How Income Investors Can Capitalize on this Booming Industry

Many investors have jumped on the renewable energy bandwagon. With mandatory renewable energy targets being adopted around the world, the industry is expected to enjoy strong growth for the next few decades.

The thing is, though, not all renewable energy companies are safe bets. Is there a way for conservative income investors to capitalize on this booming industry?

The answer is yes.

You see, building solar farms may be a risky business, but operating them is not. Moreover, operating renewable energy assets can generate stable cash flows because the business is often done through long-term contracts. So, if there is a company that focuses entirely on operating these assets, it could be worth considering for income investors.

The good news is, there is actually a group of companies that do exactly that. They are called “yieldcos.”

A Top Dividend Stock Yielding 5.9%

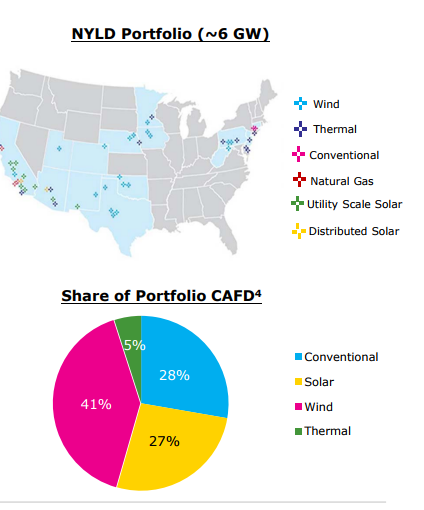

Today’s top dividend stock is NRG Yield, Inc. (NYSE:NYLD), a yieldco created by NRG Energy Inc (NYSE:NRG) to own, operate, and acquire power generation and thermal infrastructure assets.

Right now, NRG Yield owns and operates 2,934 net megawatts of renewable energy assets, 1,945 net megawatts of conventional generation assets, and thermal infrastructure assets with a 1,442 megawatt capacity. These assets are diversified across 60 states.

Note that renewable energy assets—solar and wind farms—are responsible for generating more than two-thirds of the company’s cash available for distribution (CAFD).

(Source: “Investor Presentation,” NRG Yield Inc., last accessed August 4, 2017.)

A handsome dividend yield is one of the reasons why income investors should consider this company. NRG Yield recently declared a quarterly dividend of $0.28 per share. On an annualized basis, that gives NYLD stock a dividend yield of 5.9%.

If investors purchase NRG Yield stock today, however, they will likely collect more than just 5.9% in the form of dividends. This is because the company is planning to raise its payout.

In fact, NRG Yield is one of the top dividend growers in recent years. Since the company’s initial public offering (IPO) in July 2013, it has raised its dividend rate every quarter. From its first quarterly dividend of $0.115 per share to today’s $0.28 per share, NRG Yield’s per share payout has increased by 143%. (Source: “Dividends and Splits,” NRG Yield Inc, last accessed August 4, 2017, and “NRG Yield, Inc. Reports Second Quarter 2017 Financial Results, Completes Drop Down Acquisition from NRG, Reaffirms 2017 Financial Guidance, and Raises Second Quarter Dividend by 3.7%,” NRG Yield Inc, August 3, 2017.)

Also Read:

3 Clean Energy Stocks Yielding Up to 8.5%

10 High-Yield Small-Cap Dividend Stocks for 2017

Going forward, the company will likely have more good news for income investors. NRG Yield is currently targeting a 15% growth rate in dividends per share through 2018. If the company achieves this target, purchasing NYLD stock right now would provide investors with an implied yield of approximately 7.7%.

(Source: “Investor Presentation,” NRG Yield Inc, op cit.)

Despite all of the dividend hikes, the company’s payout is more than safe. Last year, NRG Yield was paying out less than 60% of its cash available for distribution (CAFD). According to the company’s most recent earnings report, NRG Yield generated $74.0 million in CAFD in the second quarter of 2017, representing a 13.9% increase from the year-ago period. (Source: “NRG Yield, Inc. Reports Second Quarter 2017 Financial Results,” NRG Yield Inc, op cit.)

Don’t forget, this top dividend stock is built on a recurring business. As of May 2017, NRG Yield’s assets had an average remaining contract life of 16 years. (Source: “Investor Presentation,” NRG Yield Inc, op cit.)

For income investors who want some exposure to the fast-growing renewable energy industry, NRG Yield should be near the top of their watch list.