Outlook for Necessity Retail REIT Stock Robust After $1.3-Billion Acquisition

RTL Stock Has 80%+ Upside

For the U.S., consumer spending accounts for about 70% of its gross domestic product (GDP). So, it’s fair to say that shopping is necessary for juicing the U.S. economy.

When it comes to having a finger on the pulse of where Americans shop, few can compete with Necessity Retail REIT Inc (NASDAQ:RTL). The real estate investment trust (REIT) owns and manages a diverse portfolio of properties that are mostly “necessity-based” retail single-tenant and open-air shopping centers in the U.S. (Source: “Corporate Profile,” Necessity Retail REIT Inc, last accessed October 24, 2022.)

Its retail properties, which are in established suburban communities, are brick-and-mortar locations that consumers tend to visit on a daily basis. (Source: “Second Quarter 2022 Investor Presentation: August 2022,” Necessity Retail REIT Inc, last accessed October 24, 2022.)

In February, the company actually changed its name from the more generic American Finance Trust to Necessity Retail REIT Inc in order to better reflect its retail-focused property portfolio.

The REIT’s 1,057 properties cover more than 29.3 million rentable square feet (equal to about 509 NFL fields) in 48 states. As of the second quarter, 57% of the company’s straight-line rent came from Sun Belt states, a market that continues to grow and have favorable demographic tailwinds.

The company’s top customers include Dick’s Sporting Goods Inc (NYSE:DKS), Dollar General Corp (NYSE:DG), Home Depot Inc (NYSE:HD), and PetSmart LLC.

The company’s property portfolio is always expanding. In 2021, the REIT acquired 69 properties for $179.9 million. In July of this year, the company completed a $1.3-billion acquisition of an open-air shopping center. (Source: “The Necessity Retail REIT Completes $1.3 Billion Open-Air Shopping Center Acquisition, Creating Pure-Play Retail Focused Portfolio,” Necessity Retail REIT Inc, July 11, 2022.)

As of July 11, Necessity Retail had acquired 93 properties for a total of $1.4 billion. These properties span 10.2 million square feet. These transactions had an immediate positive impact on the company’s first- and second-quarter results, with the full accretive effect to be realized in the second half of this year.

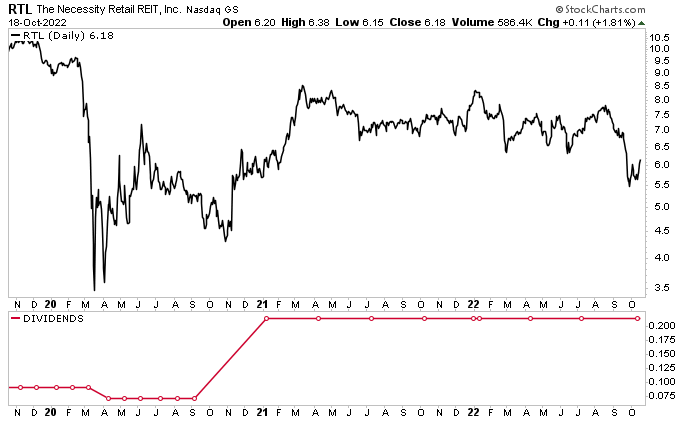

Despite all the great things going on at Necessity Retail REIT Inc, its share price hasn’t been keeping up. For the most part, Necessity Retail REIT stock has been trading in a tight range. As of this writing, it’s down by 24% year-to-date and 16% year-over-year. RTL stock needs to climb by about 70% to get to its pre-pandemic level of about $10.50.

Wall Street thinks Necessity Retail REIT stock has what it takes to break through its pre-COVID-19 highs. Of the analysts providing a 12-month share-price target for RTL stock, their average estimate is $11.00, which points to potential gains of 81%.

Chart courtesy of StockCharts.com

Necessity Retail REIT Inc’s Q2 Revenue Jumps 43% & FFO Advances 17%

For the second quarter ended June 30, Necessity Retail REIT announced that its revenue rose by 43% year-over-year to $116.9 million. (Source: “The Necessity Retail REIT Announces Second Quarter 2022 Results,” Necessity Retail REIT Inc, August 3, 2022.)

The company reported a second-quarter 2022 net loss of $56.3 million, or $0.43 per share, versus a second-quarter 2021 net loss of $7.4 million, or $0.07 per share. More importantly, its funds from operations (FFO) climbed by 17.4% to $0.27 per share in the second quarter, while its adjusted FFO went up by 11.5% year-over-year to $0.29.

“Our second quarter results reflect the anticipated accretion from the transformational $1.3 billion open-air shopping center portfolio acquisition that we recently completed,” said Michael Weil, Necessity Retail REIT Inc’s CEO. (Source: Ibid.)

“We had one of our best quarters since inception, with AFFO per share growing over 11% to $0.29 per share in the second quarter compared to a year ago and 32% over the fourth quarter of 2021, the last period prior to the acquisition of the open-air shopping center portfolio.”

The strong financial results have allowed Necessity Retail REIT Inc to continue rewarding buy-and-hold investors with ultra-high-yield dividends, which currently stand at $0.2125 per quarter, for a yield of 15.1%.

The Lowdown on Necessity Retail REIT Stock

Necessity Retail REIT Inc is an excellent, diverse REIT that provides investors with secure ultra-high-yield dividends. RTL stock is currently in bear-market territory, but that should change over the coming quarter as the company’s performance metrics exceed pre-pandemic levels.

If anything, the REIT’s wonderful quarterly results show that its diverse, necessity-based retail property portfolio is pandemic-tested and well positioned to succeed in all economic cycles.

Moreover, given that management locked in attractive fixed interest rates on 83% of Necessity Retail REIT Inc’s debt, the company has limited exposure to the current higher-interest-rate environment.