Philip Morris Stock: 5%-Yielder Reports Q4 Earnings Beat

Why PM Stock Is Trading Near Record Levels

Some investors are willing to stomach a little volatility with stocks that pay eyewatering, ultra-high-yield dividends. Other investors prefer bullish, yet less volatile, stocks that pay reliable, high-yield dividends.

Philip Morris International Inc. (NYSE:PM) is nestled in the latter category. It’s a tobacco industry juggernaut that Wall Street is increasingly bullish on. The company has raised its dividends in each of the last 14 consecutive years.

Philip Morris International Inc. is the world’s second-largest tobacco company (the largest is China National Tobacco Corporation, which is owned by the Chinese government). Moreover, thanks to a number of strategic acquisitions, Philip Morris International is working on becoming the leader in alternatives to cigarettes, otherwise known as reduced-risk products (RRP).

The company was launched in 2008 when the U.S.-based Philip Morris spun off its international division, giving Philip Morris International Inc. the right to sell Philip Morris products everywhere except the U.S., where the original company—now named Altria Group Inc (NYSE:MO)—would sell the same products.

Philip Morris International operates 38 production facilities and produces more than 700 billion cigarettes each year. Its machines can produce up to 20,000 cigarettes every minute. (Source: “Making Cigarettes,” Philip Morris International Inc., last accessed February 23, 2023.)

The company manufactures a wide variety of international and local cigarette brands. Its leading brand is “Marlboro,” the world’s best-selling international cigarette. Its other top-selling brands include “Bond Street,” “Chesterfield,” “Parliament,” and “Philip Morris.” (Source: “Building Leading Brands,” Philip Morris International Inc., last accessed February 23, 2023.)

The company’s products are sold in more than 175 markets. In many of these markets, its products hold the No. 1 or No. 2 market-share position. The company has five of the top 15 international brands in its industry.

Philip Morris International’s management is aware of the dwindling use of cigarettes. That’s why the company has been making strides toward generating the majority of its revenue from smoke-free products. It’s well on its way, with almost one-third of its total net revenue coming from RRPs.

Philip Morris International Inc. to Commercialize IQOS Brand in U.S.

In the RRP category, Philip Morris has the world’s leading smoke-free tobacco brand, “IQOS.” The product’s most recent iteration, “IQOS ILUMA,” uses induction heating instead of burning to release nicotine-containing vapor. Compared to cigarettes, IQOS ILUMA emits, on average, 95% lower levels of harmful chemicals. (Source: “Heated Tobacco Products,” Philip Morris International Inc., last accessed February 23, 2023.)

The company has been rolling out IQOS ILUMA on a global basis. In the fourth quarter of 2022, it launched the product in eight new markets, including Italy, Portugal, and South Korea. IQOS ILUMA is also available in duty-free markets across Europe and in Japan.

IQOS established Philip Morris International’s “heat-not-burn” business segment. In 2021, about six years after its initial commercial launch, the segment started making $9.0 billion in net revenues outside the U.S. annually. IQOS has achieved double-digit national market shares in Asia, Europe and other areas. (Source: “Philip Morris International Reaches Agreement With Altria Group, Inc. to End the Companies’ Commercial Relationship Covering IQOS in the U.S. as of April 30, 2024,” Philip Morris International Inc., October 20, 2022.)

The only thing missing with IQOS is its entry into the U.S. market, but Philip Morris recently cleared that hurdle. In October 2022, the company announced an agreement with Altria Group Inc to end Altria’s commercial rights covering IQOS in the U.S. as of April 30, 2024. After that date, Philip Morris International Inc. will have full rights to commercialize IQOS in the U.S.

“This agreement gives [Philip Morris International (PMI)] full U.S. commercialization rights to IQOS within approximately 18 months and provides a clear path to fulfilling the product’s full potential in the world’s largest smoke-free market, leveraging PMI’s full strategic and financial commitment to IQOS’s success,” said Jacek Olczak, Philip Morris International Inc.’s CEO, last October. (Source: Ibid.).

“The agreement also avoids what could have been an uncertain and protracted legal process that would have severely hindered the fast deployment of IQOS in the U.S.”

Recent Acquisitions

Philip Morris International Inc.’s evolution into a smoke-free company is a result of strategic acquisitions.

For instance, in September 2021, the company completed its $820.0 million acquisition of Denmark-based Fertin Pharma. (Source: “Philip Morris International Announces Closing of Fertin Pharma Acquisition; Advances PMI’s Goal of Becoming a Majority Smoke-Free Business by 2025 and Creates Growth Opportunities Beyond Nicotine,” Philip Morris International Inc., September 15, 2021.)

Ferin Pharma specializes in the research, development, and production of gums, liquefiable tablets, pouches, and other solid oral systems for the delivery of active ingredients such as nicotine.

In November 2022, Philip Morris announced that it had acquired more than 90% of Swedish Match AB for $16.0 billion. The agreement will allow Philip Morris to also acquire the remaining shares of Swedish Match. (Source: “Philip Morris International Progresses Toward Sole Ownership of Swedish Match, Further Supporting Our Ambition to Deliver a Smoke-Free Future,” Philip Morris International Inc., December 5, 2023.)

Swedish Match and its U.S. distribution network give Philip Morris a foothold in the biggest market for smoke-free tobacco products, including heated tobacco products, pouches, and vaping devices.

