National CineMedia Stock: 40%-Yielding Contrarian Play Is a Potential 10-Bagger

NCMI Stock Has 1,000% Upside Potential

The tourism and entertainment industries were gutted during the COVID-19 pandemic and haven’t fully recovered—but they’re on their way. One area that was hit particularly hard was movie theaters. Not only did quarantine orders mean theaters were shuttered, but Hollywood stopped making blockbusters. This hobbled National CineMedia, Inc. (NASDAQ:NCMI), a company that runs advertising programs at movie theaters.

While National CineMedia stock is nowhere near recovering from its pandemic losses, its outlook is pretty solid.

For starters, movie theaters are open again and blockbusters like Top Gun: Maverick and Avatar: The Way of Water have been filling seats. Second, National CineMedia, Inc. has been reporting fabulous year-over-year financial results. For 2021, the company reported total revenues of $114.6 million. For 2022, it estimates that its revenues more than doubled to $242.5 million. That’s still far below the $444.8 million it generated in 2019, the year before the pandemic, but it shows that the company’s metrics have been improving dramatically.

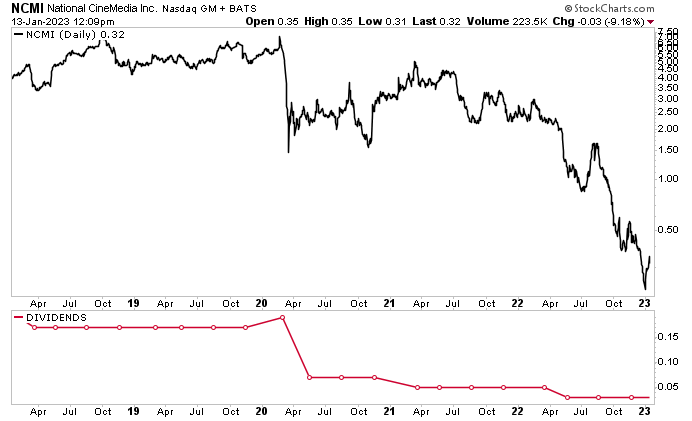

NCMI stock has taken a beating since March 2020. First, there was the pandemic. Then there’s the fact that National CineMedia, Inc. cut its dividend three times. As of this writing, National CineMedia stock is down by:

- 17% over the last month

- 38% over the last three months

- 65% over the last six months

- 87% year-over-year

In September 2022, NCMI stock fell below the $1.00 threshold for being listed on the Nasdaq. In early November, National CineMedia, Inc. received a warning from the U.S. Securities and Exchange Commission (SEC) that its share price was lower than the minimum required for a Nasdaq listing. (Source: “Form 8-K,” U.S. Securities and Exchange Commission, November 3, 2022.)

The company has until April 26 to comply with the Nasdaq’s bid price rule. To regain compliance, the closing bid price of common shares of National CineMedia, Inc. must meet or exceed $1.00 per share for a minimum of 10 consecutive business days. If National CineMedia stock fails to do so, it might be eligible for another 180-day compliance period. The company can also make an appeal to a Nasdaq hearings panel.

It’s not all bad news. Conservative Wall Street has an optimistic near-term outlook for NCMI stock. Analysts have provided a 12-month share-price target for National CineMedia stock in the range of $1.88 to $3.50, which points to potential gains in the range of approximately 485% to 995%.

Chart courtesy of StockCharts.com

About National CineMedia, Inc.

National CineMedia operates the largest in-cinema advertising network in the U.S. Its “Noovie” pre-show program is presented exclusively in 57 national and regional theater circuits, including at theaters owned by AMC Entertainment Inc (NYSE:AMC), Cinemark Holdings, Inc. (NYSE:CNK) and Regal Entertainment Group (a subsidiary of Cineworld Group plc (LON:CINE, OTCMKTS:CNNWQ). (Source: “National CineMedia, Inc. Reports Results for Fiscal Third Quarter 2022,” National CineMedia, Inc., November 7, 2022.)

