Rising Oil Prices a Boon for 9.8%-Yielding CrossAmerica Partners Stock

CrossAmerica Partners LP Has Large Business Footprint & Well-Established Relationships

If you want to kick inflation to the curb and take advantage of soaring oil prices, now is the perfect time to take a close look at CrossAmerica Partners LP (NYSE:CAPL).

Why?

With the Chinese economy continuing to reopen and the Organization of the Petroleum Exporting Countries Plus (OPEC+) slashing its oil production, oil prices are expected to rise from the current level of $80.00 per barrel to $110.00 per barrel by the middle of this year. (Source “New OPEC+ Cuts Will Push Oil to $110 This Summer,” Rigzone, April 4, 2023.)

Gasoline prices have been holding steady, but it appears that the aforementioned headwinds will send them higher. We’re entering a period that’s expected to be very expensive for motorists.

That’s where CrossAmerica Partners steps in. The partnership is a leading U.S. wholesale distributor of motor fuel, owner and lessee of real estate used for gas stations, and operator of convenience stores. (Source: “Investor Presentation: September 2022,” CrossAmerica Partners LP, last accessed April 10, 2023.)

With a geographic footprint that spans 34 U.S. states, the company distributes branded and unbranded petroleum at about 1,800 locations. It owns or leases approximately 1,100 sites.

CrossAmerica Partners LP’s convenience stores operate under seven brand names at more than 250 locations in 10 U.S. states. The stores sell food, various essentials, and car washes. The partnership’s locations are also paired with prominent international fast-food brands such as “Arby’s,” “Dunkin’,” and “Subway.”

The company has well-established relationships with several major oil companies, including Exxon Mobil Corp (NYSE:XOM). CrossAmerica Partners LP ranks as one of Exxon Mobil’s largest U.S. distributors by fuel volume and is one of the top 10 fuel distributors for other oil companies. Three of the partnership’s fuel clients are BP plc (NYSE:BP), Shell PLC (NYSE:SHEL), and Marathon Petroleum Corp (NYSE:MPC).

In November 2022, CrossAmerica Partners completed its previously announced agreement to acquire certain assets of Community Service Stations, Inc. for $27.5 million plus working capital. (Source: “CrossAmerica Announces the Closing of Acquisition of Assets of Community Service Stations,” CrossAmerica Partners LP, November 10, 2022.)

Community Service Stations’ assets consisted of wholesale fuel supply contracts to 38 dealer-owned locations, 35 sub-wholesaler accounts, and two commission locations. The supply contracts included about 75 million gallons of fuel annually through fuel brands such as “Exxon Mobil,” Gulf,” and “Shell.”

“Outstanding” Q4 & Full-Year 2022 Results

In the fourth quarter of 2022, CrossAmerica Partners’ net income increased by 42.5% to $17.1 million. (Source: “CrossAmerica Partners LP Reports Fourth Quarter and Full Year 2022 Results,” CrossAmerica Partners LP, February 27, 2023.)

The partnership’s retail segment sold 125.1 million gallons of fuel during the fourth quarter of 2022. That was fairly flat, compared to the amount it sold during the fourth quarter of 2021. The retail segment generated $8.1 million more of motor fuel gross profits in the fourth quarter of 2022 than it did in the same period of 2021, due to higher fuel margins per gallon.

CrossAmerica Partners LP’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) grew in the fourth quarter by approximately 20% to $44.3 million.

Its distributable cash flow (DCF) advanced in the fourth quarter by 7.5% year-over-year to $33.3 million. Its distribution coverage ratio for the fourth quarter of 2022 was 1.7, compared to 1.6 for the fourth quarter of 2021.

CrossAmerica Partners LP’s full-year net income jumped by 193% year-over-year to $63.7 million, while its adjusted EBITDA climbed by 45% to $179.8 million. The company’s 2022 DCF grew by 38% year-over-year to $140.9 million. Its DCF coverage ratio for 2022 was 1.8, compared to 1.3 times for 2021.

