Investing in Real Estate: Collect Monthly Income (Without Becoming a Landlord)

One Stock to Retire On

Investing in real estate can be lucrative. That is, if you don’t mind taking on a second job as a landlord. Would-be investors need solid credit and a sizeable down payment. From there, they have to find responsible tenants who won’t damage their investment. After mowing lawns, unclogging toilets, and chasing down late payments, they get to keep whatever is left over at the end of the month.

Thankfully, there’s a solution: my “Virtual Real Estate Investor” strategy. This method allows ordinary people to earn an income stream from rental properties without the hassle of becoming a landlord. I have used this method myself to supplement my income by hundreds of dollars each month.

One of my favorite partnerships in this program has paid monthly rental income to unitholders for decades. And right now, new investors can collect an upfront yield of 4.2%. The business? Realty Income Corp (NYSE:O).

The Business

Realty Income Corp is a pretty straightforward operation to wrap your head around. The partnership buys commercial properties, collects rent from tenants, and passes on the income to investors.

Over the years, the trust has accumulated a sprawling portfolio. It owns some 5,700 properties totaling 90 million square feet. To put that number into perspective, that’s about the same as 622 average-sized “Costcos” laid end-to-end.

Because Realty Income stock trades on a public stock exchange, you can buy or sell units with the click of a mouse. New investors can get started with as little as $65.00. Moreover, a professional management team handles all the day-to-day operations—finding tenants, collecting rent, negotiating lease agreements, etc. All investors have to do is sit back and wait for the checks to arrive.

How reliable is this income stream? Drugstore chain Walgreens Boots Alliance Inc (NASDAQ:WBA) is Realty Income’s largest tenant. This landlord also collects rent from high-quality companies like 7-Eleven, Inc., Walmart Inc (NYSE:WMT), and Dollar General Corp. (NYSE:DG).

Needless to say, these tenants have a lot more rent money than the nice folks answering an ad on Craigslist. They also always pay their bills on schedule and aren’t going out of business anytime soon.

It gets better.

Because of the nature of commercial real estate, Realty Income Corp’s tenants often sign long-term leases. Typically, new renters commit to a 15-year contract. The trust’s average term for remaining leases is about 10 years.

In other words, rent checks come in as if they were on automatic pilot. You don’t have to think about it. Management can literally circle the dates on the calendar as to when they’ll get paid for decades to come.

But here’s the best part. Realty Income rents properties to tenants on what’s called in industry lingo a “triple net” lease. In plain English, tenants have to pay for operational costs like insurance, maintenance, and repairs. Renters even have to pay for all of the property taxes.

So tenants, not investors, bear the risk of renovations, surprise repairs, or property tax increases. Compare that to the hassle of owning a typical rental property; an unexpected expense could wipe out your profit margin for the entire year. Almost every dollar that Realty Income Corp collects flows straight to the bottom line.

The Opportunity

As you can imagine, these qualities mean that Realty Income Corp earns some impressive returns.

In the real estate business, we measure profitability through a metric called the capitalization (cap) rate. This figure takes a property’s operating profit and divides it by the building’s cost. It gives us a rough estimate of how lucrative a real estate deal might be.

In the case of Realty Income, the partnership added 591 properties last year, at an average cap rate of nearly seven percent. That is a great return in a world where bank CDs yield two or three percent.

But the real wealth-building power of real estate doesn’t kick in until later. And it all happens through a little trick called inflation.

Think about all of the parts that go into constructing a building: bricks, nails, lumber, fixtures, pipes, appliances, etc. Now, do you think these parts will cost more in the years to come? How about contractors’ wages? How about the price of land? Yes, all of these component costs will rise over time. And coincidentally, these rising costs will pull up the value of existing properties.

Realty Income Corp owns many existing properties. Their property values increase. Their rents increase.

And with fixed-rate mortgages, they pay back their debt with cheaper dollars. At the end of 20 years, the company controls the properties free and clear. Management then has two options: one, milk the buildings for cash flow or two, refinance and buy a new income property.

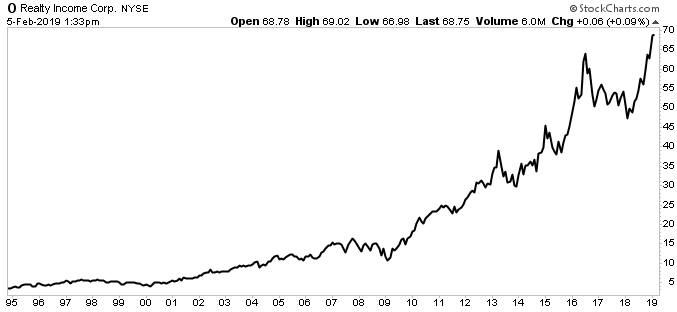

For unitholders, the combination of inflation and high upfront yields has resulted in impressive returns. Since Realty Income went public in 1994, the trust has generated a total gain, including dividends, of 3,290%. By comparison, the S&P 500 delivered a gain of only 890% over that same period. Moreover, Realty Income Corp delivered those returns with far less volatility than the broader market.

