Ramaco Resources Stock: 8.62%-Yielder with Great Upside

A Contrarian Opportunity for Income Investors

There’s some significant potential with Ramaco Resources stock.

High-quality metallurgical coal is a critical input used to produce steel-based critical materials. With the expected build-up of the country’s crumbling infrastructure, I expect the demand for steel materials to remain strong and to accelerate.

Ramaco Resources Inc (NASDAQ:METCB) is a small-cap producer of high-quality metallurgical coal. The $708.0-million market-cap company is also exploring opportunities in rare earth elements and critical minerals, which represent the minerals of the future. Given that the U.S. wants to reduce its dependence on rare earth from China, this offers opportunities. (Source: “BUILDING the Future,” Ramaco Resources Inc, last accessed July 23, 2024.)

I’m going to cover the class B shares given the higher yield compared to the class A shares, Ramaco Resources Inc (NASDAQ:METC).

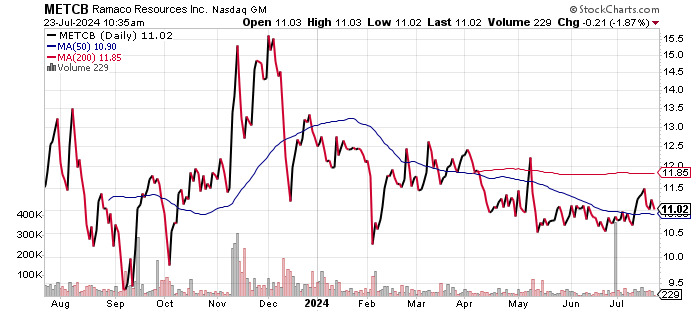

The chart shows Ramaco Resources stock down 17.2% this year. The price weakness has pushed the forward dividend yield higher to the current 8.62%.

Contrarian income investors can enter this high-yielding dividend stock and wait for the shares to rebound. In the meantime, shareholders collect a nice dividend.

METCB stock is down 38.7% from its 52-week high of $17.90. The stock is hovering just above its 50-day moving average (MA) of $10.98, but below its 200-day MA of $12.24.

Reclaiming the 200-day MA could drive Ramaco Resources stock back towards its 52-week high for a potential return of 59.4%.

Chart courtesy of StockCharts

Growing Revenues Drive Free Cash Flow

Ramaco Resources Inc increased its revenues by 201.7% from 2019 to the record $693.5 million in 2023. This included strong double-digit growth over the last three years. The compound annual growth rate (CAGR) was a strong 31.8% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $230.2 | 1.2% |

| 2020 | $168.9 | -26.6% |

| 2021 | $283.4 | 67.8% |

| 2022 | $565.7 | 99.6% |

| 2023 | $693.5 | 22.6% |

(Source: “Ramaco Resources, Inc,” MarketWatch, last accessed July 23, 2024.)

Analysts expect the company to report revenue growth of 12.6% to $780.9 million in 2024, followed by an even better 17.7% increase to $918.9 million in 2025. (Source: “Ramaco Resources, Inc (METC),” Yahoo! Finance, last accessed July 23, 2024.)

Ramaco Resources has been inconsistent with its gross margins, but it did manage a record 41.1% in 2022 before contracting.

| Fiscal Year | Gross Margins |

| 2019 | 29.4% |

| 2020 | 13.9% |

| 2021 | 31.0% |

| 2022 | 41.1% |

| 2023 | 28.8% |

The gross margin expansion in 2022 led to a record $2.60 per diluted share in generally accepted accounting principles (GAAP) profits. Ramaco Resources reported lower earnings in 2023, but it was still the second highest overall in the last 10 years.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.61 | N/A |

| 2020 | -$0.12 | -119.7% |

| 2021 | $0.90 | -850.0% |

| 2022 | $2.60 | 188.9% |

| 2023 | $1.73 | -33.5% |

(Source: “Ramaco Resources, Inc (METCB),” Yahoo! Finance, last accessed July 23, 2024.)

On an adjusted basis, Ramaco Resources earned $1.88 per diluted share in 2023. This is expected to rise to $2.43 per diluted share in 2024 and $2.37 per diluted share in 2025. The end result is that METCB stock is trading at a compelling 4.7 times its consensus 2025 earnings estimate compared to the average multiple of 10.8 times over the last five years. (Source: MarketWatch, op. cit.)

A look at the fund statement points to positive free cash flow (FCF) in 2022, followed by the record $78.1 million in 2023. The positive FCF should allow for continued dividends and financial flexibility.

Ramaco Resources Inc paid down a net $44.2 million in long-term debt in 2023 and bought back $7.3 million in common stock. It was the fourth straight year of share buybacks.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | -$3.3 | N/A |

| 2020 | -$11.4 | -242.5% |

| 2021 | -$6.3 | 45.2% |

| 2022 | $64.9 | 1,133.9% |

| 2023 | $78.1 | 20.5% |

(Source: MarketWatch, op. cit.)

The company’s balance sheet shows $30.5 million in cash and $103.5 million in total debt at the end of March. This is manageable. The interest coverage ratio has been strong in three straight years.

Ramaco Resources has also consistently covered its interest payments via higher earnings before interest and taxes (EBIT), with the exception of 2020.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | -$7.2 | $1.2 | N/A |

| 2021 | $47.0 | $2.6 | 18.1X |

| 2022 | $153.0 | $6.8 | 22.5X |

| 2023 | $113.6 | $8.9 | 12.8X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a reasonable reading of 6.0, which is above the midpoint of the 1.0 to 9.0 range.

Strong Dividend Coverage Suggests Safe Dividend

The forward yield of 8.62%, largely due to the price weakness, is attractive. An increase in Ramaco Resources stock would result in a lower yield, but an investor’s shares would appreciate in value. (Source: Yahoo! Finance, op. cit.)

The payout ratio of 54.8% is reasonable. Given the higher expected earnings, I believe Ramaco Resources Inc will continue to raise dividends. The dividend coverage ratio is strong at 5.8 times.

| Metric | Value |

| Dividend Streak | 3 years |

| Dividend Growth Streak | 2 years |

| 3-Year Average Dividend Yield | 3.9% |

| Dividend Coverage Ratio | 5.8X |

The Lowdown on Ramaco Resources Stock

My view is that Ramaco Resources stock would suit a contrarian income investor who is seeking a higher yield and price appreciation potential.