Seanergy Maritime Stock: 10.48%-Yielder Up 86.7% Over a Year

Wall Street Predicts Another 57.6% Move

Maritime shipping companies generally deliver steady revenue and earnings flow due to the fixed contracts. While this could cap this kind of company’s upside potential, it does provide a pathway to paying dividends, something that income investors demand.

In the case of Seanergy Maritime Holdings Corp. (NASDAQ:SHIP), not only is the forward dividend yield a juicy 10.48% at the time of writing, but also the shares have advanced 85.1% over the past year to October 29. This easily outperformed the Nasdaq and S&P 500.

The company owns 19 vessels that provide marine dry bulk transportation services. The combined aggregate cargo carrying capacity is roughly 3,417,608 deadweight tonnage (dwt). (Source: “About,” Seanergy Maritime Holdings Corp., last accessed October 31, 2024.)

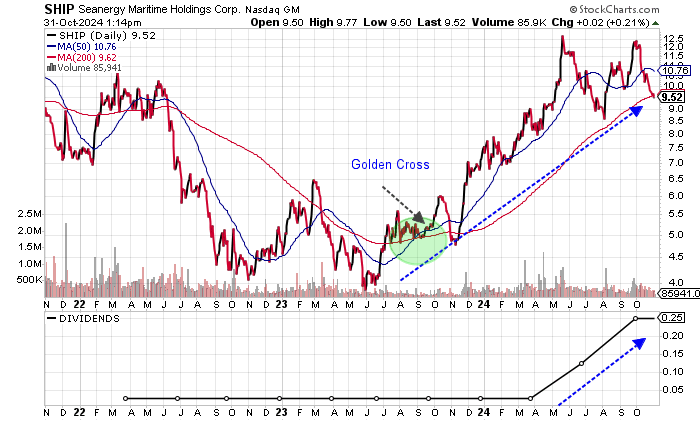

The chart shows Seanergy Maritime stock in a golden cross. This is a bullish technical crossover when the 50-day moving average (MA) is above the 200-day MA. This generally signals additional gains ahead.

Chart courtesy of StockCharts.com

Revenue & Profits Set to Rebound

Seanergy Maritime’s revenues have been all over the place during the last five years, which isn’t a surprise given the 2020 pandemic. The subsequent three post-pandemic years have returned revenues in excess of $100.0 million, albeit 2022 and 2023 have seen declines.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $86.5 | -5.5% |

| 2020 | $63.3 | -26.8% |

| 2021 | $153.1 | 141.7% |

| 2022 | $125.0 | -18.3% |

| 2023 | $110.2 | -11.8% |

(Source: “Seanergy Maritime Holdings Corp,” MarketWatch, last accessed October 31, 2024.)

Seanergy’s revenue picture is expected to significantly improve. Analysts expect the company to ramp up revenues by 58.4% to $174.6 million in 2024, with a high estimate of $195.0 million. First-half revenues of $81.4 million were up 75.7% year over year.

Revenue for the first nine months of 2024 was up 77.6% year over year at $125.8 million.

Shifting to 2025, Seanergy’s revenue growth rate is expected to contract to only three percent with revenues slated to come in between $179.8 million and a high estimate of $211.0 million. (Source: “Seanergy Maritime Holdings Corp (SHIP), ” Yahoo! Finance, last accessed October 31, 2024.)

The company’s gross margins plummeted in 2019 and 2020 prior to staging a significant expansion to the five-year high of 63.7% in 2021. Gross margins have edged lower, but they’re holding at 50%.

| Fiscal Year | Gross Margins |

| 2019 | 34.7% |

| 2020 | 31.7% |

| 2021 | 63.7% |

| 2022 | 57.8% |

| 2023 | 55.3% |

On the bottom line, Seanergy Maritime has reported mixed results, with big generally accepted accounting principles (GAAP) losses in 2019 and 2020. But this was followed by a major rebound to the record $2.50 per diluted share in 2021. Unfortunately, profits fell in 2022 and 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$122.10 | 90.9% |

| 2020 | -$5.49 | 95.5% |

| 2021 | $2.50 | 145.5% |

| 2022 | $0.96 | -61.6% |

| 2023 | $0.12 | -87.5% |

(Source: MarketWatch, op. cit.)

