Star Bulk Carriers Corp: 13.7%-Yielder Has 50% Upside

Outlook Bullish for SBLK Stock on Soaring Freight Rates

Headwinds for some are tailwinds for others. And when it comes to Star Bulk Carriers Corp (NASDAQ:SBLK), ongoing disruptions in the Red Sea, Suez Canal, and Panama Canal have resulted in long reroutes, significantly driving up shipping costs.

At the start of 2024, the Shanghai Containerized Freight Index (SCFI), which tracks the ocean freight and seaborne surcharges of shipping routes on the spot market, had more than tripled compared to the start of 2023. (Source: “Shanghai Containerized Freight Index,” Container News, November 19, 2024.)

As of November 18, 2024, the SCFI was down 40% from its 2024 high and 55% below its record level during the pandemic. That said, the index is still more than double where it was before the 2020 health crisis average and more than double the 2023 average.

What does that look like?

From January to July 2024, the average rate on the SCFI Shanghai–South America route more than doubled to $9,026 per twenty-foot equivalent unit (TEU). That’s the highest level since September 2022. (Source: “High freight rates strain global supply chains, threaten vulnerable economies,” United Nations Trade & Development, October 22, 2024.)

Over the same period, the average rate on the SCFI Shanghai–South Africa route almost tripled to $5,426 per TEU, the highest since July 2022. The SCFI Shanghai–West Africa average rate, meanwhile, advanced 137% to $5,563 per TEU, the highest since August 2022.

About Star Bulk Carriers Corp

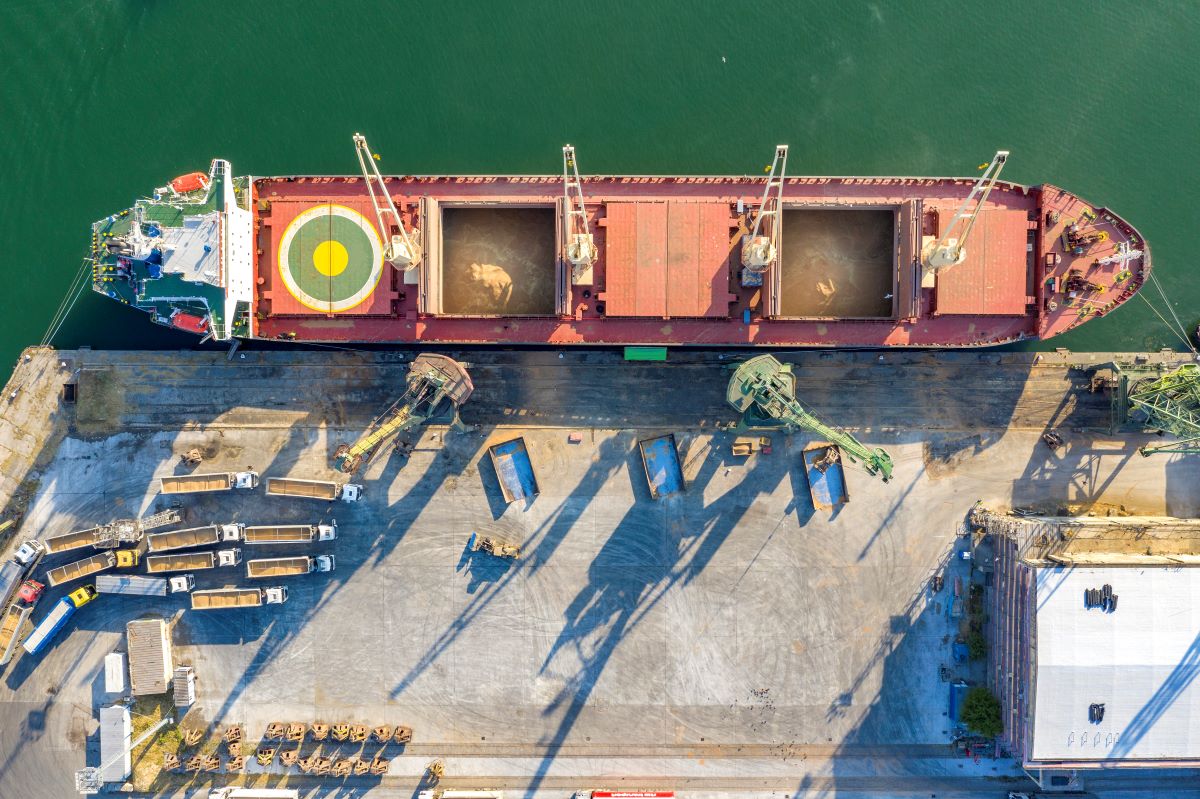

Athens-Greece-based Star Bulk Carriers is the largest dry bulk shipping company listed on the Nasdaq. As a primer, “dry bulk” consists of unpacked commodities, such as coal, bauxite, grain, iron ore, sand, gravel, and scrap metal.

