Iron Mountain Stock: High-Yielder Reported “Outstanding” Q3 & Hiked Dividend

Why IRM Stock Is Trading Near Record Highs

Some specialty real estate investment trusts (REITs) operate in interesting industries. There are REITs that own movie theaters, farmland, amusement parks, prisons, cell towers, or casinos, for example.

One specialty REIT that doesn’t get the attention it deserves, even though it’s been firing on all cylinders, is Iron Mountain Inc (NYSE:IRM).

Maybe the low amount of attention has to do with the fact that most people just think of paper shredding when they hear the name “Iron Mountain.” In terms of excitement, that industry pales in comparison to the fun, flashy lights of Las Vegas casinos.

Sure, paper shredding does make up a small portion of Iron Mountain Inc’s operations, but there’s a lot more to it than that. The REIT is the global leader in storage, asset lifecycle management, and information management services.

The company says it’s “trusted by more than 225,000 organizations around the world” to store and protect “billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts.” (Source: “Who We Are,” Iron Mountain Inc, last accessed November 7, 2023.)

The REIT’s customers include 95% of the Fortune 1000 companies. Moreover, its customers like what it does; it has a customer retention rate of 98%.

According to the company’s most recent investor presentation, its real estate network includes 1,380 facilities in 63 countries. Those facilities add up to 95 million square feet (730 million cubic feet of physical volume), which is the equivalent of 1,650 NFL football fields. (Source: “Investor Event & Site Tour,” Iron Mountain Inc, September 20, 2022)

Iron Mountain has been reporting record-high quarterly financial results, and it has set its sights on even stronger growth.

In September 2022, management introduced Project Matterhorn, a five-year plan to capture a larger share of the global addressable market. The plan includes the REIT investing 16% of its revenues (about $4.0 billion) over the 2023–2026 period. Management expects about $150.0 million in one-time costs per year in the 2023–2025 period.

For 2026, Iron Mountain Inc is targeting:

- A revenue compound annual growth rate (CAGR) of about 10% to about $7.3 billion

- An adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) CAGR of about 10% to about $2.5 billion

- An adjusted funds from operations (AFFO) CAGR of about eight percent to about $1.5 billion

Acquisition of Regency Technologies

Iron Mountain recently announced that it was acquiring Regency Technologies, a leading provider of information technology (IT) asset disposition services in the U.S., for $200.0 million. (Source: “Iron Mountain to Acquire Regency Technologies,” Iron Mountain Inc, November 2, 2023.)

Regency Technologies reported trailing fourth-quarter revenues of more than $100.0 million in the IT asset lifecycle management (IALM) space alone.

The acquisition increases Iron Mountain’s operational scale and deepens its capabilities in the IALM sector, incorporating eight new locations in the U.S.

It also extends Iron Mountain Inc’s IT asset remarketing and recycling capabilities. With the volume of e-waste continuing to rise, the demand for IT recycling is going to increase significantly.

Record-High Q3 Revenues & Adjusted EBITDA

For the third quarter ended September 30, Iron Mountain reported total revenues of $1.38 billion, an eight percent increase over the $1.28 billion it reported for the same period of last year. (Source: “Iron Mountain Reports Third Quarter Results,” Iron Mountain Inc, November 3, 2022.)

The company’s net income dropped by 53% year-over-year to $91.0 million, or $0.45 per share. That’s compared to $193.0 million, or $0.48 per share, in the same quarter of 2022.

Iron Mountain Inc’s adjusted EBITDA went up by seven percent year-over-year in the third quarter to a record $500.0 million.

The REIT’s funds from operations (FFO) came in at $0.76, equal to its FFO in the third quarter of last year. Its AFFO inched up in the third quarter of 2023 by one percent year-over-year to $290.0 million, or $0.99 per share.

Commenting on the results, William L. Meaney, Iron Mountain Inc’s president and CEO, said, “We are pleased to report a set of very strong results for the third quarter, including all-time record Adjusted EBITDA and AFFO.” (Source: Ibid.)

He added, “[W]e have set out a path for our growth trajectory with Project Matterhorn. In doing so, our expanded total addressable market[,] along with our widened suite of solutions[,] have enabled us to continue our mission of delivering value for our customers and[,] as a result[,] to achieve revenue growth of 18% and growth in Adjusted EBITDA of 16% on a constant currency basis, or 14% and 12%, respectively, on a reported basis.”

Iron Mountain Stock’s Dividend Hiked for First Time Since 2020

Before the COVID-19 pandemic, Iron Mountain Inc had a history of raising its dividends annually.

Between 2020 and the first half of 2023, management held IRM stock’s quarterly dividend steady at $0.6185 per share. In early August, the company increased its dividend by 5.1% to $0.65 per share, for a yield of 4.2%.

As of this writing, the average dividend yields of the S&P 500 and the Nasdaq are a paltry 1.6% and 1.5%, respectively.

Iron Mountain stock’s dividend is safe. If anything, there’s more than enough room for Iron Mountain to resume increasing its distributions. In fact, its payout ratio has been falling over the last few years, from 81% in 2019 to 66% in 2022.

IRM Stock Up 25% in 2023 & Still Has 21% Upside

Over the last few years, pretty much since bottoming in March 2020, Iron Mountain stock has been marching higher.

Since the start of 2020, IRM stock has more than doubled, advancing 136% (as of this writing). This year, Iron Mountain Inc’s share price is up by 25% year-to-date and 27.5% year-over-year, seriously outpacing the S&P 500 and just slightly behind the pace of the red-hot Nasdaq, which is up by 29% year-to-date and year-over-year.

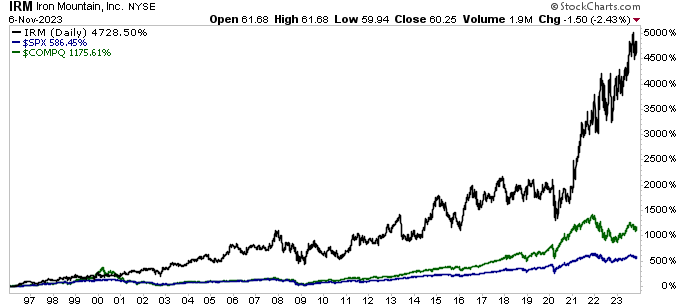

Chart courtesy of StockCharts.com

One thing that Iron Mountain stock has over the S&P 500 and the Nasdaq is its frothy dividends. Since going public in February 1996, with dividends reinvested, IRM stock has posted total returns of 4,728%.

Over the same time frame, the S&P 500 has posted total returns of 586%. The Nasdaq, with its highly touted growth stocks, has posted total returns of 1,175%.

The Lowdown on Iron Mountain Inc

Iron Mountain Inc has a solid balance sheet and recently reported another quarter of record-high revenues and adjusted EBITDA. It also recently signed an agreement to acquire Regency Technologies.

Management expects the company’s momentum to continue, with its full-year 2023 total revenues climbing by about nine percent at the midpoint, its adjusted EBITDA advancing about seven percent at the midpoint, and its AFFO per share growing by about four percent at the midpoint.

This is all good news for Iron Mountain stock’s share price and reliable, high-yield dividends.