Chart courtesy of StockCharts.com

The Dividend

But now here’s the part that really endears me to Realty Income Corp. In an effort to appeal to investors, this trust is one of the few publicly-traded businesses to pay shareholders 12 times per year. In fact, executives went so far as to trademark the tagline “The Monthly Dividend Company.”

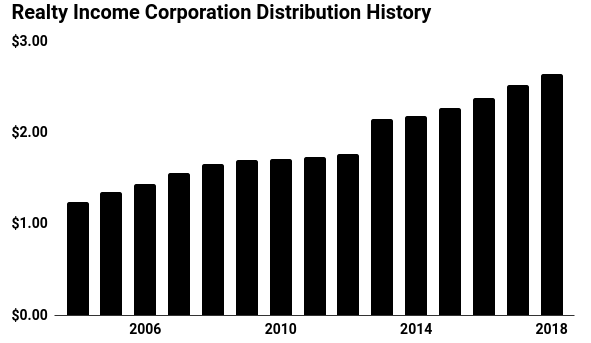

In January, the partnership mailed out its 582nd consecutive distribution to investors (that works out to more than 48 years). What’s more, the company has, since listing publicly in 1994, raised its dividend on 100 occasions.

“Our mission as The Monthly Dividend Company® is to provide our shareholders with dependable monthly dividends that increase over time,” said CEO John Case quite matter-of-factly in his annual letter to shareholders. (Source: “Realty Income Corporation 2017 Annual Report,” Realty Income Corp, last accessed February 5, 2019.)

He added, “This mission has served us well throughout our 49-year operating history and will continue to drive the quality of properties we acquire, the types of capital we raise, and the talents required of our team.”

I love dividend stocks, but they have one big problem: It’s tough to manage quarterly payouts with monthly bills. Doable? Sure. Convenient? Not so much. Realty Income’s monthly payout schedule creates a real win-win for everyone. The partnership gains a loyal investor base, first off. Unitholders, meanwhile, can better match their income with expenses.

Today, Realty Income stock pays an annual dividend of $2.71 per share. At current prices, that comes out to an annual yield of almost four percent.

That upfront payout might not jump off the page. But given enough time, even a modest payout can become quite the income stream.

As an example, unitholders who purchased Realty Income stock when the trust first went public would now be earning a 34% yield on the value of their original investment. Over that period, shareowners would have received $4.76 in dividends on every $1.00 they invested in the business. And I haven’t even counted the impressive capital gains compounded over that time.

This highlights the power of investing long-term in a company that regularly increases its dividend.

I don’t expect that Realty Income Corp will repeat those returns over the next 25 years. The partnership, however, still has several avenues for growing its profits.

In addition to paying out dividends, executives allocate some of the company’s earnings toward buying new retail properties. Realty Income’s raw size allows it to buy packages of buildings at a discount. This provides a quick boost to its profitability and enables the company to earn higher returns than its rivals.

In recent years, management has also expanded into the world of industrial real estate. This segment might not offer the glitz of shopping malls or office towers, but with the advent of e-commerce, demand for warehouse space has exploded (all of those packages need to be stored, shipped, and sorted from somewhere).

This means steep, ongoing rent hikes and great returns for landlords. Overall, analysts project that these efforts should translate into dividend growth of four to six percent annually going forward.

(Source: “Investor Presentation,” Realty Income Corp, last accessed February 5, 2019.)

The Risks

Now, be warned: you can’t call Realty Income stock a slam dunk. Because real estate companies fund most of their purchases through debt, higher interest rates will increase their financing costs. Moreover, e-commerce continues to make road pizza out of traditional brick-and-mortar retailers. That has already resulted in lower rental income for some commercial landlords.

That said, executives have positioned Realty Income Corp well for rising interest rates. Today, the business stands in fine financial health, with a modest debt load and a manageable debt maturity schedule.

More importantly, most of the partnership’s outstanding liabilities are fixed-rate debt (87% in the third quarter). Higher interest rates will slow the company’s pace of acquisitions. It won’t, however, hammer its cash flows like its more leveraged peers.

Furthermore, Realty Income has sailed through the retail industry’s recent turmoil. Over the past decade, management has taken measures to “Amazon-proof” their portfolio. Today, 90% of the company’s rental income comes from tenants that offer non-discretionary, service-oriented, or low-priced products.

The partnership’s expansion into industrial real estate also benefits from the advent of online shopping. In other words, Realty Income shareowners can sleep sound at night. Compared to the rest of its retail peers, Realty Income Corp looks prepared to handle the e-commerce threat.

The Bottom Line

I love real estate. But frankly, I don’t have the patience to deal with tenants. Who wants to spend their golden years fixing toilets, mowing lawns, and chasing down rent checks? My “Virtual Real Estate Investor” strategy sidesteps this problem. And you can find hundreds of real estate businesses set up to serve you.

Realty Income Corp is one of my favorites. With a four percent (and growing) dividend yield, a savvy management team, and commitment to paying investors, this partnership will likely generate outsized returns for years to come.