International Seaways Stock: 9.84%-Yielder Up 55%

Great Yield & Capital Appreciation

Let’s talk about International Seaways stock.

Countries around the world are constantly sourcing energy and chemicals, so this means transportation is key. There are four major avenues for moving energy sources and chemicals: pipes, rail, trucks, and ships.

Often, the product has to be moved across great stretches of water, so this area of transportation will continue to be critical.

A mid-cap player in the water transport space is International Seaways Inc (NYSE:INSW). International Seaways stock currently yields 9.84%, and it has outperformed both the Nasdaq and S&P 500 in 2024 and over the past year.

International Seaways presently owns and operates a fleet of 84 vessels that transport crude, product, and chemicals to ports around the world. (Source: “Company Profile,” International Seaways Inc, last accessed July 8, 2024.)

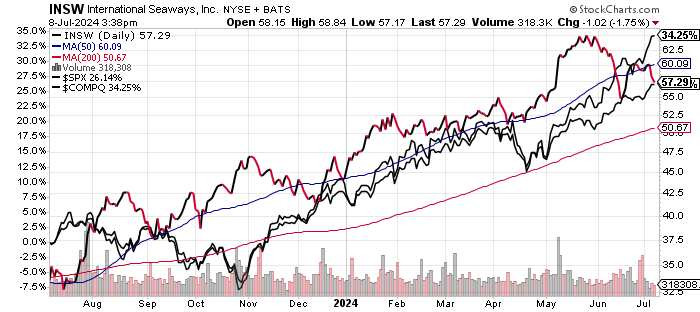

The chart shows the outperformance by INSW stock versus the Nasdaq and S&P 500. International Seaways stock has rallied 62.7% from its 52-week low of $45.51 in July 2023.

INSW stock currently sits below its 50-day moving average (MA) of $60.10 but above its 200-day MA of $51.78.

Technically, the prospects for International Seaways stock are attractive given the golden cross formation on the chart. This a bullish technical crossover when the 50-day is above the 200-day MA.

Chart courtesy of StockCharts

Revenues Crack $1.0 Billion as Free Cash Flow Surges

The last two years have seen International Seaways Inc deliver strong revenue growth.

Revenues increased 192.9% from 2019 to the record $1.07 billion in 2023. This represents an impressive compound annual growth rate (CAGR) of 30.8% during this period.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $366.18 million | N/A |

| 2020 | $421.65 million | 15.1% |

| 2021 | $274.97 million | -34.8% |

| 2022 | $865.51 million | 214.8% |

| 2023 | $1.07 billion | 23.8% |

(Source: “International Seaways, Inc.,” MarketWatch, last accessed July 8, 2024.)

But, as is case with companies following a strong revenue ramp-up, the growth tends to slow.

Analysts estimate that International Seaways will report flat revenues of $1.07 billion in 2024, followed by a 4.7% drop to $1.02 billion in 2025. I expect the actual results will be largely contingent on the global economy. (Source: “International Seaways, Inc (INSW),” Yahoo! Finance, last accessed July 8, 2024.)

A bright spot for International Seaways Inc has been the extremely strong gross margins in 2022 and 2023; they’re the highest readings over the past 10 years.

| Fiscal Year | Gross Margins |

| 2019 | 43.5% |

| 2020 | 57.8% |

| 2021 | 17.9% |

| 2022 | 67.2% |

| 2023 | 70.6% |

The bottom line shows a return to generally accepted accounting principles (GAAP) profitability in 2022 and 2023 following losses from 2016 to 2021. This included a record $11.26 per diluted share in 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.03 | N/A |

| 2020 | -$0.19 | 578.6% |

| 2021 | -$3.48 | -1,731.6% |

| 2022 | $7.78 | 323.6% |

| 2023 | $11.26 | 44.7% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, International Seaways Inc reported an adjusted $10.62 per diluted share in 2023. Analysts predict this will rise to $10.96 per diluted share in 2024 prior to declining to $10.76 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

Note that there are high estimates of $13.09 and $18.37, respectively, for 2024 and 2025.

International Seaways has also churned out positive free cash flow (FCF) over the last five years, except for 2021. FCF came in at a record $481.8 million in 2023, easily surpassing the previous years. The strong FCF allows for steady dividends along with funds for capital expenditures, debt reduction, and share buybacks.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $50.3 | N/A |

| 2020 | $165.6 | 229.2% |

| 2021 | -$155.2 | -193.7% |

| 2022 | $171.1 | 210.3% |

| 2023 | $481.8 | 181.6% |

(Source: MarketWatch, op. cit.)

The balance sheet looks solid despite $711.2 million in total debt at the end of March. International Seaways has $219.6 million in cash and strong working capital. (Source: Yahoo! Finance, op. cit.)

The interest coverage ratio is an extremely healthy 9.2 times, suggesting no current issue with the debt obligations.

International Seaways has also consistently covered its interest payments via higher earnings before interest and taxes (EBIT), with the exception of 2021. Note the strong EBIT/interest ratio in 2023.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) | EBIT/Interest Ratio |

| 2020 | $31.2 | $36.7 | 0.85X |

| 2021 | -$96.2 | $36.8 | N/A |

| 2022 | $445.7 | $57.7 | 7.72X |

| 2023 | $626.1 | $65.8 | 9.52X |

(Source: Yahoo! Finance, op. cit.)

The Piotroski score, an indicator of a company’s balance sheet, profitability, and operational efficiency, shows a strong reading of 7.0, which is just below the top of the 1.0 to 9.0 range.

Fundamentals Support Steady Dividends

International Seaways stock has an attractive forward dividend yield of 9.84%. (Source: Yahoo! Finance, op. cit.)

The company has paid out regular and special dividends over the last three years. So far in 2024, International Seaways has paid $3.07 per share in dividends. This followed $4.31 per share in total dividends in 2023, $1.42 per share in 2022, and $1.36 per share in 2021. (Source: Yahoo! Finance, op. cit.)

Based on the profitability and FCF, we could see the company continue to raise its dividend.

The Lowdown on International Seaways Stock

Institutional ownership is relatively strong, with 355 institutions holding 68.9% of the outstanding shares. Insider interest is high at 23.1% of the shares. This incentivizes company insiders to deliver strong results. (Source: Yahoo! Finance, op. cit.)

International Seaways stock has provided an ideal combination of high dividend yields and capital appreciation. It’s a transportation stock to watch.