Mach Natural Resources Stock: New Dividend-Payer Yielding 22.47%

Weak Oil Prices Presenting Opportunity

The most volatile area of the energy business is the upstream segment, because revenues depend largely on the price of oil.

When oil prices fall or are weak, upstream producers face more uncertainties given their dependence on oil prices. The converse holds true when oil prices rise and help to shore up revenues.

With the price of West Texas Intermediate (WTI) currently hovering below $70.00, upstream producers have been under some pressure.

Take the case of small-cap Mach Natural Resources LP (NYSE:MNR). MNR stock is down 16.1% over the past month to September 26, which I view as providing a contrarian opportunity.

Mach Natural Resources explores for and produces oil, natural gas, and natural gas liquid (NGL) reserves in the Anadarko Basin region located in western Oklahoma, southern Kansas, and the panhandle of Texas. (Source: “Company Profile,” Mach Natural Resources LP, last accessed September 26, 2024.)

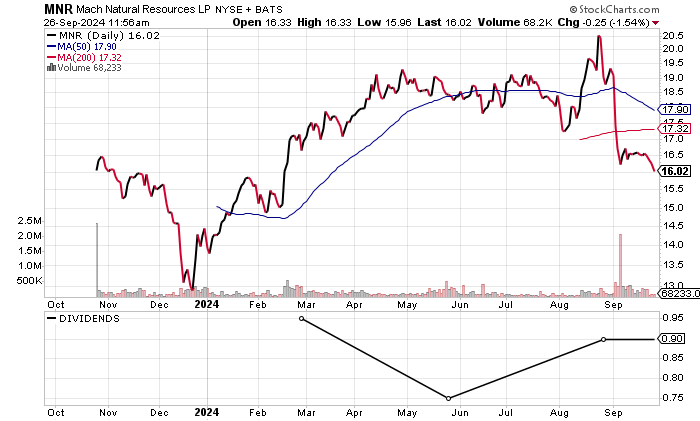

Mach Natural Resources stock is relatively new as a publicly traded company. The stock debuted at $19.00 on October 25, 2023, and reached $21.19 on April 30, 2023. But with the subsequent decline, MNR stock is now sitting 24.2% below the high.

On the chart, Mach Natural Resources stock is below both its 50-day moving average (MA) of $18.43 and 200-day MA of $18.63.

A recovery of both MAs would be bullish. It would even be more positive should the 50-day MA break above the 200-day MA and form a golden cross.

Chart courtesy of StockCharts.com

Revenues Heading Towards $1.0 Billion

Though Mach Natural Resources only has three years of reported financial history, the growth has been excellent so far.

Revenues exploded upwards by 138.8% in 2022 prior to sliding 18.7% in 2023, but the outlook is bullish.

| Fiscal Year | Revenues (Millions) | Growth |

| 2021 | $392.5 | N/A |

| 2022 | $937.4 | 138.8% |

| 2023 | $762.3 | -18.7% |

(Source: “Mach Natural Resources LP (MNR),” Yahoo! Finance, last accessed September 26, 2024.)

Analysts expect Mach Natural Resources LP to ramp up revenues by 32.8% to $1.01 billion in 2024, followed by $1.03 billion in 2025. The trailing 12 months of revenues amounted to $882.4 million. (Source: Yahoo! Finance, op. cit.)

Gross margins were above 70% in 2021 and 2022 prior to slipping just below in 2023. Not a big concern at this time.

| Fiscal Year | Gross Margins |

| 2021 | 74.0% |

| 2022 | 73.5% |

| 2023 | 69.4% |

A look at the bottom line shows the delivery of consistent generally accepted accounting principles (GAAP) profits. After a major rise in 2022, GAAP earnings fell in 2023, but they’re expected to improve.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2021 | $1.46 | N/A |

| 2022 | $5.44 | 272.6% |

| 2023 | $0.72 | -86.8% |

(Source: Yahoo! Finance, op. cit.)

At this time, analysts estimate that Mach will report profits of $2.14 per diluted share in 2024 and $2.64 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

The company’s funds statement points to positive free cash flow (FCF). This will allow for dividends and debt reduction. The trailing 12 months saw FCF of $226.5 million, so expect an increase in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2021 | $157.5 | N/A |

| 2022 | $310.5 | 97.1% |

| 2023 | $176.9 | -43.0% |

(Source: Yahoo! Finance, op. cit.)

The balance sheet is mixed. Mach Natural Resources carried $802.3 million in total debt and $144.6 million in cash at the end of June. I don’t expect any issues given the profitability and FCF. (Source: Yahoo! Finance, op. cit.)

Another way to look at it is by comparing the interest expense with earnings before interest and taxes (EBIT). The table shows that Mach’s interest has been easily covered in each year.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2021 | $140.0 | $1.7 | 82.35X |

| 2022 | $521.7 | $4.9 | 106.47X |

| 2023 | $357.8 | $11.2 | 31.95X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a slightly weak reading of 4.0, which is just below the midpoint of the 1.0 to 9.0 range.

High Dividend Payouts in First Year

Since debuting in October 2023, Mach Natural Resources stock has made three dividend payments totaling $2.60 (February, May, and August 2024). (Source: Yahoo! Finance, op. cit.)

Based on the last dividend of $0.90 in August, the forward yield is 22.47%. It looks great, but the size of Mach Natural Resources stock’s dividend may not be sustainable given the high payout ratio based on the expected earnings in 2024.

For example, based on Mach’s expected earnings of $2.64 per diluted share in 2025, a payout ratio of 50% would translate into an annual dividend of $1.32 and a forward yield of 8.14% (based on a stock price of $16.06). At a payout ratio of 80%, Mach Natural Resources stock’s forward yield rises to 10.65%. These are only estimates. I have presented several scenarios that could materialize.

| Payout Ratio | Dividend Based on 2024 Consensus | Dividend Based on 2025 Consensus |

| 50% | $1.07 | $1.32 |

| 60% | $1.28 | $1.58 |

| 70% | $1.50 | $1,85 |

| 80% | $1.71 | $2.11 |

The Lowdown on Mach Natural Resources Stock

Mach Natural Resources stock has relatively strong institutional ownership, with 40 institutions holding a 72.5% stake in the outstanding shares. Insider ownership is strong at 14.6%, which should mean more incentive to deliver better results. (Source: Yahoo! Finance, op. cit.)

While Mach Natural Resources stock’s current dividend appears to be unsustainable, I expect the yield to remain in the high single digits or low double digits if the company delivers consistent revenue, profits, and FCF.