Sabra Health Care Stock’s a 9.3%-Yielder for Contrarian Investors

Sabra Health Care REIT Inc Is Focused on Shareholder Returns

The trend of higher interest rates in the past few years has hurt real estate investment trusts (REITs) due to the high cost of borrowing capital.

But there’s optimism because interest rates are expected to go down this year. That would help lower the financing costs for many businesses, including REITS like Sabra Health Care REIT Inc (NASDAQ:SBRA).

The mid-cap company owns and invests in real estate that caters to the health-care industry in the U.S. and Canada. (Source: “Investors,” Sabra Health Care REIT Inc, last accessed February 8, 2024.)

I expect bullish tailwinds for the health-care sector, given the aging population and the demand for various health-related services.

As of September 30, 2023, Sabra Health Care held 377 properties, comprising the following:

- 240 skilled nursing/transitional care facilities

- 61 managed senior housing properties

- 43 leased senior housing properties

- 18 behavioral health facilities

- 15 specialty hospitals and other properties

(Source: “Portfolio,” Sabra Health Care REIT Inc, last accessed February 8, 2024.)

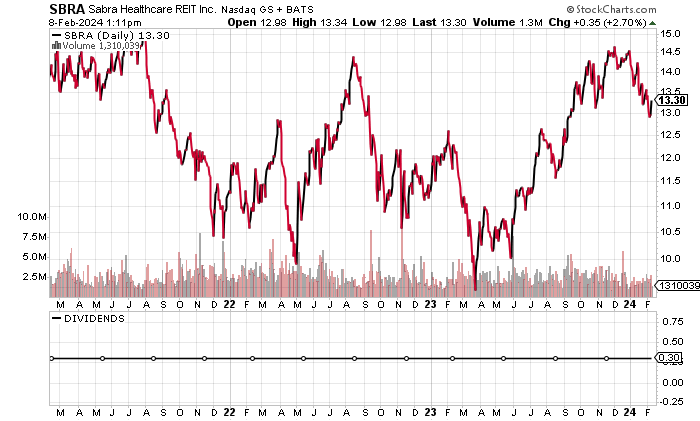

In terms of share price, SBRA stock has been a laggard, down by 7.7% in 2024 and up by a mere 1.86% year-over-year (as of this writing).

But Sabra Health Care REIT Inc has been showing signs of improvement that could reward patient investors. At the moment, the company’s share price is approaching its 52-week high of $14.82.

Plus, investors can collect dividends from Sabra Health Care stock while waiting for its share price to go up.

Chart courtesy of StockCharts.com

Why Sabra Health Care REIT Inc Is Worth a Look

The ability to deliver consistent revenue growth isn’t something that Sabra Health Care REIT Inc is known for.

The company’s revenues declined marginally for three straight years—in 2019, 2020, and 2021—prior to jumping by 6.2% in 2022 to $618.1 million—its second-best revenues in five years.

Analysts expect Sabra Health Care’s revenues to continue growing. They estimate that the REIT will report a slight revenue increase of one percent to $631.1 million for 2023, followed by an increase of 4.3% to a record-high $658.0 million for 2024. (Source: “Sabra Health Care REIT, Inc (SBRA),” Yahoo! Finance, last accessed February 8, 2024.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2018 | $626.5 | N/A |

| 2019 | $600.4 | -4.2% |

| 2020 | $590.2 | -1.7% |

| 2021 | $582.0 | -1.4% |

| 2022 | $618.1 | 6.2% |

(Source: “Sabra Health Care REIT, Inc,” MarketWatch, last accessed February 8, 2024.)

Sabra Health Care REIT Inc has also struggled with consistency in its bottom-line figures, as the below table shows.

The company reported positive generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) for 2018, 2019, and 2020, but then it reported GAPP-diluted EPS losses for 2021 and 2022.

Sabra Health Care REIT Inc’s loss narrowed in 2022, and analysts estimate that the company turned a GAAP profit of $0.12 per diluted share in 2023. They forecast that the REIT will ramp that up fivefold in 2024 to $0.60 per diluted share. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $1.51 | N/A |

| 2019 | $0.37 | -75.7% |

| 2020 | $0.67 | 82.1% |

| 2021 | -$0.52 | -177.4% |

| 2022 | -$0.34 | 35.0% |

(Source: MarketWatch, op. cit.)

Sabra Health Care REIT Inc has managed to consistently produce positive free cash flow (FCF), including in its last five reported years.

This is critical because positive FCF allows for the payment of dividends.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $358.5 | N/A |

| 2019 | $372.5 | 3.9% |

| 2020 | $356.2 | -4.4% |

| 2021 | $356.4 | 0.07% |

| 2022 | $315.7 | -11.4% |

(Source: MarketWatch, op. cit.)

As we move forward, I expect Sabra Health Care REIT Inc to work on improving its financial health, given its $2.5-billion debt and weak working capital. (Source: Yahoo! Finance, op. cit.)

The company’s relatively weak interest coverage ratio of 1.3 also suggests a need for improvement.

Moreover, in 2021 and 2022, the company failed to cover its interest expenses via its earnings before interest and taxes (EBIT).

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $239.6 | $100.4 |

| 2021 | -$12.8 | $98.6 |

| 2022 | $29.1 | $105.5 |

(Source: Yahoo! Finance, op. cit.)

Now, let’s look at Sabra Health Care REIT Inc’s Piotroski score, which is an indicator of a company’s balance sheet, profitability, and operational efficiency. The company had a reading of 5.0 in 2022. That’s just above the midpoint of the Piotroski score’s range of 1.0 to 9.0. This suggests that the REIT’s financial situation is workable for now.

SBRA Stock’s Dividends Could Rise

Sabra Health Care REIT Inc’s dividend history has been mixed, but it has paid dividends for 14 consecutive years.

Sabra Health Care stock’s recent quarterly distributions of $0.30 per share translate to a forward yield of 9.27% (as of this writing).

My view is that the REIT’s expected return to profitability, along with consistent FCF, should allow management to maintain and raise SBRA stock’s dividend.

| Metric | Value |

| Dividend Streak | 14 Years |

| 7-Year Dividend Compound Annual Growth Rate | -4.4% |

| 10-Year Average Dividend Yield | 11.5% |

| Dividend Coverage Ratio | 1.0 |

The Lowdown on Sabra Health Care Stock

Sabra Health Care REIT Inc has strong institutional support, with 475 institutions holding 97.4% of the company’s outstanding shares. The Vanguard Group, Inc. holds a 14.84% stake in SBRA stock, while Blackrock Inc (NYSE:BLK) holds a 14.41% position. (Source: Yahoo! Finance, op. cit.)

I’m bullish on the company’s return to profitability, which should give a boost to Sabra Health Care stock. The REIT’s expected five-year earnings growth of 7.3% would be a significant improvement from the 31.0% decline over the REIT’s last five reported years.

SBRA stock could end up delivering share-price appreciation in addition to its reliable dividends.