Enterprise Products Stock: Undervalued 7.5%-Yielding Midstream Play Up 11% YTD

Why EPD Stock’s Dividend Is Set to Rise for 25th Consecutive Year

Most oil and natural gas companies need energy prices to be high in order to increase their revenue and earnings.

Makes sense, but then there are the midstream oil and gas companies. They make money whether oil and gas prices go up or down. Midstream companies are involved in the transportation, storage, and wholesale marketing of crude oil or refined oil products. You can think of them as tollkeepers.

That’s why companies like Enterprise Products Partners LP (NYSE:EPD) shine.

Enterprise Products is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals. (Source: “Investor Deck: February 2023,” Enterprise Products Partners LP, last accessed May 19, 2023.)

As a midstream oil and gas company, the partnership gets paid whether drillers are making money or not. That’s because it earns a fee for each barrel that gets shipped through its 50,000+ miles of pipelines.

Enterprise Products Partners LP’s combined operations include:

- 260+ million barrels of NGL, refined product, and crude oil storage capacity

- 14.0 billion cubic feet of natural gas storage capacity

- 29 natural gas processing plants, 25 fractionators, and 11 condensate distillation facilities

- 20 deepwater docks that handle NGL, petrochemicals, crude oil, and refined products

- The world’s largest ethylene export terminal, which has a capacity of more than 2.2 billion pounds per year

- The world’s largest propylene export terminal, which has a capacity of more than 4.0 billion pounds per year

In February 2022, Enterprise Products Partners LP announced that it had completed its $3.3-billion acquisition of Navitas Midstream Partners, LLC. The acquisition gives the company a foothold in natural gas gathering, treatment, and processing in the core of the Midland Basin portion of the Permian Basin. (Source: “Enterprise Completes Acquisition of Navitas Midstream,” Business Wire, February 17, 2022.)

Navitas Midstream’s assets include approximately 1,750 miles of pipeline and more than one billion cubic feet per day of cryogenic natural gas processing capacity. Navitas Midstream’s system is anchored by long-term contracts and acreage dedications with a diverse group of more than 40 independent and publicly owned producers.

Record 2022 Financial Results & Strong Q1 2023 Results

Enterprise Products had a great 2022, achieving record financial results in each quarter. For the year, Enterprise Partners reported net income of $5.5 billion, or $2.50 per unit on a fully diluted basis, compared to $4.6 billion, or $2.10 per unit, in 2021. (Source: “Enterprise Reports Record 2022 Results,” Enterprise Products Partners LP, February 1, 2023.)

The partnership’s distributable cash flow (DCF) climbed in 2022 by 17% to $7.8 billion, compared to $6.6 billion in 2021. The DCF provided 1.9 times coverage of Enterprise Products stock’s distributions declared in 2022. Enterprise Products retained $3.6 billion of DCF in 2022 to reinvest in the partnership, repurchase its own units, and reduce its debt.

Enterprise Products Partners LP’s adjusted cash flow provided by operating activities (CFFO) increased in 2022 by 13% to $8.1 billion, compared to $7.1 billion in 2021. Its adjusted free cash flow (FCF) in 2022 was $3.0 billion. Excluding $3.2 billion used for the acquisition of Navitas Midstream in February 2022, the partnership’s payout ratio for adjusted FCF was 71%.

Management said the company’s record fourth-quarter and full-year results were fueled by record-high pipeline transportation volumes, higher NGL and natural gas pipeline transportation volumes, higher gas processing margins, and higher fee-based gas processing volumes.

That momentum carried into 2023 with solid first-quarter results.

The company’s net income grew in the first quarter to $1.4 billion, or $0.63 per unit, compared to $1.3 billion, or $0.59 per unit, in the first quarter of 2022. Its DCF in the first quarter increased by 5.5% year-over-year to $1.9 billion. Its adjusted CFFO was $2.0 billion in the first quarter of 2023 and the first quarter of 2022. (Source: “Enterprise Reports First Quarter 2023 Earnings,” Enterprise Products Partners LP, May 2, 2023.)

A.J. Teague, one of the co-CEOs of the company’s general partner, said, “Enterprise reported a solid first quarter as we benefited from record pipeline transportation and fee-based natural gas processing volumes and near record marine terminal volumes. In March, our marine terminals handled a record 2.3 million barrels per day of NGL, crude oil, refined products and petrochemical exports.” (Source: Ibid.)