In Scandinavia, Swedish Match leads the market for snus, a moist oral snuff that’s usually sold in small pouches. Also in Scandinavia, the company has the No. 2. share of the nicotine pouch market. Swedish Match’s nicotine pouches have a market presence in several European countries. (Source: “Smokefree,” Swedish Match, last accessed February 23, 2023.)

Snus isn’t a major tobacco product in the U.S., but Swedish Match has a longstanding presence in the country with its snus brand “General.” Also in the U.S., Swedish Match leads in the nicotine pouch category with its “ZYN” brand, it’s the biggest producer of chewing tobacco, and it has the third-largest market share in the moist snuff category.

Swedish Match also has the No. 2 market share in the U.S. for mass-market cigars (excluding little cigars). (Source: “Cigars,” Swedish Match, last accessed February 23, 2023.)

Philip Morris International’s takeover of Swedish Match should help the company accelerate its goal of generating more than half of its revenue from alternative smoking products by 2025. (Source: Philip Morris International Inc., December 5, 2023, op. cit.)

Q4 Earnings & Revenue Beat

For the fourth quarter ended December 31, 2022, Philip Morris announced that its net revenues inched up by 0.6% year-over-year (7.9% when excluding Russia and Ukraine) to $8.1 billion. Its net revenues from smoke-free products made up 36.0% of that total (35.6% when excluding Russia and Ukraine). (Source: “Philip Morris International Inc. (PMI) Reports 2022 Fourth-Quarter and Full-Year Results,” Philip Morris International Inc., February 9, 2023.)

The company’s fourth-quarter shipment volume increased by 1.2% year-over-year (2.6% when excluding Russia and Ukraine). Its cigarette shipment volume declined by 2.8% year-over-year in the quarter (0.5% in the full year) as consumption patterns continued to shift from cigarettes to heated tobacco and other products. The company’s heated tobacco unit shipment volume went up by 26.1% in the fourth quarter and—excluding Swedish Match—represented 17.2% of Philip Morris International Inc.’s shipment volume.

The company’s fourth-quarter earnings per share (EPS) were $1.54, up by 14.9% from $1.23 in the same period of 2021.

Olczak commented, “Despite the challenging operating environment in 2022, due to the war in Ukraine, as well as supply-chain and global inflationary pressures, we delivered very strong full-year adjusted results led by the continued growth of IQOS and a robust performance in the combustible tobacco category.” (Source: Ibid.)

He added, “We enter 2023 as a truly global smoke-free champion, with two of the industry’s leading smoke-free brands, IQOS and ZYN, and continued innovation across our broader smoke-free product portfolio.”

For 2023, Philip Morris International Inc. expects to report organic top-line growth of seven percent to 8.5% and currency-neutral adjusted diluted EPS growth of seven percent to nine percent.

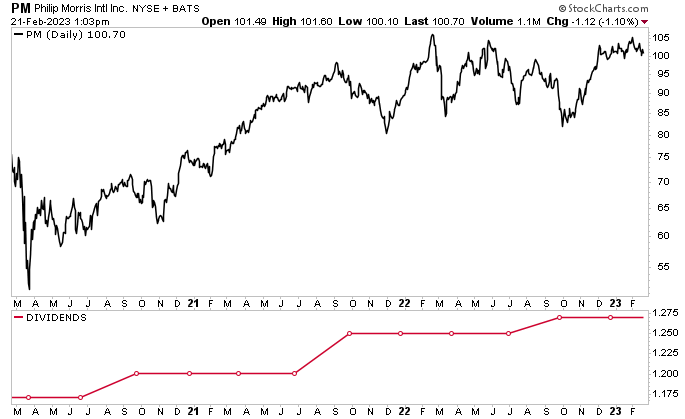

Philip Morris Stock’s Price & Quarterly Dividends Rise

Thanks to its high earnings (including $2.4 billion in the fourth quarter and $9.0 billion in full-year 2022), Philip Morris International Inc. is able to provide PM stockholders with reliable, growing, high-yield dividends. In December 2022, management declared a dividend of $1.27 per share, for a current yield of about five percent.

Management has increased Philip Morris stock’s dividend every year since the company went public in 2008, representing a total increase of 176.1%, or a compound annual growth rate of 7.5%.

Philip Morris International Inc.’s superb fourth-quarter and full-year results have been helping drive PM stock considerably higher in price. Furthermore, since late October, when the company announced it would be commercializing IQOS in the U.S., Philip Morris stock has rallied by 20%.

Chart courtesy of StockCharts.com

PM stock still needs to climb by five percent to top its record high of $111.17 (which was reached in February 2022). Meanwhile, Wall Street analysts have provided a 12-month share-price forecast of $111.09 to $120.00, which points to potential gains in the range of 10.4% to 19.2%.

The Lowdown on Philip Morris International Inc.

Philip Morris International is the world’s largest publicly traded cigarette maker, but it’s been making great progress in transitioning into a “smoke-free champion.” As mentioned earlier, the company has two of the tobacco industry’s leading smoke-free brands: IQOS and ZYN.

Philip Morris International Inc. only acquired the ZYN brand in November 2022, so the company’s growth trajectory with that product—and its entry into the U.S. market—is just beginning. With regards to IQOS, its sales should be juiced in May 2024, when Philip Morris International is able to start selling products under that brand name in the U.S.

With its control of those two brands, the company is well positioned to accelerate its position as the leader in smoke-free products. This bodes well for Philip Morris stock’s price and dividends.