Realty Income Corp Stock: 634th Consecutive Monthly Dividend

Why O Stock Should Be on Investors’ Radar

Whether you’re new to dividend investing or a seasoned pro, it’s always good to familiarize yourself with different types of dividend stocks. For example, there are companies that pay ultra-high-yield dividends that are unsustainable, companies that pay dividends that are stable and don’t grow, companies that pay dividends that fluctuate, and companies that pay dividends that increase annually.

Then there’s the gold standard of dividend investing: Realty Income Corp (NYSE:O). The company is the largest triple-net real estate investment trust (REIT) in the U.S. and the fourth-largest REIT in the world. It owns more than 12,200 properties in all 50 U.S. states, Puerto Rico, the U.K. and Spain. (Source: “Investor Presentation: Calculated Consolidation: February 2023,” Realty Income Corp, last accessed April 27, 2023.)

The REIT’s properties, which are currently 99% occupied, are under long-term net leases to about 1,240 tenants in 84 industries. Grocery stores account for the largest percentage of the company’s contractual rent, at 10%. This is followed by:

- Convenience stores at 8.6%

- Dollar stores at 7.4%

- Quick-service restaurants at 6.0%

- Drug stores at 5.7%

- Home improvement retailers at 5.6%

- Casual dining restaurants at 5.1%

- Health and fitness centers at 4.4%

- Automotive service centers at 4.0%

- General merchandise retailers at 3.7%

Five of the company’s top clients are Dollar General Corp (NYSE:DG), FedEx Corp (NYSE:FDX), Wynn Resorts, Limited (NASDAQ: WYNN), Home Depot Inc (NYSE:HD), and Kroger Co (NYSE:KR).

Thanks to the company’s diverse tenant base, 92% of its total rent is resilient to economic downturns and/or isolated from e-commerce pressures.

Recent Property Acquisitions

To maintain its status as one of the largest REITs, Realty Income Corp needs to continually expand and diversify its property portfolio. The company has been busy doing that in the past two years.

In February 2022, the REIT signed a definitive agreement to acquire the Encore Boston Harbor Resort and Casino property for $1.7 billion in a long-term net lease agreement with Wynn Resorts. (Source: “Realty Income Announces $1.7 Billion Sale-Leaseback of Encore Boston Harbor Through Partnership With Wynn Resorts,” Realty Income Corp, February 15, 2022.)

The sale-leaseback transaction with Wynn Resorts is expected to be executed at a 5.9% initial cash cap rate on a 30-year lease that increases the rent at the rate of the Consumer Price Index (CPI), with a floor of 1.75% and a ceiling of 2.5%.

Realty Income Corp’s acquisition of the resort and casino property is its first foray into the gaming sector. This will make the company less sensitive to downturns in retail spending.

On December 30, 2022, the REIT announced that it had signed a definitive agreement to acquire up to 185 single-tenant retail and industrial properties from subsidiaries of CIM Real Estate Finance Trust, Inc. (OTCMKTS:CMRF) for approximately $894.0 million in cash. This transaction is expected to close in the first quarter of 2023. (Source: “Realty Income to Acquire Properties from CIM Real Estate Finance Trust, Inc. for $894 Million, 7.1% Cash Cap Rate,” Realty Income Corp, December 30, 2022.)

The properties from CIM Real Estate Finance Trust, which cover up to 4.6 million square feet, are leased to 55 retail clients (95% of the properties) and four industrial clients (five percent of the properties). Drug stores, home improvement retailers, and grocery stores are expected to be the top three sectors in terms of the properties’ total annualized contractual rent—at 12.1%, 12.1%, and 11.9%, respectively.

Lowe’s Companies Inc (NYSE:LOW) and Walgreens Boots Alliance Inc (NASDAQ:WBA) are expected to be the top two tenants in terms of total annualized contractual rent—at 11.9% and 7.6%, respectively.

In February 2023, Realty Income Corp announced that it had joined a strategic real estate alliance with Plenty Unlimited Inc. to invest $1.0 billion to build indoor farming space leased to Plenty Unlimited. (Source: “Realty Income and Plenty Announce Strategic Alliance for up to $1 Billion of Vertical Farm Development,” Realty Income Corp, February 21, 2023.)

Arama Kukutai, the CEO of Plenty Unlimited, said the greatest challenge indoor farming faces is the significant expense of building new facilities to increase production. The deal with Realty Income Corp will help Plenty Unlimited Inc. expand. For instance, Realty Income will invest $42.0 million into Plenty Unlimited’s strawberry farm near Richmond, Virginia. The multi-farm campus is expected to deliver more than 20 million pounds of produce.

Plenty Unlimited Inc. already supplies leading grocers on the West Coast of the U.S., and it will now expand its California business footprint to also supply Walmart Inc (NYSE:WMT), which is also an equity investor in Plenty Unlimited.

Retail Store Closures an Opportunity for Realty Income Corp

The recent bankruptcy filing of Bed Bath & Beyond Inc (NASDAQ:BBBY) and the demise of Sears and Kmart point to the possibility of other retail implosions over the coming years.