The outlook for Enterprise Products Partners LP is bullish.

The partnership is on schedule to put approximately $3.8 billion of assets into service in 2023. This includes the completion of its 12th NGL fractionator, two natural gas processing plants, and the first phase of the Texas Western products pipelines. All of those projects will be new sources of fee-based cash flow and will support future distribution growth.

Enterprise Products Partners LP Poised to Increase Payout Again

Enterprise Products is known for increasing its dividends annually. In January, it raised its quarterly payout by 3.1% to $0.49 per unit, for a current dividend yield of 7.5%. That’s well above the S&P 500’s average yield of 1.6%.

The company’s DCF provided 1.8 times coverage for its first-quarter distribution. The company also retained $863.0 million of DCF in the first quarter.

Enterprise Products Partners LP’s total payout, which is made up of distributions to common unitholders and unit buybacks, was 55% of its adjusted CFFO in the 12 months ended March 31, 2023.

During the first quarter of 2023, the company repurchased 700,000 of its own common units on the open market for $17.0 million. Inclusive of these purchases, the partnership has used 37% of its authorized $2.0-billion unit buyback program.

The good times are expected to continue, at least according to the company’s management.

In July, Enterprise will celebrate the 25th anniversary of its initial public offering (IPO). According to Teague, “The partnership is on track to accomplish another significant financial milestone in 2023: 25 consecutive years of distribution growth.” (Source: Enterprise Products Partners LP, February 1, 2023, op. cit.)

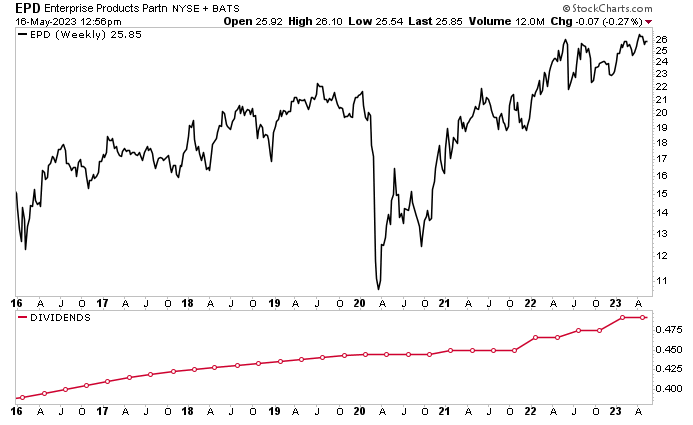

What’s interesting to note is that, even though the company is set to raise its dividend for its 25th consecutive year, it has sometimes raised its payouts more than once per year. The company’s board has raised EPD stock’s dividend three times since the start of 2022. The board also raised the distribution every quarter from 2015 to 2019. (Source: Distribution & DRIP,” Enterprise Products Partners LP, last accessed May 19, 2023.)

Recent Share-Price Performance

What about Enterprise Products stock’s price?

EPD stock’s price has been enjoying impressive growth. Over the last 20 years, with dividends reinvested, Enterprise Products Partners LP’s units have provided returns of 591%. Over the same time frame, the S&P 500 has provided returns of 336%. More recently, Enterprise Products stock is up by:

- 11% year-to-date

- Seven percent over the last six months

- Five percent year-over-year

Solid gains, and Wall Street expects EPD stock’s price to keep climbing this year. Analysts have provided a forecast for the next 12 months in the range of $32.00 to $37.00. This points to potential gains in the range of approximately 24% to 44%.

Chart courtesy of StockCharts.com

The Lowdown on Enterprise Products Partners Stock

Enterprise Products Partners LP has everything going for it. The company continues to generate excellent financial results, organically expand its operations, and make strategic acquisitions.

The partnership entered 2023 with one of the strongest balance sheets in its history. Moreover, the company repurchased $250.0 million worth of its own common units in 2022, reduced the principal amount of its debt by $1.3 billion, has $4.1 billion in consolidated liquidity, and is on schedule to put $3.8 billion of new assets into service in 2023.

All that bodes well for EPD stock’s price and its reliable, growing, high-yield distributions.