Monthly Income: Lock in Chatham Lodging Trusts’ Safe 6.7% Dividend Yield Now

If you’re not willing to go against the crowd, high-dividend-yield stocks might not be for you.

Why? It’s simple: a stock that boasts a high dividend yield generally does so because it has fallen in price.

The reason for the drop could be anything, from real problems within the company to irrational fears over the economy. But whatever the case may be, there are usually very specific concerns that surround high-yield stocks.

Of course, high-yield stocks can offer big upside as well. After all, analyst opinions are often way off the mark.

Because of Wall Street’s inaccuracy, I’m always looking at sectors with a dark cloud of pessimism over them. And today, one such space is the hotel industry.

What’s the worry? Well, analysts are concerned with occupancy rates, rising supply, and threats from vacation rental services such as Airbnb. But because of those worries–which I believe are overblown–many hotel stocks now boast mouth-watering dividend yields.

It’s up to us to separate the wheat from the chaff.

One of my favorites is Chatham Lodging Trust (NYSE:CLDT). Let’s take a closer look, shall we?

Chat About Chatham

For those unfamiliar with Chatham, it’s a hotel real estate investment trust (REIT). As of the beginning of May, the company owned 133 hotels (wholly or through joint ventures) across 15 states and Washington, D.C.

But what do I like about Chatham in particular? And why do I think it is well-positioned to withstand the hotel headwinds we are seeing today? Simple: management’s focus on the high end.

Unlike the average hotel company, Chatham only seeks to own and acquire premium-branded, select-service hotels. It then passes on the cash flow to shareholders in the form of hefty dividend payments. Brands within Chatham’s portfolio include “Courtyard by Marriott,” “Hampton Inn and Suites by Hilton,” “Hyatt Place,” and “Hilton Garden Inn.”

There are several advantages to focusing on this “branded, select-service” niche within the hotel market. Among them are higher market share, strong customer loyalty, and generally higher growth.

But more importantly, the margins are higher. In fact, Chatham boasts some of the highest operating margins among hotel REITs. This is mainly due to the fact that select-service hotels generally have lower costs than full-service hotels. But it is also due to the fact that Chatham’s properties are of very high quality.

Another important thing to note is that Chatham doesn’t operate its own hotels. In order to qualify as a REIT, it isn’t permitted to. Thus, the company hires third-party management companies to run the day-to-day operations of the portfolio. This allows Chatham to focus on what it does best: seek and acquire premium hotels at good prices.

But how well has Chatham’s portfolio been performing of late? Well, judging from its first-quarter (Q1) results last month, very well.

Andrew_Writer/Flickr

RevPAR Star

In Q1, CLDT stock posted net income per share of $0.12. That’s a big jump from $0.08 in the year-ago period. Moreover, comparable operating margins were strong as usual, increasing 70 basis points to 39.9%.

But more importantly, Chatham’s revenue per available room (RevPAR) increased 1.2% over the prior-year-period. Regular readers know that I like to focus on RevPAR when analyzing hotel companies.

Why? Because RevPAR gives us a good idea on how well a company is filling its rooms and how much it is able to charge. Thus, the increase in Chatham’s RevPAR clearly suggests that both demand and pricing power remain solid.

Management is also making strides on the expense side. During the quarter, management reduced its rooms-related expenses year-over-year. Meanwhile, its guest acquisition costs, which have grown over the past several years, finally flattened out.

“Our first quarter results exceeded our guidance expectations for the quarter, driven by a combination of better than expected RevPAR and operating margin performance,” said President and Chief Executive Officer Jeffrey H. Fisher. (Source: “Chatham Lodging Trust Announces First Quarter 2017 Results,” Chatham Lodging Trust, May 9, 2017.)

Monthly Income, Oh My!

Of course, as income investors, what we want to see most is healthy cash flow. Because while revenue growth and expanding margins are definitely nice to see, dividends are distributed in cold, hard cash. Fortunately, CLDT stock generates plenty of it.

In Q1, the company’s adjusted funds from operations (FFO), a key cash flow metric for hotels, came in at a healthy $18.1 million. Thanks to that strong FFO, management was able to declare a solid dividend of $0.11 for the month of May.

Yes, that’s right: Chatham pays out dividends on a monthly basis. And the best part is that it grows regularly.

In fact, Chatham’s annual dividend has now increased at a whopping rate of 89% since 2010, with last year’s increase clocking in at 10%.

With management expecting a 2017 AFFO payout ratio of just 62%, I don’t expect that growth to slow anytime soon.

“As we have commented over the last nine months, we have focused a lot of effort on modifying and enhancing our revenue management strategies and are pleased with these gains, especially in this environment,” Fisher added. (Source: Ibid.)

High Dividend Yield at a Bargain

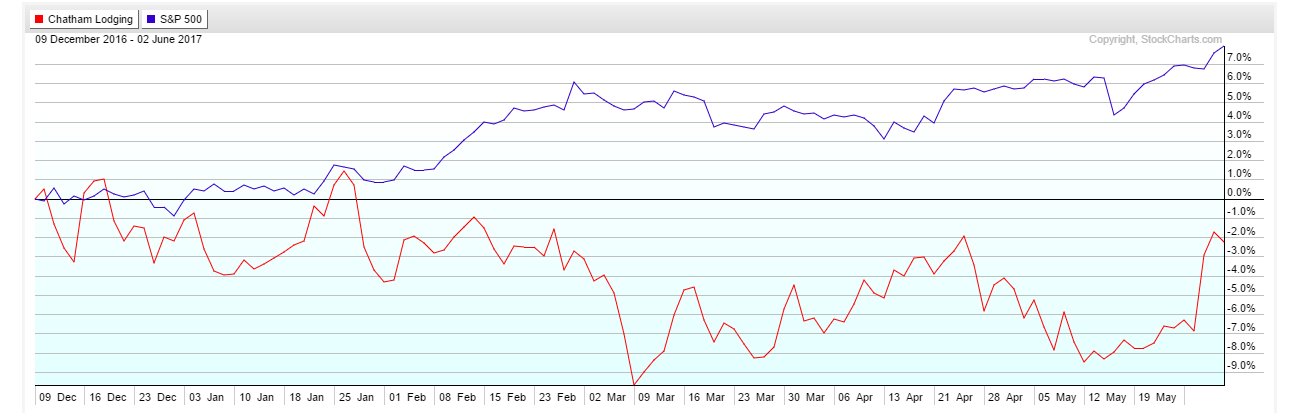

We can now circle back to Chatham’s stock price, which has clearly underperformed over the past six months:

Source: StockCharts.com

As I touched on earlier, I believe the company is being thrown out with the hotel sector bathwater. Considering how strong its fundamentals are holding up, Chatham shares represent a sweet income opportunity.

In fact, Chatham stock now sports a juicy dividend yield of 6.7%. That yield is higher than the real estate industry average (5.3%), as well as its own five-year average (4.9%).

With the rest of Chatham’s 2017 expected to remain strong, I’d fully expect the dividend yield to return to its historical mean.

The Bottom Line on Chatham Lodging Trust

And there you have it: several reasons why I believe Chatham is an unloved stock worth watching.

As always, don’t consider this article a formal recommendation. Rather, use it as a jump-off point for more research.

That said, Chatham’s differentiated portfolio and high dividend yield certainly make it an above-average prospect for retirement portfolios.

Also Read:

Top 9 Stocks That Earn Monthly Dividends

5 Best ETFs That Pay a Monthly Dividend