8.5%-Yielding NuStar Energy Stock Hit 52-Week High

NS Stock Has 23-Year Dividend Streak

Oil prices are volatile and often have impacts on the operations of upstream energy companies. As such, it sometimes makes more sense for investors to play the midstream energy industry, which is less vulnerable to oil price swings.

As long as oil and natural gas are flowing, midstream companies do well; that’s been the case for NuStar Energy L.P. (NYSE:NS).

The mid-cap company operates about 9,500 miles of pipelines and 63 terminal and storage facilities. NuStar Energy stores and distributes crude oil, refined products, renewable fuels, ammonia, and specialty liquids. Its storage capacity is roughly 49 million barrels. (Source: “Partnership Profile,” NuStar Energy L.P., last accessed November 30, 2023.)

There are concerns about the Joe Biden administration’s focus on green energy, but that doesn’t mean an end to fossil fuels. The shift to green energy isn’t seamless, and it will take time.

I doubt the use of fossil fuels will completely disappear. In my view, the production of green energy probably won’t expand fast enough to replace fossil fuels over the next few decades.

Moreover, if the country were to change back to a more fossil-fuel-friendly government, I’d expect a pickup in oil exploration and production. That would benefit companies like NuStar Energy L.P.

NuStar Energy has been inconsistent in terms of growing its dividends, but it has paid dividends for 23 consecutive years. NuStar Energy stock’s current quarterly dividend of $0.40 per share translates to a yield of 8.52% (as of this writing).

Given the company’s expected rise in earnings and free cash flow (FCF), NuStar Energy L.P. could end up raising its dividends.

| Metric | Value |

| Dividend Streak | 23 Years |

| 10-Year Average Dividend Yield | 16.1% |

| Dividend Coverage Ratio | 1.7 |

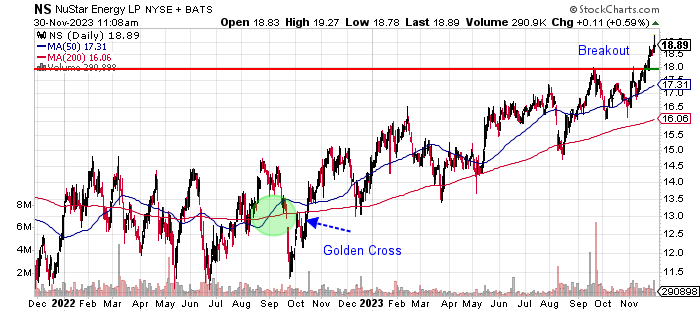

The following chart shows NS stock staging a nice rally and recent breakout.

In September 2022, NuStar Energy stock moved into a golden cross formation, a bullish technical crossover pattern that forms when a stock’s 50-day moving average (MA) breaks above its 200-day MA. Since that bullish crossover happened, NuStar Energy L.P.’s share price has advanced by about 40%.

On November 30, investors bid up NS stock to a new 52-week high of $19.27.

Chart courtesy of StockCharts.com

NuStar Energy L.P. Has Been Ramping Up Profits & FCF

NuStar Energy increased its revenues in 2021 and in 2022, reaching a five-year best in 2022. Its revenues in 2022 were its highest since 2016, when it generated $1.76 billion.

Analysts estimate that the company will report lower revenues for full-year 2023 of $1.6 billion, but unless it delivers really strong fourth-quarter results, it could fall short. (Source: “NuStar Energy L.P. (NS),” Yahoo! Finance, last accessed November 30, 2023.)

For 2024, analysts forecast that NuStar Energy’s revenues will rebound by five percent to $1.68 billion.

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $1.52 | N/A |

| 2019 | $1.5 | -1.5% |

| 2020 | $1.48 | -1.1% |

| 2021 | $1.62 | 9.2% |

| 2022 | $1.68 | 4.0% |

(Source: “NuSTAR Energy L.P.” MarketWatch, last accessed November 30, 2023.)

A look at NuStar Energy’s cost side shows the company consistently generating steady gross margins from 2018 through 2022.

| Fiscal Year | Gross Margin |

| 2019 | 33.9% |

| 2020 | 36.8% |

| 2021 | 33.8% |

| 2022 | 34.4% |

(Source: “Nustar Energy L.P. Common Units (NS),” Nasdaq, last accessed November 30, 2023.)

On the bottom line, NuStar Energy L.P. has been inconsistent in its ability to generate generally accepted accounting principles (GAAP) earnings-per-share (EPS) profits. An encouraging sign, however, was the company’s return to GAAP-diluted EPS profits in 2022 after three straight years of losses.

Analysts expect NuStar Energy’s GAAP earnings to more than double to $0.99 per diluted share in full-year 2023 and further rise to $1.20 per diluted share in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $1.02 | N/A |

| 2019 | -$2.30 | -325.0% |

| 2020 | -$3.15 | -36.7% |

| 2021 | -$0.99 | 68.6% |

| 2022 | $0.36 | 136.4% |

(Source: MarketWatch, op. cit.)

NuStar Energy L.P.’s funds statement shows high FCF in its last three reported years.

The strong FCF numbers allow the company to continue paying dividends and reducing its debt.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $79.1 | N/A |

| 2019 | -$37.5 | -147.5% |

| 2020 | $327.9 | 973.5% |

| 2021 | $320.4 | -2.3% |

| 2022 | $386.9 | 20.8% |

(Source: MarketWatch, op. cit.)

On its balance sheet, NuStar Energy has to contend with a sizable debt of $3.48 billion (as of the end of September). (Source: Yahoo! Finance, op. cit.)

I’m not that concerned at this point, given the partnership’s high FCF and expected higher profitability.

NuStar Energy’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a decent reading of 5.0, which is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Moreover, NuStar Energy L.P. can cover its interest payments, considering its interest coverage ratio of about 2.0. The following table shows that NuStar Energy has managed to cover its interest expense via high earnings before interest and taxes (EBIT) in 2019, 2021, and 2022.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2019 | $390.9 | $183.1 |

| 2020 | $32.7 | $229.1 |

| 2021 | $256.1 | $214.0 |

| 2022 | $435.0 | $209.0 |

(Source: Yahoo! Finance, op. cit.)

The Lowdown on NuStar Energy L.P.

NuStar Energy’s return to profitability and high FCF are positive developments for its stock, which has experienced some decent share-price appreciation this year and has paid dividends for more than 20 consecutive years.

Furthermore, the company bought back $222.4 million worth of its own common and preferred stock in 2022. (Source: MarketWatch, op. cit.)

NuStar Energy L.P.’s enterprise multiple of 7.3 times is reasonable, while its return on equity of 22.7% suggests that management is doing a good job in putting the partnership’s resources to work.