Mach Natural Resources Stock: 15.20%-Yielder Beating S&P 500

A Small Oil & Gas Play to Watch

Mach Natural Resources stock is a dividend pick you’ll want to keep an eye on.

The Nasdaq and S&P 500 continue to set fresh new highs, powered largely by a small group of mega-cap technology stocks.

While it may be hard to watch as an income investor, our focus at Income Investors is on stocks that generate dividend income and some capital appreciation to build long-term wealth. Warren Buffett is a prime example of this proven investing strategy.

A relatively new entrant to the dividend space that looks compelling is Mach Natural Resources LP (NYSE:MNR). This small oil and gas play has a market valuation of $1.9 billion.

Mach Natural operates as an upstream oil and gas company currently focused on Southern Kansas, the Anadarko Basin region of Western Oklahoma, and the panhandle of Texas. (Source: “Company Profile,” Mach Natural Resources LP, last accessed July 9, 2024.)

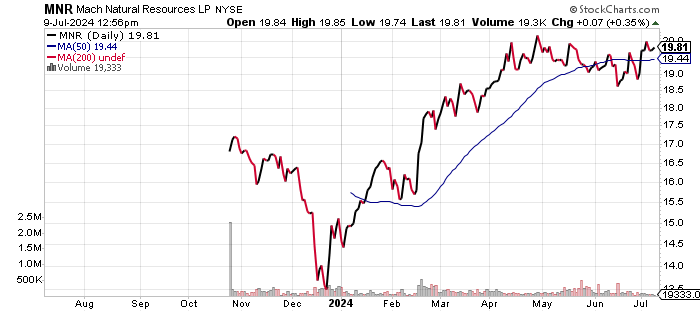

MNR stock has outperformed the S&P 500 so far in 2024, with a return of 20.1%, which is also just below the 23.1% move by the Nasdaq. Now, I wouldn’t expect the outperformance to continue, but then you are also receiving a nice dividend.

Trading at $19.80 at the time of writing, Mach Natural Resources stock is hovering around its 50-day moving average (MA) of $19.76 and above its 200-day MA of $18.54. There is also a golden cross formation on the chart, which is a bullish technical crossover that occurs when the 50-day is above the 200-day MA.

Chart courtesy of StockCharts

Revenues Expected to Break $1.0 Billion

Mach Natural Resources LP only has three years of financial history, but there are encouraging signs so far.

The company’s revenues surged 138.8% from 2021 to the record $937.4 million in 2022, prior to contracting to $762.3 million in 2023.

| Fiscal Year | Revenues (Millions) | Growth |

| 2021 | $392.5 | N/A |

| 2022 | $937.4 | 138.8% |

| 2023 | $762.3 | -18.7% |

(Source: “Mach Natural Resources LP (MNR),” Yahoo! Finance, last accessed July 9, 2024.)

The outlook looks promising, with Mach Natural Resources expected to generate revenues of $1.05 billion in 2024 and $1.02 billion in 2025. (Source: Yahoo! Finance, op. cit.)

Early on, the company has delivered strong gross margins.

| Fiscal Year | Gross Margins |

| 2021 | 74.0% |

| 2022 | 73.5% |

| 2023 | 69.4% |

Profitability has been mixed. Mach Natural Resources reported a record $5.44 per diluted share in 2022 based on generally accepted accounting principles (GAAP). The past year saw a significant decline to $0.72 per diluted share, but the outlook seems optimistic.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2021 | $1.46 | N/A |

| 2022 | $5.44 | 272.6% |

| 2023 | $0.72 | -86.8% |

(Source: Yahoo! Finance, op. cit.)

Look for Mach Natural Resources to deliver $2.71 per diluted share in 2024, followed by $3.40 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Achieving these results would be impressive, but, as is the case with upstream energy plays, much depends on the exploration and production results and the price of oil.

Mach Natural Resources LP has produced strong positive free cash flow (FCF) in each of the three operating years. After the record $310.5 million in 2022, FCF fell in 2023 when the company bought back $167.6 million in stock. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2021 | $157.5 | N/A |

| 2022 | $310.5 | 97.1% |

| 2023 | $176.9 | -43.0% |

(Source: Yahoo! Finance, op. cit.)

The balance sheet is manageable, with $151.3 million in cash and $821.7 million in total debt at the end of March. (Source: Yahoo! Finance, op. cit.)

The strong financial flexibility is supported by a healthy interest coverage ratio of 9.3 times.

Mach Natural Resources has also easily covered its interest payments via much higher earnings before interest and taxes (EBIT). The EBIT/interest ratio is extremely strong.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | EBIT/Interest Ratio |

| 2021 | $140.0 | $1.7 | 82.4X |

| 2022 | $521.7 | $4.9 | 106.5X |

| 2023 | $357.8 | $11.2 | 32.0X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a manageable reading of 4.0 for Mach, which is just below the midpoint of the 1.0 to 9.0 range.

Dividend Shows Early Promise

Mach Natural Resources stock has a high forward dividend yield of 15.2%. (Source: Yahoo! Finance, op. cit.)

There is some uncertainty surrounding the company’s dividend strategy given that there have only been two dividend payments so far.

Mach Natural Resources paid its initial dividend of $0.95 per share in February 2024, followed by a payout of $0.75 per share in May. This results in an annualized $3.00 per share in dividends, but we will have to wait and see what the company does next.

The dividend coverage ratio of 3.7 times suggests that Mach has no issues covering its dividend.

The Lowdown on Mach Natural Resources Stock

Mach Natural Resources stock has attracted relatively strong institutional interest, with 38 institutions holding 78.2% of the outstanding shares. (Source: Yahoo! Finance, op. cit.)

Insider interest is also relatively high at 15.7%, implying insiders would be motivated to deliver results.

For income investors looking for a potentially rewarding dividend play, Mach Natural Resources stock is worth a look.

There is some risk given the lack of a dividend history, so take that into consideration.