The company’s advertising network includes more than 21,100 movie screens in more than 1,700 theaters in 190 designated market areas. It also includes Lobby Entertainment Network (LEN), which comprises strategically-placed screens and other forms of advertising and promotions in theater lobbies. On top of that, the company extends its ad campaigns into online and mobile platforms.

The company derives the majority of its revenues from the sale of advertising to national, regional, and local businesses.

National CineMedia, Inc. intends to distribute substantially all its free cash flow to its shareholders through quarterly dividends.

NCMI stock paid $0.68 per share in full-year 2018, $0.68 per share in 2019, $0.40 in 2020, and $0.20 in 2021. In May 2022, the company lowered its quarterly dividend from $0.05 to $0.03 per share, for a current yield of about 40%. (Source: “Dividend History,” Nasdaq, last accessed January 18, 2022.)

The lower dividend allows the company to continue paying regular quarterly dividends for the foreseeable future.

3Q Revenue Climbs 71% Year-Over-Year

For the third quarter ended September 29, 2022, National CineMedia, Inc. announced that its revenues increased by 71.9% year-over-year to $54.4 million. Its operating loss improved to $4.2 million from a loss of $18.7 million in the third quarter of 2021. (Source: Ibid.)

The company’s adjusted operating income before depreciation and amortization (OIBDA) improved to $7.0 million from negative-$8.2 million in the third quarter of 2021. The company’s net loss improved to $8.9 million, or $0.11 per diluted share, from $15.2 million, or $0.19 per diluted share, in the third quarter of 2021.

In the first nine months of 2022, the company’s revenues increased by 208.2% to $157.5 million. Meanwhile, its operating loss improved to $21.2 million from $76.6 million in the first nine months of 2021. National CineMedia, Inc.’s adjusted OIBDA improved in the first nine months of 2022 to $15.2 million from negative-$43.1 million in the first nine months of 2021. The company’s net loss in the first nine months of 2022 was $34.8 million, or $0.43 per diluted share, compared to $57.3 million, or $0.72 per diluted share, in the first nine months of 2021.

Tom Lesinski, National CineMedia, Inc.’s CEO, said, “We have just completed a highly successful upfront sales campaign and are happy to report the return of long time [National CineMedia (NCM)] clients across all key categories…NCM is well positioned for continued success and growth.”

For the fourth quarter of 2022, National CineMedia, Inc. expects to report revenues in the range of $85.0 to $95.0 million, compared to $63.5 million in the fourth quarter of 2021. It also expects to report adjusted OIBDA in the range of $32.0 to $42.0 million, compared to $18.4 million in the fourth quarter of 2021.

For full-year 2022, National CineMedia, Inc. expects to report revenues in the range of $242.5 to $252.5 million, which would be more than double the $114.6 million it made in 2021. It also expects to report adjusted OIBDA in the range of $47.3 to $57.3 million, compared to a loss of $24.7 million in 2021.

The Lowdown on National CineMedia, Inc.

National CineMedia stock isn’t for the faint of heart. The company’s share price has taken a beating—to the point that the stock isn’t in compliance with the $1.00 minimum price required for being listed on the Nasdaq. Moreover, National CineMedia, Inc. cut its quarterly dividend in 2022.

If you ignore the white noise, you’ll see that there are many of good things about National CineMedia.

People have been flocking back to movie theaters recently, and the company has been reporting outstanding financial results. Its advertising revenues have been experiencing significant growth. In the third quarter, they came in at 85% of National CineMedia, Inc.’s historical revenue average. Management provided strong guidance for full-year 2022, expecting its revenues to grow by at least 111% and its adjusted OIBDA to turn from negative to positive.

This helps explain why Wall Street is so bullish on NCMI stock and why investors should put this beaten-down penny stock on their radar.