A Simple Formula for Spotting Top Dividend Stocks

Top Dividend Stocks Share These Common Traits

What are the traits of top dividend stocks?

When I ask this question at conferences, audiences will throw out a bunch of answers. You’ll hear responses like innovative products, great management teams, and big growth potential. Some might bring up financial factors like dividend yields and price-to-earnings ratios.

Those are all great answers. And they’re all wrong.

Well, they’re not totally wrong, but they’re not the most important factors. And the most important factors are not what most people might think.

Let me tell you a story.

On a gorgeous spring afternoon 10 years ago, two young men graduated from the same college. They were very much alike. Both had earned spots on the Dean’s list, both were pleasant and agreeable, and both, like many young college graduates, had big ambitions for their future.

Recently, I ran into both of these gentlemen at one of our university’s alumni events.

They were still much alike. Both were now married. Both had a child on the way. And both, it turned out, had started their own freelance service businesses.

But there was a difference. One gentleman struggled to make ends meet month-to-month. The other generated a healthy six-figure income.

What made the difference?

Have you ever wondered, as I often do, why some businesses become wildly successful while others struggle? Or, because you probably care more about investments, why do some stocks generate outsized returns for their shareholders? And why do others languish for years, leaving their investors angry and disgruntled?

The difference lies in the economics of each business. With some companies, the underlying economics make it difficult for even the smartest manager to make money. In others, the dumbest businessperson can’t help but get rich.

Today I want to show you a simple formula for spotting wonderful businesses (and top dividend stocks). Normally I explain these concepts using big, corporate examples. But sometimes it’s easier to wrap your head around these ideas using smaller operations.

Consider my fellow alumnus who struggles to make ends meet.

He always had talent behind the camera. So to turn his passion for taking pictures into a career, he started a wedding photography business. As you can imagine, the economics of running such an operation can be tough.

First off, you’re on a constant treadmill to generate new revenue, running faster and faster but getting nowhere. Weddings, by and large, tend to be one-off sales. Unless your customers have an especially high divorce rate, they probably won’t call you back for repeat business. So each time you shoot a wedding, you’re back out looking for the next gig. If you have an especially good year, you have to work even harder on marketing just to maintain your annual revenues.

But it gets worse. You need to spend a lot of money just to get your photography business off the ground. Owners have to cough up big bucks for cameras, lenses, flashes, memory cards, etc. Operating costs, such as gasoline and vehicle wear and tear, as well as software subscription fees, also take a big chunk out of your profits.

And to top it all off, you have no real other barriers to entry. Anybody with the equipment can set up shop as a wedding photographer (though they won’t necessarily be good at it). That creates fierce competition for sales, driving down prices across the industry.

You don’t need a Ph.D. to see the problems here. The underlying economics of the wedding photography business makes it tough to turn a large profit. Some still pull down six-figure incomes. But for every success story, you have 100 shutterbugs struggling to pay their rent.

Now consider the more successful graduate I mentioned earlier.

He started out working on Wall Street. But after years cooped up inside a cubicle, he started his own freelance writing business. Now, most people don’t associate wordsmiths with big incomes. But this gentleman had a number of advantages to make the venture pay off.

To begin with, he had a steady base of recurring sales. Sure, the occasional one-off magazine assignment padded his bottom line, but for the most part, he stuck to writing blog posts, e-newsletters, and market commentaries. These gigs led to a lot of repeat business. Once you get a client on board, the sales roll in like clockwork each month.

Moreover, a writing business has little in the way of startup costs. Your initial investment amounts to a modest laptop and an Internet connection. Copious amounts of coffee constitute your biggest ongoing expense.

And the most important ingredient: this gentleman had become the kingpin of his niche. Anyone can call themselves a writer, but this guy had a deep background in financial planning and digital marketing, which would be difficult for rivals to learn overnight. As a result, our alumnus became the go-to source for content among investment professionals and charged a price to match his expertise.

In other words, the freelance writer had developed a business I like to call a ROCK: (R)ecurring revenues, (O)utstanding margins, (C)apital-light operations, and a (K)ingpin position.

When you own or invest in businesses like these, it’s almost impossible not to make a lot of money. While others struggle to keep the lights on, these businesses crank out outsized profits year after year.

I apply the same concept to investing. The Core Portfolio for Passive Monthly Income paid subscribers amounts to a giant ROCK collection of great businesses: Brown-Forman Corporation (NYSE:BF-A, NYSE:BF-B), Middlesex Water Company (NASDAQ:MSEX), Walmart Inc (NYSE:WMT), Starbucks Corporation (NASDAQ:SBUX), and Clorox Co (NYSE:CLX).

Take one of my favorite dividend stocks on our list, Hershey Co (NYSE:HSY). Sure, a chocolate factory costs a bit of money upfront, but once you have it up and running, it doesn’t cost that much to maintain. Chocolate bars cost pennies to make and you sell them for a few dollars.

It’s also the type of product that people like to eat every other day (or every day, if you’re a fan like me).

Hershey stands as the biggest player in its industry, accounting for more than $0.45 out of every dollar of chocolate sold nationwide. (Source: “Market share of Hershey’s in the United States in 2017, by confectionery segment*,” Statista, last accessed March 13, 2019.)

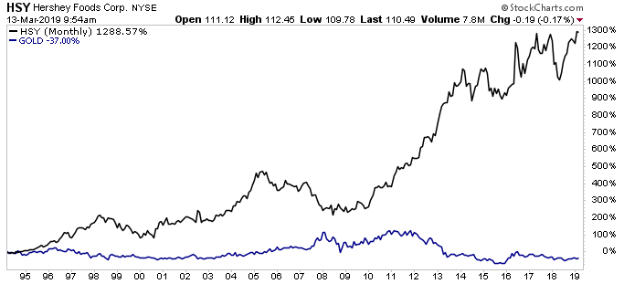

That has created a profitable formula for shareholders. Since 1994, Hershey stock has generated a total return, including dividends, of 1,300%. That crushes the 550% gain from the broader S&P 500 over the same period.

Now consider a business that definitely does not qualify as a ROCK: Canadian miner Barrick Gold Corp (NYSE:GOLD).

Does it have recurring revenues? When you haul an ounce of gold out of the ground, you have to replace it with new reserves elsewhere. Does the business have outstanding margins? Unless commodity prices take a big upswing, even the best mines operate on razor-thin profit margins. Capital-light? New projects require big upfront investments. As one of the largest gold miners in the world, you could call Barrick a kingpin of sorts. But when you sell a commodity, buyers won’t pay a premium for your product.

So how have things fared for shareholders? If you had invested $10,000 in Barrick Gold back in 1994, your wife has probably left you by now. The stock has lost more than a half of its value since then. On a total return basis, including dividends, shareholders have lost 37% of their original investment.

Chart courtesy of StockCharts.com

If you want to become a more successful entrepreneur or a more successful investor, you want to own a ROCK business. Great companies enjoy recurring revenues, outstanding margins, capital-light operations, and a kingpin position. As the two college graduates I met demonstrated, that can make all the difference.