Oaktree Specialty Lending Stock: 11%-Yielding BDC Has 10% Upside

Undervalued OSCL Stock Trading at Record Level

Oaktree Specialty Lending Corp (NASDAQ:OCSL) is an excellent business development company (BDC) that reports high earnings and robust origination activity.

For 2022, it reported a record-high level of adjusted net investment income.

That momentum has carried into 2023. The company’s high return on equity has helped it increase Oaktree Specialty Lending stock’s dividend on an almost quarterly basis. The BDC’s outstanding financial results have also helped send OCSL stock’s share price to record-high levels.

In today’s high-interest-rate market, it’s hard to find reasons not to love BDCs like Oaktree Specialty Lending Corp.

Oaktree Specialty Lending loans capital to companies that have limited access to public or syndicated capital markets. As of June, it had $179.0 billion in assets under management in “contrarian, value-oriented, risk-controlled investment strategies across a variety of asset classes.” (Source: “Investor Presentation: Third Quarter 2023,” Oaktree Specialty Lending Corp, last accessed September 6, 2023.)

And that figure continues to grow. The company’s history of assets under management includes the following:

- 1995: $5.0 billion

- 2000: $18.0 billion

- 2005: $30.0 billion

- 2010: $84.0 billion

- 2015: $114.0 billion

Oaktree Specialty Lending Corp’s portfolio is primarily made up of first-lien loans (76%), second-lien loans (12%), unsecured debt, equity debt, and joint ventures. By interest rate type, 86% of the portfolio is floating rate and 14% is fixed rate.

The BDC’s portfolio is currently made up of 156 companies. The five biggest industries in the portfolio are software (18.1%); specialty retail (5.2%); real estate management and development (4.4%); financial services (4.1%); and professional services (4.1%). Other industries represented in the portfolio include pharmaceuticals, health-care technology, aerospace and defense, machinery, and chemicals.

Since 2005, Oaktree Specialty Lending Corp has invested more than $40.0 billion in more than 640 companies.

Another Quarter of Strong Earnings

In early August, Oaktree Specialty Lending announced another quarter of high earnings.

The company’s total investment income in its third fiscal quarter (ended June 30) was $101.9 million, or $1.32 per share. That’s up from $96.3 million, or $1.32 per share, in its second fiscal quarter. (Source: “Oaktree Specialty Lending Corporation Announces Third Fiscal Quarter 2023 Financial Results and Declares Distribution of $0.55 Per Share,” Oaktree Specialty Lending Corp, August 3, 2023.)

Meanwhile, its adjusted total investment income was $101.1 million, or $1.31 per share, versus $95.7 million, or $1.31 per share, in its second fiscal quarter.

The BDC’s net investment income in its third fiscal quarter was $48.4 million, or $0.63 per share, up by six percent from $46.0 million, or $0.63 per share, in its second fiscal quarter. Its adjusted net investment income came in at $47.6 million, or $0.62 per share, compared to $45.4 million, or $0.62 per share, in the second fiscal quarter.

During the third fiscal quarter, Oaktree Specialty Lending originated $251.0 million of new investment commitments and received $261.0 million in proceeds from prepayments, exits, other paydowns, and sales. The company’s weighted average yield on new debt investments was 12.6%.

Commenting on the results, Armen Panossian, Oaktree Specialty Lending Corp’s CEO and chief investment officer, said, “OCSL produced solid results in our fiscal third quarter, supported by strong earnings and robust origination activity, which drove our annualized return on adjusted net investment income to 12.6%.” (Source: Ibid.)

He continued, “We leveraged Oaktree’s platform to source compelling investments, including several opportunistic transactions that resulted from the prevailing volatile market environment. We believe these investments present an appealing risk-reward and position OCSL to continue to deliver attractive returns to our shareholders.”

Oaktree Specialty Lending Corp Declared Q3 Dividend of $0.55

Oaktree Specialty Lending is certainly known for delivering attractive returns to its shareholders. That’s partly due to the fact that as a BDC, the company legally has to distribute at least 90% of its taxable income to investors.

