. (Source: “Portfolio,” Stellus Capital Investment Corp, last accessed February 24, 2025.)

Solid Third-Quarter Operating Results

For the third quarter ended September 30, 2024, Stellus reported investment income of $26.5 million, down slightly from $27.2 million in the same prior-year period. (Source: “Stellus Capital Investment Corporation Reports Results for its Third Fiscal Quarter Ended September 30, 2024,” Stellus Capital Investment Corp, November 7, 2024.)

Net investment income slipped to $10.3 million, or $0.39 per share, versus $10.8 million, or $0.47 per share, in the third quarter of 2023. Stellus’ core net investment income came in at $10.6 million, or $0.40 per share, compared with $11.2 million, or $0.49 per share, in the third quarter of 2023.

Commenting on the results, Robert T. Ladd, the company’s chief executive officer, said, “I am pleased to report solid operating results for the quarter ended September 30, 2024, in which we earned U.S. net investment income of $0.39 per share and core net investment income of $0.40 per share, which covered the regular dividend declared of $0.40 per share. Subsequent to the quarter end, we increased our capital base by $55 million through the upsizing of our Credit Facility to $315 million.”

Monthly Distribution of $0.1333/Share

Thanks to its reliable free cash flow, Stellus is able to provide investors with a reliable monthly dividend. Most recently, it declared a monthly dividend of $0.1333 for February, March, and April. (Source: “Stellus Capital Investment Corporation Announces $0.40 First Quarter 2025 Regular Dividend, Payable Monthly in Increments of $0.1333 in February, March, and April 2025,” Stellus Capital Investment Corp, January 9, 2025.)

This works out to $0.40 for the first quarter, or $1.60 on an annual basis, for a current forward dividend yield of 10.39%.

Over the last 12 years of operations, Stellus Capital Investment stock shareholders have received a total of $273.0 million in distributions, which is equivalent to $16.28 per share, or 105% of its current share price.

Stellus Capital Investment Stock Crushing Broader Market

More often than not, ultra-high-yield dividends are attached to a stock that isn’t doing very well. That’s because a company’s share price and its dividend have an inverse relationship. Fortunately, that isn’t the case with Stellus Capital.

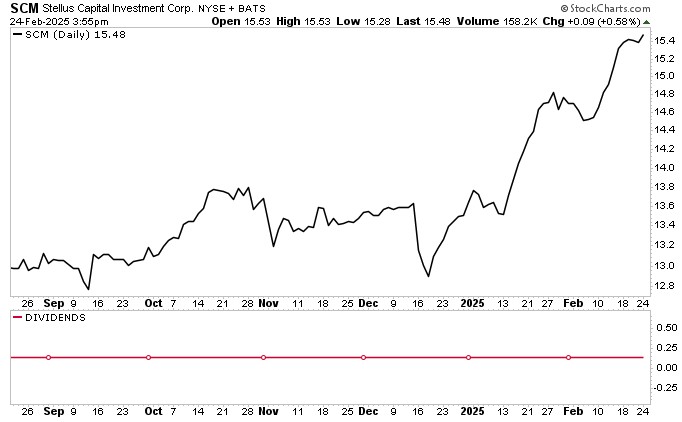

The last time we looked at Stellus Capital Investment stock back in October 2024, it had just hit a new record intraday high of $14.44. Fast forward four months, and SCM stock has notched up a number of additional fresh highs.

At a time when much of the market is experiencing weakness, Stellus Capital Investment stock remains resilient, hitting a new record high of $15.55 on February 20.

As of February 24, Stellus Capital Investment stock is up:

- 5.3% over the last month

- 13.5% year to date

- 18.5% over the last six months

- 33.5% year over year

For the sake of comparison, over the same time period, the S&P 500 is up:

- 1.7% year to date

- 6.2% over the last six months

- 17.5% year over year

The index is down 2.2% over the last month.

Chart courtesy of StockCharts.com

The Lowdown on Stellus Capital Investment Stock

Stellus Capital Investment Corp is one of the longest-tenured BDCs specializing in senior secured loans in the lower middle market. Collectively, Stellus has invested over $8.5 billion in the lower middle market credit and in equity investments across multiple cycles and industries over the last 20 years.

Thanks to its strong balance sheet, Stellus Capital is able to provide investors with a reliable monthly dividend. Its solid financial results are also why investors have sent Stellus Capital Investment stock to record levels. The business-friendly environment could help the stock rally to fresh highs over the coming quarters, too.

That’s great news for common shareholders and the 65 institutions that collectively hold 11.03% of all outstanding shares. Some of the biggest holders of Stellus Capital Investment include Two Sigma Advisers, LP, Raymond James Financial, Inc., Morgan Stanley, and BlackRock Inc.