Nail Down AllianceBernstein’s 8.5% Dividend Yield Today

This Dividend Yield Stock Is Something to See

Regular readers know that I’m always on the hunt for companies with a high dividend yield, consistent payout history, and a sluggish stock price, which makes the income opportunity all the more enticing. Asset manager AllianceBernstein Holding LP (NYSE:AB), for example, is down more than seven percent over just the past three months and currently boasts a near-double-digit dividend yield.

To be sure, AllianceBernstein is a master limited partnership (MLP) that distributes the majority of its income to investors, so a high dividend yield isn’t all that rare and unusual. But when you consider the strong performance of its mutual funds over the past few years, as well as its stable operating results of late, AllianceBernstein has all the characteristics of an inexpensive income opportunity (at least on the face of it).

As I always tell our Income Investors readers, there is simply no more surefire way to get rich in the market than by picking up high-quality, high-dividend-yield stocks on the cheap. While it might not have the brand cachet of asset managers like BlackRock, Inc. (NYSE:BLK), Franklin Resources, Inc. (NYSE:BEN), or T. Rowe Price Group Inc (NASDAQ:TROW), I believe AllianceBernstein nicely fits that description.

Let’s take a closer look.

Asset Manager Maven

For investors who aren’t familiar with AllianceBernstein, it is an asset management company with assets under management of nearly $490.0 billion. The company provides research and diversified investment management services to its clients through three distribution channels: institutions, retail, and private wealth management.

The company’s institutional services consist primarily of actively managed equity accounts, fixed income accounts, group trusts, and mutual funds. These represent about 50% of the assets under management by the firm. AllianceBernstein’s institutional client base largely includes pension funds, endowment funds, institutions, and governments.

In the retail services segment, AllianceBernstein offers investment management such as cash management products (money market funds and deposit accounts), sub-advisory relationships, and managed account products to individual investors. This segment represents about one-third of assets under management.

Finally, the company provides investment management services to private clients such as high-net-worth individuals, trusts and estates, and charitable foundations. The private wealth management channel accounts for nearly 20% of assets under management.

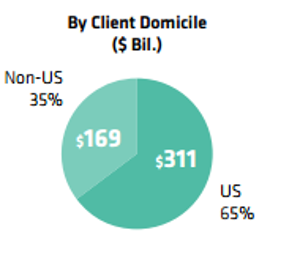

Now, it would be natural to think that AllianceBernstein is an ordinary, run-of-the-mill investment manager from that description alone. But here’s the unique thing about AllianceBernstein: although it is based in the U.S., more than one-third of its assets are owned by clients domiciled outside the United States.

Source: “Fourth Quarter 2016 Fact Sheet,” AllianceBernstein Holding LP, December 31, 2016.

Thus, the company is one of the more global publicly traded asset managers. Given the higher savings rates outside the U.S., this overseas reach is definitely a huge positive.

Powerful Performance

In the company’s most recent quarter, for example, revenue increased eight percent year-over-year to $786.0 million. The top line was bolstered by a solid jump in performance fee income and high-single-digit growth from Bernstein research services.

Operating income jumped an impressive 29% year-over-year to $209.0 million, while operating margin expanded 490 basis points to 25.3%. This combination of an increasing top line and improving profitability suggests that the company’s competitive position overseas continues to strengthen.

In fact, assets under management for the month of February increased about 1.8% to $489.0 billion. The bump was driven largely by market appreciation, but investor contributions globally also helped. Specifically, the company saw net inflows from both the retail and private wealth channels.

In other words, AllianceBernstein’s products continue to perform solidly, and investors around the globe continue to want “in” on the action. When investing in asset managers, this is exactly the type of situation you want to see.

“During challenging times, we maintained strong long-term track records in the large majority of our fixed income and equity strategies; expanded our business in promising growth areas like customized factor analysis, energy and real estate commercial debt; and increased our adjusted operating margin for the fifth straight year,” said Chairman and CEO Peter Kraus. (Source: “AllianceBernstein Holding Announces Fourth Quarter Results,” AllianceBernstein Holding LP, February 14, 2017.)

Sharing the Wealth

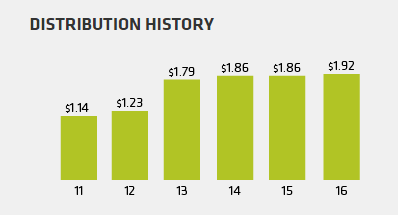

More importantly for income investors, though, is that AllianceBernstein’s performance translates into robust, consistent, and growing distributions. After all, it is a company’s dividend distributions, not accounting income, that ultimately ends up in our pockets.

In Q4, management bumped its quarterly distribution to $0.67, a solid increase of 34% from the year-ago payout of $0.50. In total, the company paid out dividends of $1.92 per share in 2016, representing a compound annual growth rate of 11% over the past five years.

Source: “Investor Relations,” AllianceBernstein Holding LP, last accessed April 4, 2016.

Given the increasing appeal of AllianceBernstein’s products—90% of its fixed-income funds and 64% of its active equity funds have outperformed on a five-year basis—I wouldn’t expect that distribution growth to slow significantly.

“At a time when providing unique value to clients is more important than ever, I feel very good about our strategy and offering,” said Kraus. “Our goal for the past 50 years has been to keep clients Ahead of Tomorrow, and it will be for many years to come.”

High Dividend Yield On the Cheap

That brings us to AllianceBernstein’s slumping stock price, which is down about 12% from its 52-week highs. Why the worry on Wall Street? Well, analysts are mainly concerned over the impact that rising interest rates will have on the company’s fixed-income products. Moreover, higher interest rates would make the dividend yield on the stock itself less attractive.

But while there are certainly real risks ahead, I think AllianceBernstein’s juicy dividend yield of 8.5% more than factors them in. That yield is much higher than those offered by previously mentioned asset managers BlackRock (2.6%), Franklin Resources (1.9%), and T. Rowe Price (1.9%).

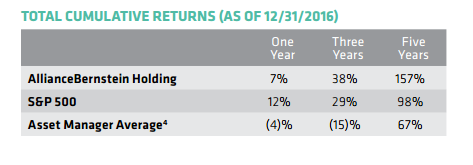

Of course, neither of those companies is an MLP like AllianceBernstein, so a wide spread is to be expected. However, given how much AllianceBernstein shares have crushed the asset manager average (on a total return basis) in recent years, I think that spread is too wide.

Source: “Fourth Quarter 2016 Fact Sheet,” AllianceBernstein Holding LP, December 31, 2016.

The Bottom Line On AllianceBernstein

There you have it, my fellow Income Investors: a few reasons to think about adding AllianceBernstein to your income portfolio.

As always, don’t consider this as a formal “buy” recommendation, but simply as an idea worth further research. Although AllianceBernstein’s enticing 8.5% dividend yield seems well covered by strong operating performance of late, it is absolutely crucial that investors keep a close eye on interest rates and their impact on future results.

At the moment, though, AllianceBernstein is easily an above-average investment candidate.