MNR Stock: Could 15.02%-Yielder Have 50.9% Upside?

MNR Stock to Benefit From Oil-&-Gas-Friendly Climate

Make no mistake about it: the presidential election win by Donald Trump is expected to open up the flow of energy across the country.

While oil and gas companies managed to thrive under President Joe Biden, we could see significant opportunities under President-elect Trump over the next four years.

Upstream oil and gas companies will likely experience less regulation and fewer carbon restrictions under Trump 2.0.

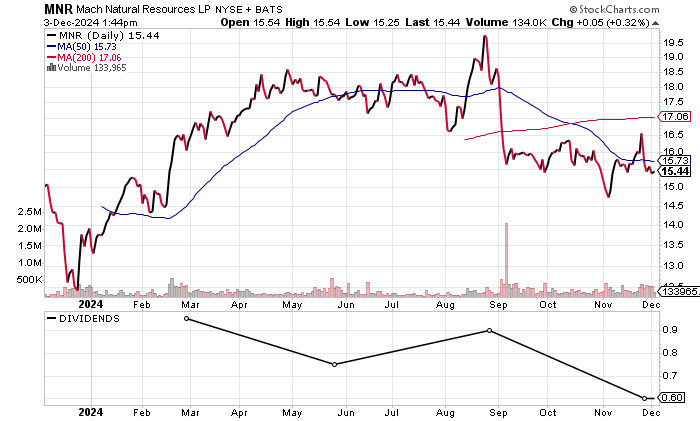

The change in the White House should benefit smaller exploration and production companies like Mach Natural Resources LP (NYSE:MNR). MNR stock has gone down 13.6% over the past year (to December 3), but it could rebound in a more energy-friendly government.

Mach Natural Resources explores for and produces oil, natural gas, and natural gas liquid (NGL) reserves. The company’s key operating regions include the Anadarko Basin in western Oklahoma, southern Kansas, and the panhandle of Texas. (Source: “Company Profile,” Mach Natural Resources LP, last accessed December 3, 2024.)

MNR stock has only been trading since its initial public offering at $19.00 on October 25, 2023. The stock subsequently traded as high as $21.19 on April 30, 2024, prior to sinking to the current price of $15.44.

Chart courtesy of StockCharts.com

Mach Natural Resources Delivers Third-Quarter Beat

Mach Natural Resources LP has only three years of reported financial history, but its growth has been stellar.

Driven by acquisitions, the company’s revenues surged 138.8% from $392.5 million in 2021 to the record $937.4 million in 2022. Its revenues contracted 18.7% to $762.3 million in 2023, but the outlook seems promising. (Source: “Mach Natural Resources LP (MNR),” Yahoo! Finance, last accessed December 5, 2024.)

Mach reported strong third-quarter revenues of $255.5 million and $734.7 million for the nine months to September 30. This reflected year-over-year growth of 45.6% and 37.5%, respectively, versus the same periods in 2023. (Source: “FORM 10-Q,” Mach Natural Resources LP, last accessed December 5, 2024.)

Based on the results to date in 2024, Mach Natural Resources appears to be on target to come close to the consensus estimate for this year.

Analysts expect Mach Natural Resources LP to grow revenues 30.4% to a record $994.2 million in 2024 followed by $1.01 billion in 2025. (Source: Yahoo! Finance, op. cit.)

The bottom line has been profitable but mixed. The three-year-best generally accepted accounting principles (GAAP) profit was $5.44 per diluted share in 2022, up 272.6% versus $1.46 per diluted share in 2021. The company’s earnings fell to $0.72 per diluted share in 2023, but the results to date in 2024 point to an improvement. (Source: Yahoo! Finance, op. cit.)

Mach Natural Resources reported $0.70 per diluted share in the third quarter, representing a $0.14 or 25% beat and nearly higher than what was reported in 2023.

For the nine months to September 30, earnings came in at $1.55 per diluted share as the company heads to its best second highest GAAP earnings since 2021.

Analysts estimate that Mach Natural Resources LP will report profits of $2.28 per diluted share in 2024 and $2.77 per diluted share in 2025. This gives MNR stock an attractive 5.6 times the consensus 2025 earnings per share (EPS) estimate. (Source: Yahoo! Finance, op. cit.)

The funds statement indicates that positive free cash flow (FCF) is supporting the dividends, capital spending, and debt reduction. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2021 | $157.5 | N/A |

| 2022 | $310.5 | 97.1% |

| 2023 | $176.9 | -43.0% |

(Source: Yahoo! Finance, op. cit.)

The company’s balance sheet needs some attention. Mach Natural Resources held $802.3 million in total debt and $144.6 million in cash at the end of September. I don’t expect any issues given the profitability, FCF, and interest coverage ratio of 3.9 times. (Source: Yahoo! Finance, op. cit.)

A Significant Dividend Payer

While MNR stock only started to trade in October 2023, Mach Natural Resources has already paid $3.20 in dividends in 2024. (Source: Yahoo! Finance, op. cit.)

The concern is the mixed dividends paid so far, which has likely hurt the shares. MNR stock paid a quarterly dividend of $0.60 per share in November versus $0.90 in August, $0.75 in May and $0.95 in March.

Based on the recent dividend, the forward dividend yield is still high at 15.02%. The payout ratio is around 86.6% based on the $0.60 dividend and the consensus 2025 EPS estimate.

Depending on the results in 2025, we could see the quarterly dividend readjusted again in 2025.

The Lowdown on MNR Stock

Both institutions and insiders like MNR stock. Around 47 institutions hold a 72.7% stake in the outstanding shares, while insiders own 14.5% of the shares. (Source: Yahoo! Finance, op. cit.)

Wall Street analysts are targeting a $23.33 price for MNR stock, representing a potential price move of 50.9%. This is attractive, plus a shareholder gets paid to hold the stock. (Source: Yahoo! Finance, op. cit.)