The company’s diverse fleet consists of 159 bulk carriers, ranging from Supramax to Newcastlemax vessels. It also has seven newbuildings set for delivery over the next two years, with two of its newest vessels slated for delivery in the fourth quarter of 2024. (Source: “Overview,” Star Bulk Carriers Corp, November 19, 2024.)

With an average age of approximately 11.3 years, Star Bulk’s vessels give it exposure to all cargo types and trade routes.

Its Capesize vessels are mainly responsible for transporting minerals from the Americas and Australia to East Asia.

The shipping company’s Supramax vessels carry minerals, grain products, and steel between the Americas, Europe, Africa, Australia, and Indonesia—and China, Japan, South Korea, Taiwan, the Philippines, and Malaysia.

TCE Rates Climb 58%

For the third quarter ended September 30, Star Bulk announced that voyage revenue increased 54% year over year to $344.2 million. (Source: “STAR BULK CARRIERS CORP. REPORTS NET PROFIT OF $81.3 MILLION,” Star Bulk Carriers Crop., November 19, 2024.)

Net income jumped 86% to $81.2 million, or $0.69 per share. Adjusted net income advanced 150% to $82.7 million, or $0.71 per share.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) grew 48% year over year to $143.4 million. Adjusted EBITDA were $144.3 million, up 71.5% from $84.1 million in the third quarter of 2023.

Time charter equivalent revenues (TCE) climbed 58% to $256.9 million from $162.5 million in the same prior-year period.

The daily TCE rate was $18,843, up 25% from $15,068 in the third quarter of 2023.

Star Bulk ended the quarter with cash and equivalents of $467.9 million, compared with $259.7 million at the end of 2023.

Commenting on the results, Petros Pappas, the company’s chief executive officer, said, “On the financing front, we have received approval for a new $130m debt facility to finance the delivery of our five latest generation high specification eco Kamsarmax Newbuilding vessels delivering in Q4 2025 and H1 2026 in China. With this seven-year post-delivery financing in place and the equity for the vessels already secured, the vessels are now fully financed on very competitive terms.”

“Regarding the dry bulk market, we remain optimistic about its medium-term prospects given the favorable supply picture, stricter environmental regulations, and recent steps by the Chinese government to stimulate the economy.”

Declares 15th Consecutive Quarterly Dividend

As part of its balanced approach to capital allocation, Star Bulk continues to return capital to shareholders in the form of a reliable, ultra-high-yield dividend.

In November, the company’s board declared a dividend of $0.60 per share, or $2.80 on an annual basis, for a forward yield of 13.7%. This represents the 15th consecutive dividend payment.

In addition to a reliable dividend, Star Bulk also has an active share repurchase program.

Since the beginning of 2021, through 15 consecutive dividend payments, Star Bulk has returned operational free cash flow after debt service of more than $1.33 billion.

At the same time, management has taken advantage of strong vessel values having sold 29 vessels, generating gross proceeds of $563.0 million. Part of these funds has been used for share repurchases amounting to $443.0 million.

SBLK Stock Has 50% Upside

Star Bulk Carrier stock had a great start to the year, hitting a 52-week high of $25.82 on May 29. SBLK has retreated a little since then, now trading near $20.00 per share. Despite the pullback from profit-taking, the stock is still up 15% on an annual basis.

Solid gains, but Wall Street expects SBLK to make further gains over the coming quarter, with analysts providing a 12-month share price target range of $25.67 to $30.00. This points to potential upside of up to 50%.

Why the optimism?

Of the four analysts following Star Bulk Carriers, the average earnings estimate for 2024 is $3.40 per share, up from $1.84 per share in 2023. In 2025, earnings are projected to climb again to $3.67 with a high estimate of $4.69 per share. (Source: “Star Bulk Carriers Corp. (SBLK),” Yahoo! Finance, last accessed November 19, 2024.)

Chart courtesy of StockCharts.com

The Lowdown on Star Bulk Carriers Corp

Star Bulk Carriers Corp is a great marine shipping company that continues to report solid financial results, with strong revenue, earnings, adjusted EBITDA, and daily TCE rate growth.

With total liquidity of over $700.0 million, solid industry tailwinds, and a shortage of dry bulk vessels, the outlook remains excellent for Star Bulk Carriers, its share price, and its ultra-high-yield dividend.

That’s something of which Wall Street is well aware. Insider ownership of SBLK is relatively light at 5.19%, but institutional ownership is solid, with 299 institutions holding 40.72% of the outstanding shares.

Around 8.75% of Star Bulk shares are held by Oaktree Capital Management LP (5.04% stake) and Arrowstreet Capital, Limited Partnership (3.7%).