In 2022, the partnership sold 496.6 million gallons of retail fuel, which was 23% higher than in 2021. The increase was primarily driven by CrossAmerica Partners LP’s acquisition of assets from 7-ELEVEN, Inc., which mostly occurred in the third quarter of 2021.

The company’s same-store fuel distribution volume in full-year 2022 was 324.8 million gallons, which was about one percent lower than its distribution volume of 329.3 million gallons in 2021.

The retail segment generated $67.2 million of additional motor fuel gross profit for the 12 months ended December 31, 2022, compared to the same period of 2021, due to both an increase in overall volume and a higher fuel margin per gallon.

Charles Nifong, CrossAmerica Partners LP’s president and CEO, commented, “Our results for the quarter, and year, were outstanding and our year-end balance sheet reflects our strong overall financial position…the Partnership was well positioned to capitalize on the favorable operating environment in the second half of 2022. Our strong strategic position and our excellent operational execution combined to generate exceptional financial performance for the year.” (Source Ibid.)

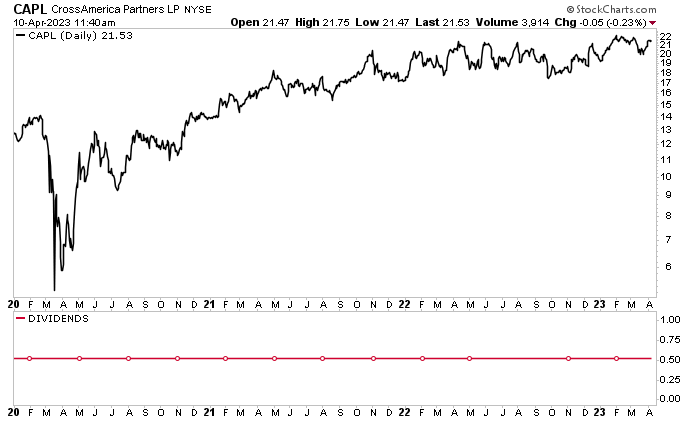

Quarterly Dividend Held at $0.525/Unit; CAPL Stock Trading at Record Level

In January, CrossAmerica Partners LP announced that its board approved a distribution of $0.525 per unit, for a yield of 9.8%. (Source: Ibid.)

That payout is safe. As noted above, CrossAmerica Partners stock’s distribution coverage ratio was 1.7 times for the fourth quarter of 2022 and 1.8 times for the full year.

While CAPL stock’s dividend has held steady at $0.525, CrossAmerica Partners LP’s ongoing high profitability growth should allow it to start raising its quarterly payouts again. Between 2013 and 2017, management raised CrossAmerica Partners stock’s quarterly payout 19 times.

What’s better than a reliable, inflation-crushing dividend stock? One that also has a share price that trumps the broader market.

In early February, CAPL stock hit a new all-time high of $22.36, for a year-to-date gain of 15.3%. As of this writing, CrossAmerica Partners stock is still trading near that record high, at $21.50 per share, which is:

- Up by 9.5% year-to-date

- Up by 13.2% over the last six months

- Down by 7.1% year-over-year

In comparison, the S&P 500 is:

- Up by 7.5% year-to-date

- Up by 14.5% over the last six months

- Down by 6.9% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on CrossAmerica Partners LP

While analysts are still calling for a recession this year, the strong economic data suggests the economy will continue to chug along despite rising interest rates. This, and other industry tailwinds, will continue to put upward pressure on oil and gasoline prices. And with the summer driving season just around the corner, the outlook for companies like CrossAmerica Partners LP is solid.

The company reported “outstanding” fourth-quarter and full-year 2022 results and expects to report “exceptional” results for 2023. CAPL stock is trading near its record level, and it continues to reward buy-and-hold investors with reliable, ultra-high-yield dividends.