Chicago Atlantic BDC Paying Big Dividends

Interest rates are heading lower, driving down the yield paid on interest-bearing instruments.

For income investors, this means you need to find alternative income investments yielding above the treasury bill and inflation rates.

That’s when a business development company (BDC) may be ideal. These high-yielding securities aim to pay regular, consistent quarterly dividends and also provide the opportunity for some capital appreciation and deliver a nice total return.

The structure of a BDC is to deliver investment income for investors by making debt and equity investments in small- and medium-sized companies, including distressed companies. The BDC also provides capital and expertise to help companies grow or work on operational issues.

Investment income that flows from the investments is paid as dividends to investors. A BDC is required to distribute a minimum of 90% of its taxable income and tax-exempt interest annually.

A small but top-performing BDC that has returned both capital and dividends to investors is Chicago Atlantic BDC Inc (NASDAQ:LIEN), with $292.2 million in market cap as of December 17.

Chicago Atlantic operates as a specialty finance company focused on lending to private, middle-market companies in the underserved cannabis segment.

The Biden administration failed to federally decriminalize cannabis, so these companies are shut out from the traditional banking system. That’s where Chicago Atlantic BDC comes in as a lender and investor in eligible cannabis companies.

At the end of September 2024, the company’s investments at fair value were $55.8 million. (Source: “Overview,” Chicago Atlantic BDC Inc, last accessed December 17, 2024.)

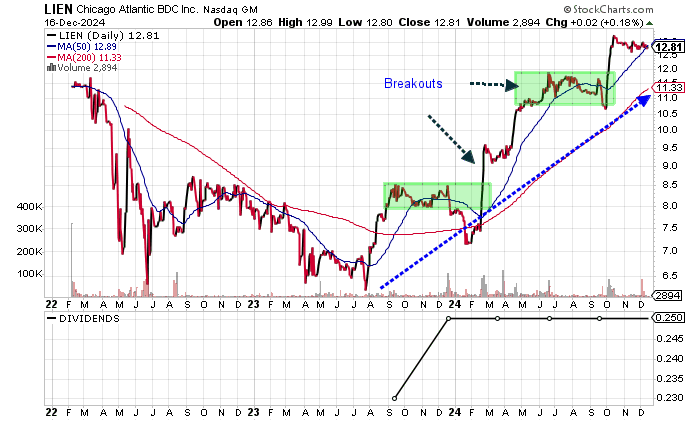

LIEN stock has delivered strong capital appreciation so far in 2024, making a stellar move of 51.7% as of December 17. The stock is just off its 52-week high of $13.34 established on October 15.

Trading at the current $12.81, LIEN stock is above its 200-day moving average (MA) of $11.59 and just below its 50-day MA of $12.89.

Moreover, LIEN stock has broken higher on several attempts. The stock is also in a golden cross—a bullish technical crossover when the 50-day MA is above the 200-day MA. This suggests there could be additional upside moves with LIEN stock.

Chart courtesy of StockCharts.com

Investment Income Set to Surge

Chicago Atlantic BDC Inc reports its revenues as total investment income and earnings as net investment income.

The company’s financial results have been limited, but, so far, the top and bottom lines have been strong, and the outlook is positive.

Total investment income surged to $11.9 million for the year ending December 31, 2023. Chicago Atlantic changed its year end from the previous March 31. For the period from April 1, 2022, to December 31, 2022, total investment income was $4.0 million. (Source: “Form-10K,” Chicago Atlantic BDC Inc, last accessed December 17, 2024.)

In the third quarter, Chicago Atlantic reported total investment income of $3.2 million, up from $2.9 million in the year-ago third quarter.

For the nine months to September 30, the BDC’s total investment income came in at $9.0 million versus $8.3 million for the comparative period in 2023. The results offer a pathway for a beat in 2024.

Chicago Atlantic is reporting strong growth in the bottom line. Its net investment income came in at $1.07 per share for the year to December 31, 2023, well ahead of the $0.35 per share for the period from April 1 to December 31, 2022.

In the third quarter, the net investment income was less than $0.005 per share, which was better than the expected loss of $0.01 per share. For the comparative third quarter in 2023, the company reported investment income of $0.26 per share.

For the nine months to date, Chicago Atlantic reported that net investment income slowed to $0.23 per share versus $0.79 per share for the same period in 2023.

The single estimate expects the BDC’s net investment income to fall to $0.76 per share in 2024, prior to recovering to $1.11 per share in 2025. (Source: “Chicago Atlantic BDC, Inc (LIEN),” Yahoo! Finance, last accessed December 17, 2024.)

Fourth-Quarter Dividend Up 36%

Chicago Atlantic has paid nice dividends in both years since its initial public offering, including an increase to $0.36 per share in December, up 36% compared to $0.25 per share in March, June, and September. (Source: Yahoo! Finance, op. cit.)

LIEN stock’s total dividends paid in 2024 amounted to $1.11 per share, versus $1.33 per share in 2023. The December dividend equates to a forward yield of 11.24%.

The Lowdown on LIEN Stock

Insiders hold a high 63.1% of LIEN stock. This will entice the insiders to deliver better results. (Source: Yahoo! Finance, op. cit.)

Chicago Atlantic BDC Inc will benefit from the lower interest rates over the next few years. Also, a more pro-business climate under President-elect Donald Trump should also be beneficial.

For income investors, LIEN stock offers a high dividend yield, plus it has delivered strong capital appreciation so far in 2024.