Why Target Is a Top Dividend Stock: A Juicy 4.2% Dividend Yield

The retail industry isn’t a great place to be invested in these days. Retail giant Target Corporation (NYSE:TGT), for instance, is a top dividend stock that has tumbled more than 25% over just the past three months, while the Dow Jones has climbed about 10% over the same time period.

The latest wallop came last Wednesday, when Target stock plummeted about 13% after posting highly disappointing quarterly results and downbeat full-year guidance. Intensifying competition from big-box peers and ever-rising digital sales continue to weigh on the dividend stock.

But, as regular readers know, nothing piques my interest more than when a stock with a solid dividend history falls sharply in price. Why? Well, if the company’s long-term fundamentals remain sound and the dividend continues to be well covered, then the high yield that usually results from the drop becomes all the more mouth-watering.

With a four-percent-plus dividend yield, I think that perfectly sums up TGT stock. Let’s take a closer look.

Target Trauma

There’s no sugarcoating it: Target’s Q4 results were ugly—really ugly.

Earnings per share (EPS) of $1.45 missed the consensus by $0.06, while revenue sank four percent to $20.7 billion, $50.0 million below estimates. More importantly, same-store sales, a key metric in gauging a retailer’s health, fell 1.5% on “unexpected softness” at its locations, representing the company’s third consecutive quarter of declines. Furthermore, the gross margin fell 100 basis points to 26.9%, reinforcing worries that the company’s operating environment is only becoming more intense.

“We’re operating in an incredibly challenging environment,” said Chairman and CEO Brian Cornell. “All across the retail industry many of our competitors are aggressively rationalizing their assets. They are closing stores, exiting markets. They are cutting costs just to keep their heads above water.” (Source: “Edited Transcript: TGT – Q4 2016 Target Corp Earnings Call,” Target Corporation, February 28, 2017.)

The retail industry continues to face serious pressure from weak consumer spending, the rise of online gorilla Amazon.com, Inc. (NASDAQ:AMZN), as well as concerns over President Donald Trump’s aggressive proposed trade policies.

But Target seems to be losing favor with customers at an especially worrisome rate, prompting management to embark on a bold multi-year plan to lower prices, provide a better overall shopping experience, and boost digital sales.

Needless to say, Wall Street wasn’t exactly happy with that idea. Let me explain why.

More Margin Pain Ahead

See, in order start winning back consumers, Target plans “aggressive promotional activities” designed to ensure that it is competitively priced each and every day. While that sounds great on the surface, it means that investors can expect further pressure on margins and earnings into the foreseeable future.

In 2017, management sees full-year operating income declining by a staggering $1.0 billion due to the heavy discounting, with same-store sales expected to decline in the low-single digits. Meanwhile, the company is targeting full-year EPS of $3.80–$4.20 from continuing operations, well below the average analyst estimate of above $5.00.

So, while it might be fair to assume that Target will regain some market share with aggressive pricing, the massive stress on its short-term results can’t be understated. After all, when your biggest rivals are brick-and-mortar behemoth Wal-Mart Stores Inc (NYSE:WMT) and e-commerce king Amazon, competing on price is a particularly daunting endeavor.

(Source: “Cathy Smith EVP & Chief Financial Officer,” Target Corporation, last accessed March 6, 2017.)

In addition to the $1.0-billion investment in operating profits this year, Target plans to spend $2.0 billion of capital in 2017 and more than $7.0 billion over the next three years.

A good chunk of that budget will be dedicated to opening more of the company’s new small-format stores, which have about double the sales productivity of the average Target store. In three years, management expects to add more than 100 small-format stores in prime urban locations and college campuses, where the company’s much larger suburban store format simply doesn’t make sense.

Additionally, Target plans to revamp, or “reimagine,” more than 500 of its stores over the next three years by freshening things up visually and even providing space to support digital fulfillment.

(Source: “John Mulligan EVP & Chief Operations Officer,” Target Corporation, last accessed March 6, 2017.)

Consistent with that strategy to fold e-commerce into the physical shopping experience, Target will, of course, continue to invest heavily in its battle against Amazon.

