Realty Income Corporation (NYSE:O) Increases Monthly Cash Dividend

Realty Income Announces Dividend Increase

Today, we check in on an established business churning out steady dividends.

Longtime readers know we love real estate investment trusts, or REITs. These businesses allow you to collect regular income from rental properties without dealing with tenants.

Case in point: Realty Income Corp (NYSE:O). The company buys recession-proof commercial buildings like auto shops, restaurant chains, and convenience stores. Management then leases these properties back to businesses in long-term contracts, with inflation bumps baked into the rent payments.

Most of these profits get passed on to shareholders in the form of stable, growing distributions. Over its 48-year operating history, the company has made 570 consecutive monthly dividend payments totaling some $5.2 billion.

Also Read:

Realty Income Corp: A Monthly Real Estate Stock

And judging by the latest Realty Income news, business looks good. In a press release Tuesday, management boosted the quarterly distribution 0.2% to $0.2125 per share. This payout comes out to an annual dividend of $2.55 per share, bringing the yield on Realty Income stock to 4.6%. (Source: “94th Common Stock Monthly Dividend Increase Declared By Realty Income,” Realty Income Investor Relations, December 12, 2017.)

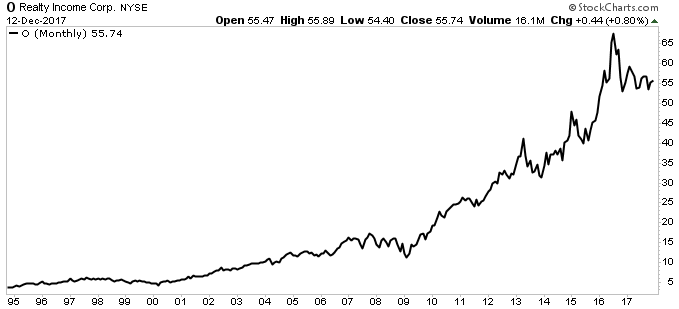

Those small dividend hikes can add up over time. Since going public in 1994, management has increased Realty Income’s monthly dividend 94 times. And through that period, shares have risen from a split-adjusted price of $3.50 to $55.00 today.

Chart courtesy of StockCharts.com

That beats chasing down rent checks from tenants. Why not kick up your feet and let Realty Income Corporation do all the hard work?