But, as with the revenue side, GAAP profitability is expected to ramp up higher to move above the expected revenue growth rate.

Analysts expect Seanergy Maritime Holdings to generate earnings of $2.78 to as high as $3.80 per diluted share in 2024. This is expected to be followed by $2.77 or a high estimate of $4.26 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

On a quarterly basis, the company has beaten the consensus earnings estimates in the last four straight quarters.

The second quarter saw profits of $0.68 per diluted share, or 15.3% above the consensus. This followed a 92.3% beat in the first quarter and a 111.5% beat in the fourth quarter of 2023.

First-half earnings came in at $1.18 per diluted share or 278.6% higher than the comparative first half in 2023.

On a quarterly basis, Seanergy has beaten consensus earnings estimates in the last five straight quarters.

The third quarter saw profits of $0.69 per diluted share, which was 11.2% above the consensus. This followed a 15.3% beat in the second quarter, a 92.3% beat in the first quarter, and a 111.5% beat in the fourth quarter of 2023.

Earnings for the first nine months of 2024 came in at a record $2.04, which was significantly higher than the $0.02 per share in the first three quarters of 2023.

Seanergy’s funds statement points to inconsistency. Free cash flow (FCF) was negative from 2020 to 2022 before moving to positive in 2023. This was also the highest FCF on record.

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | -$33.6 | N/A |

| 2021 | -$116.6 | 246.5% |

| 2022 | -$33.2 | 71.6% |

| 2023 | $30.8 | 193.0% |

(Source: MarketWatch, op. cit.)

Seanergy Maritime carried $248.0 million in total debt and $32.7 million in cash at the end of June. The high debt is not a surprise given the high capital expenditure involved in buying and operating large ships. (Source: Yahoo! Finance, op. cit.)

I don’t see any liquidity issues here given that the company’s interest coverage ratio has been above 1.0 since 22021.

Moreover, Seanergy Maritime Holdings managed to cover its interest payments via higher earnings before interest and taxes (EBIT) in the last three years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | -$3.7 | $14.6 | N/A |

| 2021 | $52.2 | $10.8 | 4.8X |

| 2022 | $20.5 | $12.3 | 1.7X |

| 2023 | $20.5 | $18.3 | 1.1X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows an extremely sound reading of 8.0 for Seanergy. This is just one notch below the best reading of the 1.0 to 9.0 range.

Seanergy Maritime Stock: Reasonable Payout Ratio Suggests Dividend Could Rise

Seanergy Maritime stock’s last quarterly dividend payment was $0.25 per share in September. This equates into a forward dividend yield of 10.48% if the dividend continues.

Prior to this, the quarterly dividend was $0.15 per share in June, $0.10 per share in March, and $0.025 per share in December 2023. Its forward dividend yield is 10.2% compared to the prior 7.1% for the trailing four quarters.

However, strong third-quarter results allowed the company’s board to approve its biggest-ever dividend in its history at $0.26 per share.

Prior to that, Seanergy Maritime stock paid out $0.25 per share in September and $0.15 in June.

It won’t pay out the $0.26-per-share dividend until January 2025. So, right now, the company’s annual distribution stands at $1.00 per share, equating to a forward dividend yield of 10.78%.

The Lowdown on Seanergy Maritime Stock

Institutional ownership of 21.9% of the outstanding shares is low, but the 27.4% insider interest in Seanergy Maritime stock is high. The high insider ownership can often entice insiders to deliver better results. (Source: Yahoo! Finance, op. cit.)

SHIP stock looks attractive if the company can deliver on its consensus estimates. Seanergy Maritime stock trades at a mere 2.47 times its consensus 2024 and 2025 earnings-per-share estimates.

And while Seanergy Maritime stock has surged 85.1% over the past year, the consensus price target is at $15.00 or up another potential 57.6%.