Kenon Holdings Stock: 12.66%-Yielder Up 23.3% This Year

Heavy Insider Interest Is Bullish

The insider ownership of a stock can sometimes be used as a gauge on the direction of a company. By this, I mean that the presence of high insider interest could be a bullish signal.

Insiders guiding a company may have more incentive to drive growth and results when they are heavily invested.

That’s the situation I see with Singapore-based Kenon Holdings Ltd (NYSE:KEN), which has significant insider interest of 56.3%.

The $1.56-billion-market-cap pick operates as a holding company, with its primary focus on power generation and a minority interest in maritime shipping. Kenon invests in and helps grow these businesses.

Kenon Holdings’ primary investment is its 54.5% equity stake in OPC Energy Ltd, a power generation company with facilities in Israel and the U.S.

The holding company also has a 16.5% minority interest (as the single largest shareholder) in ZIM, a global maritime shipper. (Source: “Corporate Profile,” Kenon Holdings Ltd, last accessed December 18, 2024.)

Kenon Holdings stock traded at a 52-week high of $31.26 on December 12, but it remains well below its record $72.90 in March 2022.

Compared to the market, KEN stock has fared well, with a move of 23.3% in 2024 as of December 18.

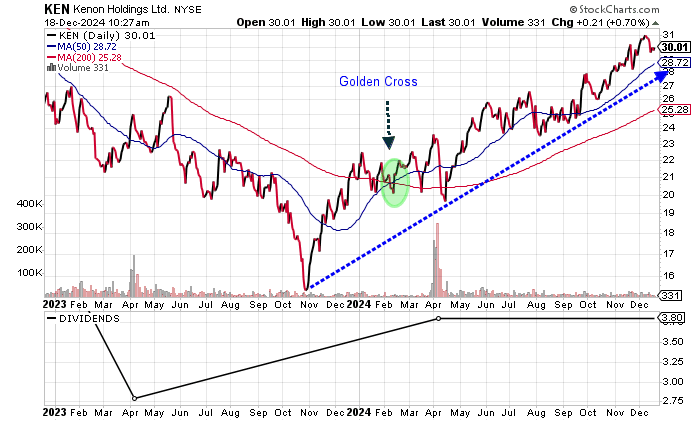

A look at the chart shows Kenon Holdings stock trading above both its 50-day moving average (MA) of $27.69 and 200-day MA of $25.30. Technicians will also like that KEN stock is in a golden cross, which is a bullish technical crossover when the 50-day MA is above the 200-day MA. This generally signals that there should be gains ahead.

Chart courtesy of StockCharts.com

5 Straight Years of Revenue Growth

Kenon Holdings Ltd delivered higher revenues in five straight years, with revenues growing 85.2% from 2019 to the record $691.8 million in 2023. The compound annual growth rate (CAGR) was an impressive 16.7% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $373.5 | 2.6% |

| 2020 | $386.5 | 3.5% |

| 2021 | $487.8 | 26.2% |

| 2022 | $574.0 | 17.7% |

| 2023 | $691.8 | 20.5% |

(Source: “Kenon Holdings Ltd.,” MarketWatch, last accessed December 18, 2024.)

The current year is looking positive, with revenues of $237.0 million in the third quarter, up 30.9% versus the third quarter in 2023. For the nine-month period, the company’s revenues of $592.0 million are well ahead of its 2023 pace.

Gross margins have held steady at the 20%–30% levels, expanding in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 31.4% |

| 2020 | 27.0% |

| 2021 | 31.1% |

| 2022 | 27.3% |

| 2023 | 28.5% |

On the bottom line, Kenon Holdings has reported mixed results, but it produced strong generally accepted accounting principles (GAAP) profitability from 2020 to 2022. A loss emerged in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.25 | N/A |

| 2020 | $9.41 | 3,895.8% |

| 2021 | $17.27 | 83.4% |

| 2022 | $5.80 | -66.4% |

| 2023 | -$4.42 | -176.2% |

(Source: MarketWatch, op. cit.)

With a return to GAAP profits for 2024, there’s optimism. Kenon Holdings’ third-quarter GAAP earnings were $0.81 per diluted share, growing to $3.08 per diluted share for the nine months to September 30.

The company’s funds statement shows positive free cash flow (FCF) in three of the last five years, including a record $496.7 million in 2022. FCF turned negative again in 2023 due to the bottom-line loss.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $32.3 | N/A |

| 2020 | -$6.9 | -121.4% |

| 2021 | $24.8 | 458.6% |

| 2022 | $496.7 | 1,905.2% |

| 2023 | -$65.5 | -113.2% |

(Source: MarketWatch, op. cit.)

In spite of the negative FCF in 2023, Kenon Holdings Ltd increased its share buyback to $60.0 million from $10.0 million. The company will repurchase up to $30.0 million by March 30, 2025. (Source: “Kenon Holdings Reports Q2 2024 Results and Additional Updates,” Kenon Holdings Ltd, September 9, 2024.)

Kenon held $1.44 billion in long-term debt at the end of September, but this was partially offset by its $773.0 million in cash and strong working capital. The debt is expected given the high capital expenditure required to build power facilities. (Source: MarketWatch, op. cit.)

Look at the following table; it shows that Kenon Holdings easily covered its interest payments via higher earnings before interest and taxes (EBIT) from 2020 to 2022, before the weakness in 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | Interest Coverage Ratio |

| 2020 | $524.8 | $24.4 | 21.5X |

| 2021 | $931.6 | $51.9 | 18.0X |

| 2022 | $435.2 | $47.5 | 9.2X |

| 2023 | -$133.4 | $52.3 | N/A |

(Source: “Kenon Holdings Ltd. (KEN),” Yahoo! Finance, last accessed December 18, 2024.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a manageable reading of 4.0 for Kenon. This is just below the midpoint of the 1.0 to 9.0 range. Prior to this, the average score was 5.0 from 2018 to 2023.

Kenon Holdings Stock’s Annual Dividend Rises 36.2% in 2024

Unlike the majority of dividend stocks, Kenon Holdings stock only pays a dividend once a year, in April.

The 2024 payment was $3.80 per share, representing a forward dividend yield of 12.8%. In April 2023, the yield was $2.79 per share. (Source: Yahoo! Finance, op. cit.)

Based on the results, I expect Kenon Holdings stock’s nice dividend to continue, especially given the strong dividend coverage ratio of 3.8 times.

The Lowdown on Kenon Holdings Stock

As I mentioned earlier, KEN stock has extremely high insider ownership of 56.3%, which can be viewed as a positive sign. (Source: Yahoo! Finance, op. cit.)

The valuation of 2.3 times on a revenue basis looks reasonable for Kenon Holdings stock, plus you get a high dividend yield.