Realty Income Corp: 4.1%-Yielder Raises Dividend for 96th Consecutive Quarter

Realty Income Corp Announces 618th Consecutive Monthly Dividend

Realty Income Corp (NYSE:O) has positioned itself as “The Monthly Dividend Company.” For dividend hogs who would rather get paid monthly than quarterly, O stock makes a lot of sense. It doesn’t matter what’s going on in the world; one thing investors can rely on is that this dividend stock will pay them each and every month.

What “The Monthly Dividend Company” motto doesn’t quite get across is that the real estate investment trust (REIT) also raises its dividend on a regular basis. In fact, Realty Income Corp stock has paid dividends in 618 consecutive months, and its dividend has increased 114 times since the stock went public on the New York Stock Exchange in 1994. (Source: “114th Common Stock Monthly Dividend Increase Declared by Realty Income,” Realty Income Corp, December 15, 2021.)

Even better, its dividend has increased in the last 96 consecutive quarters. Most recently, on December 15, 2021, Realty Income Corp declared an increase in its monthly common dividend from $0.246 to $0.2465 per share, for a yield of 4.1%.

“As we approach the end of 2021, I’m pleased that our Board of Directors has once again determined that Realty Income can increase the amount of the monthly dividend,” said Sumit Roy, president and CEO. “This will be our 114th dividend increase since 1994 and is in line with our mission to invest in people and places to deliver dependable monthly dividends that increase over time.” (Source: Ibid.)

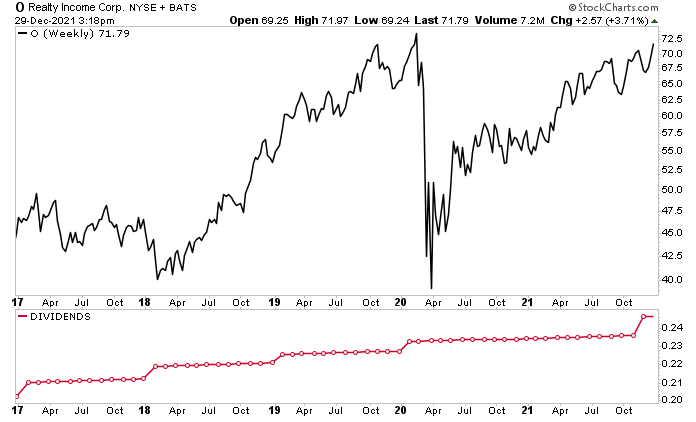

Chart courtesy of StockCharts.com

That’s a huge, storied dividend history. But can it continue? If a global recession and pandemic can’t derail the company’s monthly dividend increases, one has to wonder what could?

As you can see in the above chart, O stock has been doing well in terms of share price. As of this writing, Realty Income Corp stock is up by 14% over the last three months and 27% year-over-year. Since the stock began trading in 1994, its compound annual total return has been 15.1%, with compound annual dividend growth of 4.5%.

About Realty Income Corp

Realty Income Corp is the largest triple net REIT in the U.S., owning 11,000 properties under long-term net lease agreements. Its properties are leased to about 650 clients in 60 industries in all 50 U.S. states plus Puerto Rico, Spain, and the U.K. Thanks to the company’s diverse portfolio, 96% of its total rent is resilient during economic downturns and/or is protected from e-commerce competition. (Source: “Investor Presentation: November 2021,” Realty Income Corp, last accessed December 31, 2021.)

The company’s top 10 tenants are:

- 7-Eleven (5.7% of portfolio)

- Walgreens (5.0%)

- Dollar General (4.2%)

- FedEx (3.4%)

- Dollar Tree/Family Dollar (3.3%)

- Sainsbury’s (3.2%)

- LA Fitness (2.8%)

- AMC Theatres (2.5%)

- Regal (2.4%)

- Walmart/Sam’s Club (2.3%)

Realty Income Corp is able to attract such high-quality tenants because the lease terms are very favorable to them, with annual rent increases of just one percent.

To grow its business, the REIT needs to continue adding to its property portfolio. In 2020, the year that COVID-19 brought the global economy to its knees, the company invested $2.3 billion in properties and properties under development or expansion.

Its acquisition strategy was even more aggressive in 2021. From October 1, 2021 through December 1, 2021, the company acquired properties with an aggregate purchase price of approximately $1.1 billion. It also entered agreements or letters of intent to purchase additional properties with an aggregate estimated purchase price of over $1.1 billion. (Source: “Realty Income Provides Business Update,” Realty Income Corp, December 2, 2021.)

Between the acquisitions that have closed in the fourth quarter of 2021, the properties that Realty Income Corp currently has under agreements and letters of intent, and the $3.8 billion of acquisitions closed in 2021 through September 30, Realty Income’s 2021 investment pipeline represents approximately $6.0 billion of volume.

The company says its “fortress balance sheet and access to a low-cost, diversified capital pool supports the curation of a best-in-class real estate portfolio generating growing cash flows guaranteed by large, national, blue-chip operators.” (Source: “Investor Presentation: November 2021,” Realty Income Corp, op. cit.)

Merger With VEREIT

In November 2021, Realty Income completed the previously announced merger with VEREIT, Inc. (NYSE:VER). VEREIT was a full-service REIT that owned and managed one of the largest portfolios of single-tenant commercial properties in the U.S. (Source: “Realty Income Closes Merger With VEREIT,” Realty Income Corp, November 1, 2021.)

Immediately following the closing of the merger, Realty Income Corp completed the spin-off of its office assets of the combined company into Orion Office REIT Inc (NYSE:ONL). Orion Office REIT common stock began trading on the New York Stock Exchange on November 15, 2021.

Excellent Q3 Results

On the same day Realty Income Corp closed its merger with VEREIT, Inc., it announced strong third-quarter results. Its net income per share increased to $0.34 in the quarter, from $0.07 in the same period in 2020. (Source: “Realty Income Announces Operating Results For The Three and Nine Months Ended September 30, 2021,” Realty Income Corp, November 1, 2021.)

The REIT’s normalized funds from operations increased by 8.5% year-over-year to $0.89, while its adjusted funds from operations climbed by 12.3% year-over-year to $0.91 per share.

Also during the third quarter, the company invested $1.6 billion in 308 properties and properties under development or expansion, including $532.5 million in Europe.

The Lowdown on Realty Income Corp

Realty Income Corp certainly lives up to its self-description as “The Monthly Dividend Company.” As mentioned earlier, the REIT has paid a dividend each month for 618 consecutive months and has raised its dividend in the last 96 consecutive quarters. The company’s operating metrics and growing, diverse property portfolio make O stock’s dividend one of the most stable sources of passive income.

Its share-price growth is nothing to sneeze at, either. As noted above, with dividends, Realty Income Corp stock has reported a 15.1% compound annual total return since going public in 1994.

With its VEREIT merger, Realty Income Corp’s size, scale, and diversification should further enhance its competitive advantages, accelerate its investment activity, and enhance shareholder value.