McDonald’s Stock Is the Ultimate “Forever Asset”

McDonald’s Corporation (NYSE:MCD) stock is one for the next 100 years.

Sure, if you like hot startups, this might not be the one for you. But if you like good old-fashioned dividends, you’ll like this firm just fine.

Long-time shareholders have made a fortune, and the company has paid out distributions for 40 years. For these reasons, this is one dividend stock to own forever.

Let me explain.

A Dividend Stock to Buy and Hold?

I’m a big fan of a group of stocks I like to call my “Forever Assets.”

These wonderful, timeless businesses have produced profits for decades. Because they don’t tend to be in “sexy” industries, Forever Assets don’t get a lot of coverage in the press. Longtime shareholders, though, are happy to trade water cooler high-fives for steady dividends.

Some of the best Forever Assets just “sell the basics:” items like beer, soda, and cigarettes. For proof, you only need to glance at the stock market’s top performers. The list is littered with outright boring businesses like Hershey Co (NYSE:HSY), Kraft Heinz Co (NASDAQ:KHC), and The Coca-Cola Co (NYSE:KO).

One of my favorites? McDonald’s.

You don’t need an MBA to wrap your head around this firm. McDonald’s makes burgers and pays out dividends. Its status as a Forever Asset comes down to a couple of points.

First, you have a timeless business.

When I start thinking of holding periods on generation-like timescales, you don’t want the company to disappear overnight. You have to ask yourself, “can I imagine my children and grandchildren buying this product?”

I don’t know what the world will look like in 50 years. I can’t tell you which smartphones people will be using. I’m confident, though, that folks will still enjoy soda pop, fries, and burgers.

You tend to stick to what you trust when you’re putting things in your mouth. As the top dog in fast food, McDonald’s has a bigger brand than any rival. For this reason, customers will likely pick “Micky D’s” over “Mom and Pa’s” burger shack.

Over time, more people will be living in this country. Those people will need a place to feed their kids or grab a quick lunch. It’s not hard to imagine that families will be visiting the “golden arches” in 2070.

I also want some sort of an edge.

For McDonald’s, the edge comes from its raw scale. Last year, the company did $85.0 billion in systemwide sales, more than double its nearest competitor. (Source: “McDonald’s Turnaround Signals Accelerating Long-Term Growth,” Forbes, January 31, 2017.)

When you swing a stick this big, you can strike large discounts with suppliers. Other costs, like lawyers, marketing, and management, can also be spread across a larger base of sales. This allows McDonald’s to earn $0.31 in operating profits on every dollar made in revenue; one of the highest in the business.

The franchise model is also a big edge. Small business owners, not McDonald’s shareholders, must front the funds for each restaurant. They’re the ones who take the risk, while investors enjoy a steady stream of rents and royalties.

All of this means outsized returns for shareholders. Over the past decade, the company has earned $0.25 in annual returns for every dollar invested into the business. Sure, some firms can generate returns like this once in a while. Few businesses, though, post numbers like these year after year.

Finally, we want to see a long track record of dividends.

No farmer keeps a cow that can’t give milk around for long. There’s a term for such cows: burgers.

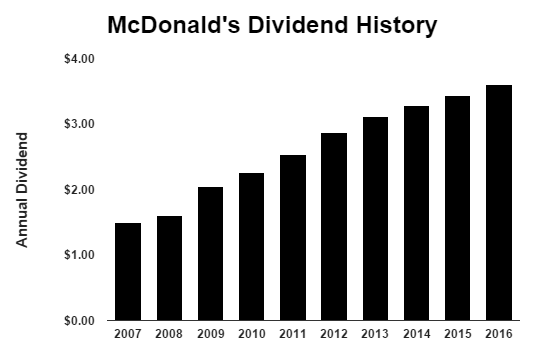

MCD stock, however, can be milked for reliable income. The company has posted 41 straight years of dividend hikes. Today shares yield 3.1%, which should grow inline with profits.

(Source: “McDonald’s Corporation (MCD),” Yahoo! Finance, last accessed February 6, 2017.)

A special dividend could be on the way, too. Over the past few years, executives have sold off company-run stores to franchisees. Last month, management unlocked $2.0 billion by selling off their Chinese business. (Source: “McDonald’s gives up control of its China business in $2 billion deal,” CNN, January 9, 2017.)

What can they do with such a windfall? The top brass might pay out a large, one-time distribution. We could also see a combination of dividend hikes and share buybacks.

Of course, McDonald’s stock is no sure thing.

The fast food giant’s best growth days are behind it. The fast food market is saturated. Cutthroat competition will hit margins.

McDonald’s, though, finds news ways to compete. If you ever want to feel really American, you can order the new Grand Big Mac and some large fries. It’s like injecting 1,300 calories of raw patriotism straight into your veins. Other innovations like the all-day breakfast and healthier menu options also keep people coming back.

And, while shareholders love growth, owning a mature business can be lucrative, too. The company is shifting from expansion to harvest mode. With less money plowed back into operations, McDonald’s will have more cash left for distributions.

Owning these cash cows can be incredibly profitable. For proof, just look at some of the market’s biggest winners, like Altria Group Inc (NYSE:MO) (cigarettes), Colgate-Palmolive Company (NYSE:CL) (toothpaste), or Anheuser Busch Inbev NV (ADR) (NYSE:BUD) (beer). All of these are mature businesses. Shareholders who patiently reinvested their dividends, however, have crushed the market as the years ticked by.

The Bottom Line on McDonald’s Stock

Regardless, the company’s problems are short-term. New issues will always emerge, moving the stock price one way or another. Most of these challenges, though, disappear when your time frame is long enough.

Bottom line: McDonald’s stock is a true Forever Asset, a timeless business with a big competitive edge and a long track record of paying dividends. This is one name I could see owning for the next 100 years.