KRP Stock: 25% Upside with This 10.24%-Yielder?

Drilling Could Open Up Under Trump Presidency

Today, we’re taking a look at KRP stock.

Why?

Well, President-elect Donald Trump may be exactly what the energy sector needs to jumpstart the oil and natural gas sector.

The idea of renewed growth and less regulation in oil and gas could help an upstream energy company like Kimbell Royalty Partners LP (NYSE:KRP). This $1.53-billion-market-cap energy play could find itself within a friendlier operating environment over the next four years.

Operating since 1998, the company’s portfolio of assets comprises around 17 million gross acres spread across 28 states. Kimbell Royalty Partners owns in excess of 129,000 gross wells, including more than 50,000 wells located in the energy-rich Permian Basin. (Source: “About,” Kimbell Royalty Partners LP, last accessed November 27, 2024.)

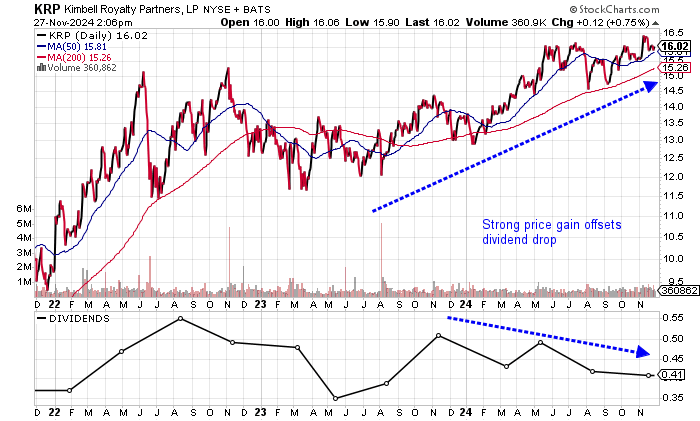

KRP stock is up around 6.5% in 2024, but it’s still well below its 52-week high of $17.07 as of November 27. The stock’s 10-year high was $24.50 in July 2018.

The current KRP stock price of $16.02 is just below both its 50-day moving average (MA) of $16.10 and 200-day MA of $16.06 at the time of writing. But there’s a technically interesting sign: the appearance of a golden cross on the chart. This is a bullish technical crossover when the 50-day MA is above the 200-day MA. This pattern signals that a potentially bigger upside move could be on the horizon for KRP stock.

Chart courtesy of StockCharts.com

Strong Third-Quarter Revenue & Profit Growth

Kimbell Royalty Partners LP achieved record revenues of $285.0 million in 2022 prior to slipping 4.2% to $273.2 million in 2023. (Source: “Kimbell Royalty Partners L.P.,” MarketWatch, last accessed November 27, 2024.)

The company’s revenue picture is improving in 2024, with revenues of $235.5 million in the nine months to September 30, up 28.2% year over year. The third quarter saw revenues of $83.8 million, up 24.7% versus $67.2 million in the third quarter of 2023. (Source: “Kimbell Royalty Partners Announces Third Quarter 2024 Result,” Kimbell Royalty Partners LP, November 7, 2024.)

Analysts expect Kimbell Royalty Partners to report revenue growth of 8.6% to $319.4 million in 2024, followed by a record $330.3 million in 2025. (Source: “Kimbell Royalty Partners, LP (KRP),” Yahoo! Finance, last accessed November 27, 2024.)

On the bottom line, Kimbell Royalty Partners LP produced generally accepted accounting principles (GAAP) profits from 2021 to the record $1.72 per diluted share in 2022. However, GAAP profits slid to $0.91 per diluted share in 2023. (Source: MarketWatch, op. cit.)

The company’s third-quarter GAAP earnings came in at $0.22 per diluted share, up from $0.19 per diluted share in the year-ago third quarter. The rise in earnings per share (EPS) occurred despite a major rise in the weighted average number of KRP shares to 116.4 million in the 2024 third quarter, compared to 95 million shares a year earlier. (Source: Kimbell Royalty Partners LP, op. cit.)

On an adjusted basis, Kimbell Royalty reported $0.64 per diluted share in 2023. Analysts expect earnings to drop to $0.60 per diluted share in 2024 before a strong rebound to $0.94 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Kimbell Royalty Partners produced positive free cash flow (FCF) in five straight years to the record $174.1 million in 2023. FCF is set to move higher in 2024 after the company reported $194.2 million in the first three quarters of 2024. (Source: MarketWatch, op. cit.)

The balance sheet is relatively sound, with strong working capital, cash of $34.7 million, and total debt of $253.8 million at the end of September. The total debt-to-equity ratio of around 26.9% is manageable and supported by the strong interest coverage ratio of 4.5 times in 2023. (Source: Yahoo! Finance, op. cit.)

Stronger FCF Could Signal Higher Dividends with KRP Stock

KRP stock has paid dividends in eight consecutive years, but Kimbell reduced its quarterly dividend to $0.41 per share in November from $0.42 per share in August, $0.49 per share in May, and $0.43 per share in March. (Source: Yahoo! Finance, op. cit.)

Based on the $0.41-per-share dividend, the forward yield is 10.24%.

| Metric | Value |

| Dividend Streak | 8 years |

| Dividend 3-Year CAGR | 39% |

| 3-Year Average Dividend Yield | 13.6% |

| Dividend Coverage Ratio | 1.6X |

The Lowdown on KRP Stock

The reductions in the KRP stock dividend are not what we want to see, but Kimbell Royalty Partners’ strong third quarter and its expected growth in FCF this year could result in higher dividends in 2025.

Moreover, the advent of Trump 2.0 could lift upstream energy stocks like KRP stock.