MFIC Stock: A BDC That’s Yielding 11.3% for Income Investors

Trump 2.0 Should Improve the Lending Climate

Anyone looking for consistent dividend income and the potential for some price appreciation should consider an investment that operates as a business development company (BDC).

The idea behind a BDC is to provide capital and expertise to small- and medium-sized companies and help them improve their operations or deal with any operational issues. A BDC will also invest in distressed companies that require immediate attention.

Then, the income generated from the investments is funneled out as dividends to the BDC’s shareholders.

Given the expected decline in interest rates, the pro-business environment, and the likelihood of reduced regulation under President-elect Donald Trump, the next few years should be good for BDCs.

On this note, take a look at MidCap Financial Investment Corp (NASDAQ:MFIC), a $1.26-billion-market-cap BDC that is affiliated with Apollo Global Management, a major global alternative investment manager with a long story of success in equity and debt investing.

MidCap Financial operates as a specialty finance company with a focus on providing senior debt investments to middle-market companies. Its objective is to drive income from the investments along with creating some capital appreciation. (Source: “About,” MidCap Financial Investment Corp, last accessed December 30, 2024.)

MidCap Financial Investment has an investment portfolio of around $3.03 billion spread across 250 portfolio companies.

Its top four portfolio businesses are:

- High-tech industries: 18.1%

- Health-care & pharmaceuticals industries: 16.4%

- Business services: 10.5%

- Consumer services: 9%

Income investors seeking a stream of steady dividends should take a serious look at MFIC stock, which is currently hovering just below the midpoint of its $12.26 to $16.36 range.

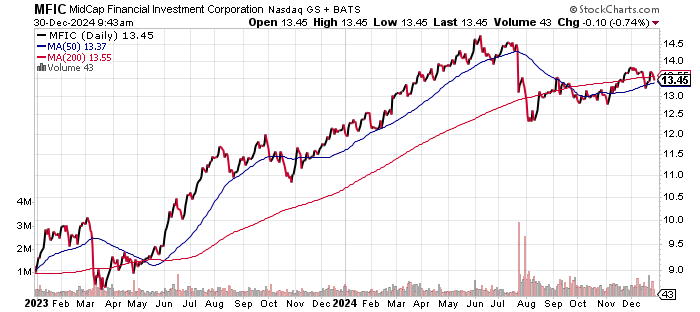

Trading at $13.45 at time of writing (on December 30, 2024), MFIC stock is just below both its 50-day moving average (MA) of $13.64 and 200-day MA of $14.36 in a narrow trading channel.

Chart courtesy of StockCharts.com

Strong Expected Growth in Disciplined Investments

MidCap Financial Investment Corp reports revenues as total investment income and earnings as net investment income.

In 2023, the BDC’s total investment income reported was $276.5 million. Analysts expect this to rise by 10.7% to $306.1 million in 2024, followed by 17.1% growth to $358.5 million in 2025. The growth rate is quite good for a BDC. (Source: “MidCap Financial Investment Corporation (MFIC),” Yahoo! Finance, last accessed December 30, 2024.)

In the third quarter of 2024, MidCap Financial reported total investment income of $82.1 million, up from $68.2 million in the year-ago third quarter. This is on track to easily beat the consensus estimate for 2024. (Source: “MidCap Financial Investment (MFIC) Beats Q3 Earnings Estimates,” Yahoo! Finance, November 7, 2024.)

On the bottom line, the BDC delivered net investment income of $0.44 per share in the third quarter versus $0.43 per share a year earlier. It was $0.02 above the consensus. MidCap Financial has beaten the consensus in four straight quarters.

For the nine months to September 30, its net investment income came in at $1.32 per share, unchanged from the same period in 2023.

Analysts expect MidCap Financial Investment to deliver net investment income of $1.72 per share in 2024 and $1.61 per share in 2025. (Source: Yahoo! Finance, op. cit.)

As far as the balance sheet goes, the BDC’s debt load is generally high given the nature of the business. MidCap had $1.77 billion in total debt and $84.8 million in cash at the end of September. The total debt to equity ratio of 125.2% is manageable given the business and the fact that the working capital is extremely strong. (Source: Yahoo! Finance, op. cit.)

Steady Dividends & a High Yield

MidCap Financial Investment Corp recently declared an $0.38 per share dividend that was paid on December 10. The same dividend has been in place since December 2022; I expect it to hold in spite of the lower expected earnings for 2025. (Source: Yahoo! Finance, op. cit.)

At $1.52 per share annually, MFIC stock’s forward yield is 11.3%, which is far better than what you would earn in treasuries and with the majority of investment-grade bonds.

The Lowdown on MFIC Stock

MidCap Financial Investment is geared to the income investor who seeks a high yield and, to a lesser extent, capital appreciation.

I feel there’s also some decent upside potential given the lower interest rate environment to come, as well as Trump 2.0, which could drive loan activity. And, given the current price compared to the five-year high of $18.33 in December 2019, there’s some room for MFIC stock to rally.