The size of Oaktree Specialty Lending stock’s current payout needs to be explained a little.

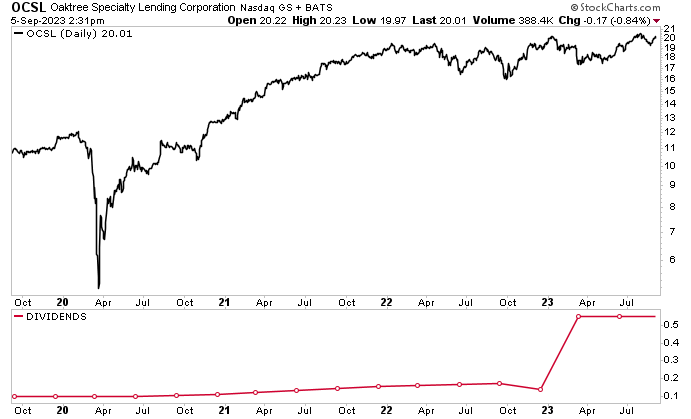

In the chart below, it looks like the company hiked its quarterly dividend from $0.18 per share in late 2022 to $0.55 in the first quarter of 2023. It didn’t; the higher payout was a result of a one-for-three reverse stock split.

In the fourth quarter of 2022, the company declared a quarterly distribution of $0.18 per share and a special distribution of $0.14 per share. This was OCSL stock’s 10th consecutive quarterly dividend increase. (Source: “Oaktree Specialty Lending Corporation Announces Fourth Fiscal Quarter and Full Year 2022 Financial Results and Declares Increased Quarterly Distribution of $0.18 Per Share and Special Distribution of $0.14 Per Share,” Oaktree Specialty Lending Corp, November 15, 2023.)

In January 2023, Oaktree Specialty Lending announced that its shareholders had approved a merger with Oaktree Strategic Income II, Inc. and a one-for-three reverse split of its common stock. The reverse stock split was effective as of the opening of trading on January 23. (Source: “Oaktree Specialty Lending Corporation and Oaktree Strategic Income II, Inc. Announce Stockholder Approvals of Merger,” Oaktree Specialty Lending Corp, January 20, 2023.)

In February, the company declared a cash distribution of $0.55 per share, up from $0.54 in the prior quarter. This represented Oaktree Specialty Lending stock’s 11th consecutive quarterly distribution increase. (Source: “Dividends,” Oaktree Specialty Lending Corp, last accessed September 6, 2023.)

Management held the payout at $0.55 per share in the third quarter of fiscal 2023. This works out to a yield of 11.0%. For context, the U.S. inflation rate is currently about 3.3%.

Chart courtesy of StockCharts.com

Oaktree Specialty Lending Stock’s Price Could Keep Rising

In terms of share price, OCSL stock has been climbing high, especially since the COVID-19 pandemic fueled a stock market crash.

As of this writing, Oaktree Specialty Lending stock is up by:

- 72% since the start of 2020

- 293% since bottoming in March 2020

- 11% year-over-year

OCSL stock hit a new record high of $20.60 on July 31 and continues to trade near that level. Wall Street analysts believe that, over the next 12 months, Oaktree Specialty Lending stock could climb as high as $22.00.

The Lowdown on Oaktree Specialty Lending Corp

Oaktree Specialty Lending is a great BDC with a growing, diverse portfolio with more than 150 companies. Currently, 88% of the loans in its portfolio are senior secured (first and second lien) and 86% have floating interest rates.

In 2022, the company generated a record level of adjusted net investment income, with a return on equity of nearly 10%. Oaktree Specialty Lending Corp has continued to perform well in 2023, reporting high earnings and robust origination activity.

With more than $500.0 million in unrestricted cash and undrawn capacity under its credit facility—and a defensively positioned portfolio—the BDC is well positioned to do well in what management calls “a continuing volatile market environment.”

This, of course, bodes well for OCSL stock’s share price and inflation-thrashing dividends.