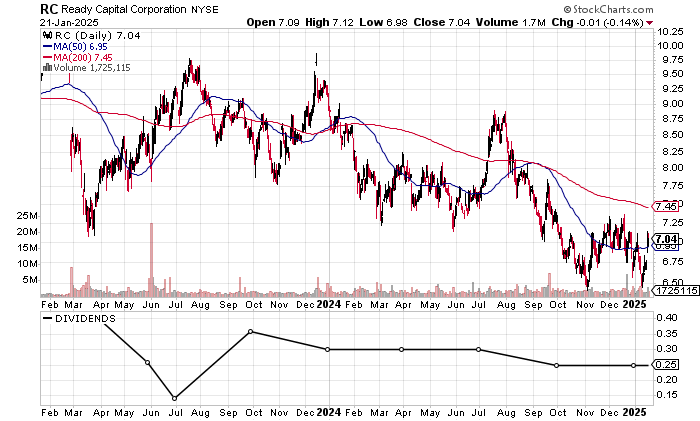

Ready Capital Stock: A Juicy 14.2% Yield with Strong Upside

Small-Cap REIT Offers Strong Risk/Reward

Interest rates are beginning to head lower. The only question is: how fast will this happen?

It looks like there could be one or two cuts in 2025 depending on inflation and the economy.

A lower interest rate environment supports capital-heavy businesses such as those found in real estate investment trust (REIT) vehicles.

The REIT is designed for the income investor given that it is required to distribute at least 90% of its taxable income to shareholders in any given year. The more the REIT makes, the more income you receive, and vice-versa. So, I think that a move to lower interest rates could power an upside move in REITs.

Take the case of Ready Capital Corp (NYSE:RC), a small-cap REIT with a market valuation of $1.15 billion as of January 22.

It operates as a multi-strategy real estate finance company. Ready Capital originates, acquires, finances, and services lower-to-middle-market, investor- and owner-occupied commercial real estate loans.

To hedge against the loan risk, the REIT focuses on loans collateralized by commercial real estate. This includes agency multifamily, investor, construction, and bridge loans, along with U.S. Small Business Administration loans. (Source: “About Ready Capital,” Ready Capital Corp, last accessed January 22, 2025.)

In my view, the expected ratcheting down of interest rates should help power loan demand for the company over the next few years.

Chart courtesy of StockCharts.com

Moving Towards $1.0 Billion in Revenues

Ready Capital’s business is generally dependent on the economy and interest-rate environment.

A strong economy and lower rates are both positive factors driving clients to expand, which benefits Ready Capital.

In 2023, the REIT reported $945.8 million in interest income, which is the revenue derived from its loan investments. (Source: “Ready Capital Corporation Reports Fourth Quarter 2023 Results,” Ready Capital Corp, February 27, 2024.)

But, as I said, the interest income is highly correlated to numerous factors, so it can be inconsistent.

Case in point: analysts estimate that Ready Capital will report a consensus $921.6 million in 2024, albeit the range varies from a low of $905.3 million to a high of $940.8 million.

The REIT’s wide moat for revenues extends into 2025 with an expected drop to $785.7 million. The estimates are extremely broad, ranging from as low as $300.3 million to a high of $1.02 billion. (Source: “Ready Capital Corporation (RC),” Yahoo! Finance, last accessed January 22, 2025.)

A look at the third quarter showed that Ready Capital had interest income of $226.5 million, compared to $248.7 million for the comparable period in 2023. The first three quarters delivered interest income of $693.0 million, suggesting that the consensus estimate is on target. (Source: “Ready Capital Corporation Reports Third Quarter 2024 Results,” Ready Capital Corp, November 7, 2024.)

On the bottom line, Ready Capital reports on both a generally accepted accounting principles (GAAP) and distributable earnings per share (the company’s core or adjusted earnings) basis. The latter is what the company looks at for its dividends.

In 2023, Ready Capital generated $2.27 per share in GAAP earnings and $1.18 per share in distributable earnings.

Analysts estimate that the REIT will hit consensus distributable earnings of $0.97 per share in 2024 and $1.16 per share in 2025. But, just like the interest income, the estimates are quite broad. The range is $0.80 to $1.14 for 2024 and $0.97 to $1.39 for 2025. (Source: Yahoo! Finance, op. cit.)

In the third quarter, Ready Capital reported a GAAP loss of $0.07 per diluted share and a distributable earnings loss of $0.28 per diluted share. While this was well short of the consensus, the REIT paid a $0.25-per-share dividend. (Source: Ready Capital Corp, op. cit.)

The major risk with Ready Capital is the $8.2 billion in total debt on the balance sheet. And, while there’s only $192.4 million in cash, the REIT’s working capital is extremely strong at this time. (Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a weak 3.0 for Ready Capital, which is below the midpoint of the 1.0 to 9.0 range.

Ready Capital Stock’s Dividend Should Be Safe

Ready Capital stock’s current dividend of $0.25 per share was paid in September and December; it’s down from the $0.30 per share in June and March.

Based on the REIT’s recent dividend, the annualized dividend of $1.00 translates into a forward dividend yield of 14.2%.

The expected payout ratio is 103.1% for 2024, prior to falling to a reasonable 86.2% based on the 2025 estimate.

Moving forward, I expect Ready Capital to continue to focus on delivering income to investors. If the economy holds and interest rates decline, the company could see a corresponding rise in distributable earnings and dividends.

| Metric | Value |

| Dividend Streak | 9 years |

| Dividend 7-Year CAGR | -2.2% |

| 10-Year Average Dividend Yield | 19.2% |

| Dividend Coverage Ratio | 1.0X |

The Lowdown on Ready Capital Stock

Ready Capital operates in a complex loan business that entails risk and macroeconomic uncertainties. The company has navigated through the uncertainties of the last few years while still paying dividends.

The REIT is also in the midst of a $100.0-million stock repurchase program started in 2023. So far, Ready Capital has bought back around 1.7 million shares at a much higher average share price of $10.82. This suggests that the company believes its stock is undervalued.