After all, digital sales were pretty much the lone bright spot for Target in Q4, with online sales jumping 34% over the year-ago period. And, over the past three years, the company’s digital sales have more than doubled from $1.4 billion in 2013 to about $3.4 billion 2016, easily outpacing the industry’s digital performance.

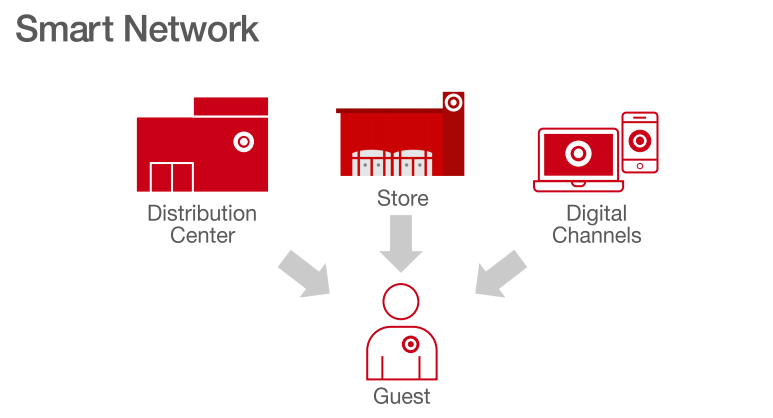

Furthermore, Target’s stores actually fulfilled 68% of its online orders in 2016. So, while Target still doesn’t come close to matching Amazon’s online muscle, its stores have plenty of multi-purpose upside that might translate into a meaningful network advantage over time.

(Source: “Brian Cornell Chairman and Chief Executive Officer,” Target Corporation, last accessed March 6, 2017.)

Dividends Dynamo

But, at the end of the day, dividends are what matters most to us Income Investors. And, although Target will discount aggressively and spend a ton of cash over the next several years, pressuring margins in the process, the dividend still looks pretty safe to me.

In 2016, the company generated healthy operating cash flow of $5.4 billion while paying out dividends of just $1.3 billion. And even when we use Target’s disappointing 2017 EPS estimate of $4.00, the payout ratio still sits at a very comforting 60%. Naturally, that kind of coverage provides plenty of room for decent dividend growth, despite strong competitive headwinds.

In fact, the company says it’s on track to deliver its 46th consecutive year of annual dividend growth. Talk about consistency.

Target has also returned more than $10.0 billion to shareholders through dividends and share repurchases over just the past two years, suggesting that management will remain disciplined even as it attempts to win back market share.

“With the investments we’re making,” said CFO Cathy Smith in the call, “we will be best positioned to deliver positive in-store comp sales and a rapid and profitable growing digital channel, stable to growing enterprise profit margins, continued strong cash flow, and the ability to return capital to shareholders, and superior ROIC over time.” (Source: “Edited Transcript: TGT – Q4 2016 Target Corp Earnings Call,” Target Corporation, Op cit.)

Bull’s-Eye Bargain

So is Target stock’s big pullback worth pouncing on? Well, considering how solidly covered the dividend seems to be, as well as how attractive the yield is, I’d definitely say so.

In fact, Target’s dividend yield of 4.2% easily tops that of main big-box store peers Wal-Mart (2.9%) and Costco Wholesale Corporation (NASDAQ:COST) (1.1%). Furthermore, Target’s cheapish forward price-to-earnings (P/E) multiple of 14 represents a clear discount to those same brick-and-mortar rivals, as well as the high-flying Amazon.

So, although Target’s poor performance and bleak near-term outlook certainly warranted some kind of stock price decline, I think the punishment is now overdone.

The Bottom Line On TGT Stock

Target looks like a top dividend stock at these two-year lows. While competitive and economic headwinds are working against the company, I don’t expect TGT stock’s decades-long streak of dividend growth to stop anytime soon.

Target’s short-term road will definitely be rocky, but with its scale advantages still largely intact and a stock that boasts an industry-trouncing dividend yield, the dividend stock’s long-term turnaround potential is too attractive to pass up.