A recent study suggests that up to 50,000 retail stores in the U.S. (of the current 940,000) will close down by 2027. This excludes gas and food service stations. (Source: “Retail Store Closures ‘to Sharply Accelerate Going Forward’: UBS Research,” Yahoo! Finance, April 24, 2023.)

The closure of underperforming retail chains such as Bed Bath & Beyond will open the door for strong national players to expand. The closure of 50,000 stores that had average sales per store of $5.7 million means there’s $285.0 billion in potential retail sales for the taking.

If we assume that 25% of the potential sales go to online retailers, it means store chains like Walmart, Lowe’s, and Home Depot still have the potential to reel in $214.0 billion of sales at their brick-and-mortar locations.

My point is that the retail market has been taking a hit, but some companies are better prepared than others to deal with online shopping and other forms of competition. Many of those retailers are already part of Realty Income Corp’s tenant base and could fill the spaces that will be left behind by other retailers.

Realty Income Corp Stock’s Dividend Triple the S&P 500 Average

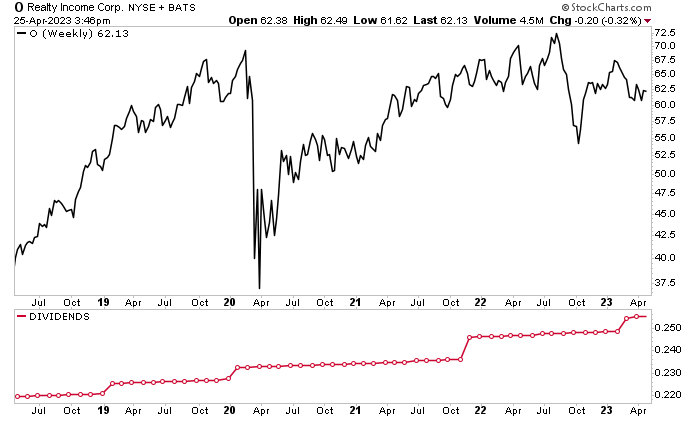

Realty Income Corp doesn’t attract the same kind of attention as some of its flashier peers because its dividend isn’t as high as theirs. As of this writing, O stock pays a monthly dividend of $0.255 per share, for a dividend yield of 4.9%. That’s not exactly a small yield; it’s almost triple the S&P 500’s average dividend yield of 1.7%.

What really sets Realty Income Corp stock apart from its peers? No company can compete with Realty Income Corp when it comes to number of consecutive monthly payouts and number of dividend increases.

At a time when inflation, rising interest rates, and a looming recession are forcing some companies to cut or suspend their dividends, Realty Income Corp has been living up to its nickname as “The Monthly Dividend Company.”

As of April, O stock had paid dividends for 634 consecutive months! Moreover, the REIT has increased its dividend 120 times since going public in 1994. That means shareholders can look forward to a pay raise each quarter. (Source: “634th Consecutive Common Stock Monthly Dividend Declared by Realty Income,” Realty Income Corp, April 11, 2023.)

What about its share price? It’s easy for a company to have a high dividend yield when its share price is falling. Realty Income Corp stock’s price hasn’t been exactly thumping the broader market, but it hasn’t been plummeting either. As of this writing, it’s down by one percent year-to-date and 10.5% year-over-year. On the plus side, it’s up by 5.1% over the last six months.

Part of the challenge might be investor optimism, or lack thereof right now, however misguided.

Chart courtesy of StockCharts.com

Strong Q4 & Full-Year 2022 Results

For the fourth quarter of 2022, Realty Income Corp announced that its revenue increased by 29.7% year-over-year to $888.7 million. Its net income went up significantly to $227.3 million, or $0.36 per share. (Source: “Realty Income Announces Operating Results for the Three Months and Year Ended December 31, 2022,” Realty Income Corp, February 21, 2023.)

The REIT’s normalized funds from operations (FFO) increased by 18% to $1.05 per share and its adjusted FFO went up by 6.4% to $1.00 per share.

During the fourth quarter, the company completed its previously announced acquisition of land and real estate from Wynn Resorts, invested $3.9 billion in 578 properties, and announced the previously-mentioned acquisition of up to 185 single-tenant retail and industrial properties for approximately $894.0 million.

In full-year 2022, Realty Income Corp’s total revenues went up by 60% to $3.3 billion. Its net income more than doubled to $869.4 million, or $1.42 per share. Its normalized FFO increased by 19.8% to $4.06 per share, while its adjusted FFO increased by 9.2% to $3.92 per share.

During the year, the REIT invested $9.0 billion in 1,301 properties and properties under development or expansion, including $2.5 billion in Europe. It also reported occupancy of 99%, its highest percentage in more than 20 years.

For dividend hogs, the company’s payout increased by 4.7% in 2022.

The Lowdown on Realty Income Corp

When it comes to reliable, growing dividends, it’s tough to beat Realty Income Corp stock.

Billing itself as “The Monthly Dividend Company,” the REIT is a member of the S&P 500 Dividend Aristocrats, which means it has raised its dividend for at least the past 25 years. As mentioned earlier, to date, Realty Income Corp has declared 634 consecutive monthly dividends throughout its 54-year operating history and has increased its dividend 120 times since going public in 1994.

The reliable dividends and share-price growth make O stock a no-brainer for passive income investors, especially those who are just getting started.