Spok Stock: Price of Ignored 8.7%-Yielder Up 23% Year-Over-Year

Why Investors Should Take a Look at Spok Stock

Warren Buffett is one of the greatest investors of all time. So, it’s probably a good idea to at least listen to some of his investing advice. One of the easiest pieces of advice to follow is to invest in what you understand.

“I get into enough trouble with things I think I know something about…Why in the world should I take a long or short position in something I don’t know anything about?” (Source: “Warren Buffett’s 3 Guiding Investment Principles,” Washington State University, last accessed June 17, 2024.)

Buffett wasn’t an early adopter of technology stocks. That’s because he didn’t understand how many tech companies would stay profitable and maintain a competitive advantage.

One overlooked tech stock that’s easy to understand is Spok Holdings Inc (NASDAQ:SPOK). The company is a leader in its field, it continues to report fabulous results, it has a rock-solid balance sheet, and it has a stated goal of returning capital to shareholders.

For Spok, it’s all about an antiquated technology: pagers. Through its subsidiary, Spok Inc., the company provides health-care communications services to hospitals in the U.S., Canada, Europe, Australia, and the Middle East. (Source: “Spok Holdings, Inc. (SPOK),” Yahoo! Finance, last accessed June 17, 2024.)

Its customer base includes more than hospitals, although health care accounts for 85% of its revenue. Government, large enterprise, and “other”’ account for the remaining 15%. (Source: “Sidoti Presentation: March 2024,” Spok Holdings Inc, last accessed June 17, 2024.)

Spok is the largest paging carrier in the U.S., with about 765,000 pagers. Its solutions are used in more than 2,200 hospitals.

Its customers send more than 70 million messages each month. (Source: “Spok Reports First Quarter 2024 Results,” Spok Holdings Inc, May 1, 2024.)

Why are pagers such an important tool for hospitals?

They’re the safest, most secure, and most reliable way for doctors and other hospital staff to communicate. Pagers only send numeric messages or basic text messages, and it’s impossible for confidential information to get into the wrong hands—something that’s common with cell phones.

Moreover, pagers run on batteries that can last up to 30 days. That means they’re less likely to lose power, and don’t need to be charged all the time like cell phones. (Source: “7 Shocking Facts About Paging,” Spok Holdings Inc, May 22, 2018.)

Spok Holdings Inc has longstanding customer relationships with the best hospitals in the country, including seven of U.S. News & World Report’s Top 10 Children’s Hospitals and 20 of its Top 22 Adult Hospitals. The average customer-relationship tenure of those hospitals is 24 years. (Source: “Sidoti Presentation: March 2024,” Spok Holdings Inc, op. cit.)

The long-term contracts with top customers provide the company with a reliable revenue stream. More than 80% of its revenue is reoccurring, due to maintenance revenue and wireless paging revenue.

Spok Holdings Inc Reported Another Strong Quarter

For the first quarter ended March 31, Spok announced that its total revenues increased by 5.2% year-over-year to $34.9 million. Its net income climbed 35.9% year-over-year to $4.2 million, or $0.21 per share. (Source: Spok Holdings Inc, May 1, 2024, op. cit.)

The company also reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $7.5 million, up by 9.2% year-over-year.

Spok ended the quarter debt-free, with cash and cash equivalents of $23.3 million.

Commenting on the tremendous first-quarter results, Vincent D. Kelly, Spok Holdings Inc’s CEO, said, “I am proud of the strong performance our team was able to deliver in the first quarter and believe these results position us well for the remainder of the year, as we continue to execute on generating cash flow and returning capital to stockholders, while responsibly investing in and growing our business.” (Source: Spok Holdings Inc, May 1, 2024, op. cit.)

Management Reiterated 2024 Guidance

Spok Holdings Inc’s management noted that the company’s wonderful first-quarter performance provided it with a “solid springboard for 2024.” (Source: Spok Holdings Inc, May 1, 2024, op. cit.)

At the midpoint of its 2024 guidance range, management believes the company is on track to again grow its consolidated revenues on a year-over-year basis, with slight declines in its expected wireless revenue being more than offset by continued growth in its expected software revenue.

Management also announced that the midpoint of its 2024 adjusted EBITDA guidance is consistent with last year’s EBITDA, with additional growth potential at the high end of its guidance range.

Spok Holdings Inc Returned $6.3 Million to Shareholders in Q1

In Spok’s investor presentations, management makes a point of saying the company’s strategic goal is to run the business profitably and generate cash. Sure, any company can say that, but few follow through.

Spok Holdings Inc returns some of the cash it generates to shareholders in the form of reliable dividends. Since 2004, the company has returned more than $680.0 million to its shareholders. In 2022, it returned $25.0 million. In 2023, it increased its total payouts to $25.6 million. (Source: “Dividend History,” Spok Holdings Inc, last accessed June 17, 2024.)

In the first quarter of 2024, it returned a total of $6.3 million to shareholders, or dividends of $0.3125 per share.

As of this writing, that translates to a yield of 8.7%.

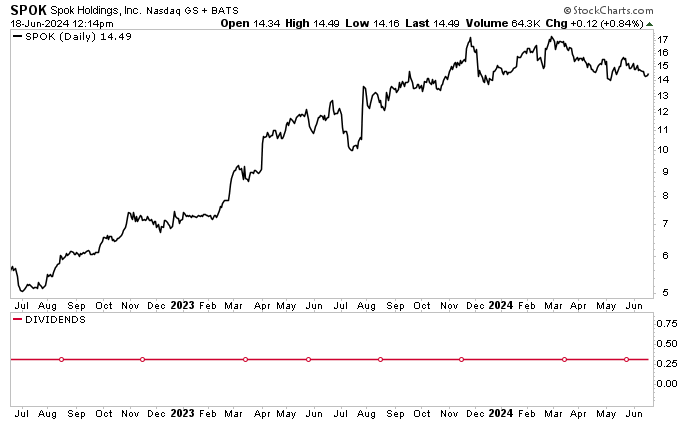

Spok Stock Up 23% Year-Over-Year

Spok’s share price has been performing well over the last two years, rallying by an impressive 165% over that period.

It hit a new record high of $17.47 on March 4. It has given up some short-term ground since then, trading at $14.49 per share as of this writing. (Source: “Spok Holdings, Inc. (SPOK),” StockCharts.com, last accessed June 17, 2024.)

This puts the stock up by 23% over the last year but down 3.5% year-to-date.

Chart courtesy of StockCharts.com

The outlook for Spok stock is solid. For 2023, the company reported diluted earnings of $0.77 per share, with analysts expecting that to rise to $0.81 per share in 2024 and $0.89 per share in 2025.

The Lowdown on SPOK Holdings Inc

Spok stock is a health-care play I’ve been following for a while now. And for good reason. The company has a strong foothold in the health information services industry and has been reporting terrific financial results, including a solid balance sheet.

In the first quarter, Spok Holdings Inc made excellent progress in several key performance areas, including software revenue, wireless revenue, software operations bookings, and backlog. This allowed management to reiterate its full-year guidance.

Additional strong financial results should help juice Spok stock’s price and allow the company to continue providing investors with reliable, high-yield distributions.