The Safest Ultra-High Yielder on the Market?

Ask any investor what kind of yield they want to have in their income portfolio, and the answer will likely be “the higher, the better.” Yet the blunt reality is that many people struggle to bring their portfolio yield above five percent. The reason is simple: most ultra-high yielders aren’t known for their dividend safety.

So, for risk-averse income investors, the conventional wisdom is to stick with well-known, large-cap stocks, which don’t offer much in terms of yield. Right now, the average dividend yield of all S&P 500 companies stands at a measly 1.77%.

Still, that doesn’t mean there’s no way for investors to boost their portfolio yield. In this article, I’m going to show you a high-yield stock that would be suitable for even the most conservative income investor: Select Income REIT (NASDAQ:SIR).

Also Read:

REIT ETF List: Earn Regular Income from These Real Estate ETFs

As the name suggests, Select Income is a real estate investment trust (REIT). The company owns and invests in properties and lands that are primarily net leased to single tenants. As of September 30, 2017, Select Income’s portfolio consists of investments in 366 buildings, leasable land parcels, and easements totaling 45.5 million square feet. (Source: “Investor Presentation – November 2017,” Select Income REIT, last accessed February 2, 2018.)

The business is quite straightforward. The company leases out its land and properties and collects a rental income stream. It then distributes part of that income to shareholders in the form of dividends.

Right now, the company pays quarterly dividends of $0.51 per share. Trading at $21.71 apiece, SIR stock offers an annual yield of 9.4%.

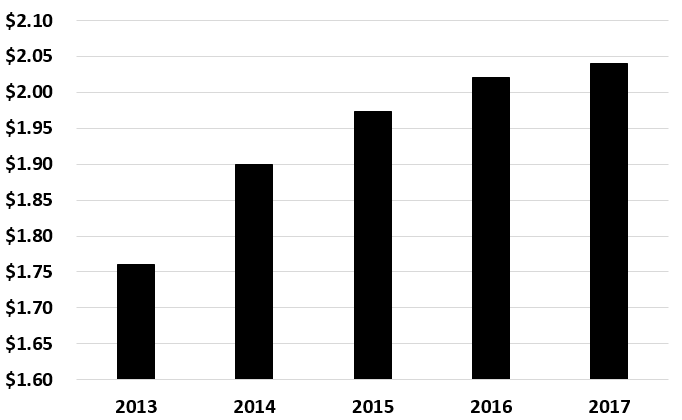

As I mentioned earlier, ultra-high yielders usually aren’t the safest bets. The good news is that Select Income stock has been an exception. Just take a look at the chart below and you’ll see what I mean:

Select Income REIT Dividend History

Source: “Dividend History,” Select Income REIT, last accessed February 2, 2018.

The above chart shows SIR stock’s dividend history for the past five years. In 2013, Select Income paid total dividends of $1.76 per share. In 2017, the amount grew to $2.04 per share, representing an increase of 16%.

But to be honest, I’m not really surprised by SIR stock’s track record. The company has a high-quality portfolio that is well-set to deliver recurring cash flows. By the end of September 2017, Select Income’s properties were 96.2% leased, with a weighted average lease term of 9.5 years. It also has a well-laddered lease expiration schedule. From now until the end of 2021, only 9.4% of the company’s annualized rental revenues are expected to expire.

To give you an idea of just how secure SIR stock dividends are, let’s take a look at the company’s financials.

In the real estate business, cash flow is a key measure of a company’s operating performance. In the third quarter of 2017, Select Income REIT generated normalized funds from operations (FFO) of $60.7 million, or $0.68 per diluted share, which was considerably more than the company’s quarterly cash dividend of $0.51 per share. (Source: “Select Income REIT Announces Third Quarter 2017 Results,” Select Income REIT, October 27, 2017.)

In the first nine months of 2017, the company’s normalized FFO totaled $175.2 million, or $1.96 per diluted share. Since Select Income REIT declared and paid total dividends of $1.53 per share during this period, it had a payout ratio of 78%, leaving a margin of safety.

At the end of the day, there are stocks offering even higher yields than Select Income REIT. However, most of them don’t even come close in the matter of dividend safety. With a stable business, oversized cash flows, and a yield approaching 10%, SIR stock is a top pick for income investors.