INSW Stock: A Beaten-Down 14.38%-Yielder for Contrarians

International Seaways Stock Could Rally 95.9%

Today, I’m putting INSW stock in the spotlight.

The world is increasingly interconnected as global trade grows and the demand for transport solutions rises along with it. Energy and chemical companies employ pipelines, railways, roadways, and waterways to move product. In some cases, the only mode of transport is maritime shipping.

A highly profitable, attractive play in the maritime transport space is International Seaways Inc (NYSE:INSW).

The company currently owns and operates a fleet of 82 vessels that transport crude, product, and chemicals around the world. (Source: “Company Profile,” International Seaways Inc, last accessed December 19, 2024.)

But after trading at a 52-week high of $65.94 in May, INSW stock has been in a tailspin, with its shares down 34.1% over the last three months as of December 19.

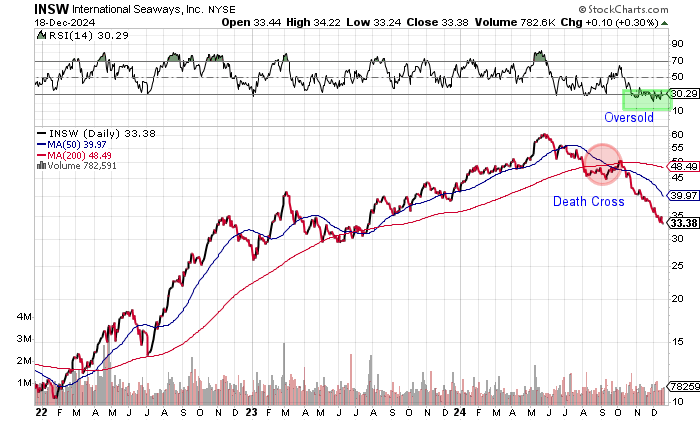

In the process, INSW stock broke below its 200-day moving average (MA) of $51.89 and 50-day MA of $42.50, but it’s in an oversold situation.

The chart shows the stock caught in a death cross, which is a bearish technical crossover when the 50-day MA moves below the 200-day MA. The price deterioration has pushed INSW stock’s dividend yield up to the current 14.38%.

Chart courtesy of StockCharts.com

Valuation Looks Compelling

International Seaways is a major maritime shipper that generated over $1.0 billion in revenues in 2023. The company’s five-year growth has been impressive, with revenues rising by 192.9% from 2019 to the record $1.07 billion in 2023.

| Fiscal Year | Revenues | Growth |

| 2019 | $366.18 million | N/A |

| 2020 | $421.65 million | 15.1% |

| 2021 | $274.97 million | -34.8% |

| 2022 | $865.51 million | 214.8% |

| 2023 | $1.07 billion | 23.8% |

(Source: “International Seaways, Inc.,” MarketWatch, last accessed December 19, 2024.)

Analysts estimate that International Seaways will report a drop in revenues to $957.2 million in 2024 before recovering the $998.8 million level it hit in 2025. There is a high estimate of $1.42 billion for 2025. The valuation for maritime shipping stocks is generally low, as it is with INSW stock trading at a mere 1.6 times its consensus 2025 revenue estimate. (Source: “International Seaways, Inc. (INSW),” Yahoo! Finance, last accessed December 19, 2024.)

The company’s third-quarter revenues of $225.2 million were down from $241.7 million a year earlier, but they were above the consensus. (Source: “International Seaways Reports Third Quarter 2024 Results,” International Seaways Inc, December 19, 2024.)

International Seaways’ bottom line points to generally accepted accounting principles (GAAP) profitability in 2022 and 2023.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | -$0.03 | N/A |

| 2020 | -$0.19 | 578.6% |

| 2021 | -$3.48 | -1,731.6% |

| 2022 | $7.78 | 323.6% |

| 2023 | $11.26 | 44.7% |

(Source: MarketWatch, op. cit.)

Adjusting for the non-recurring expenses, International Seaways reported an adjusted $10.62 per diluted share in 2023. Analysts predict this will fall to $8.00 per diluted share in 2024 and $7.51 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

The low estimates have worried investors as reflected in the share weakness. But even at the lower estimates, INSW stock trades at only 4.4 times the consensus 2025 earnings-per-share (EPS) estimate.

A positive was that the adjusted earnings of $1.57 per diluted share in the third quarter beat the Zacks consensus of $1.42 per diluted share. (Source: “International Seaways (INSW) Surpasses Q3 Earnings and Revenue Estimates,” Yahoo! Finance, November 7, 2024.)

The funds statement shows that the company reached positive free cash flow (FCF) in four of the last five years, including a record $481.8 million in 2023.

International Seaways used some of its FCF to buy back 501,646 shares at an average price of $49.81 per share in the third quarter. (Source: International Seaways Inc, op. cit.)

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $50.3 | N/A |

| 2020 | $165.6 | 229.2% |

| 2021 | -$155.2 | -193.7% |

| 2022 | $171.1 | 210.3% |

| 2023 | $481.8 | 181.6% |

(Source: MarketWatch, op. cit.)

INSW Stock’s Dividends Up 33.8% Versus 2023

INSW stock’s dividend is a combination of regular and supplemental dividends.

With the recent December dividend of $1.20 per share, International Seaways has paid $5.77 per share for 2024. This is $1.46 or 33.8% above the $4.31 per share in dividends paid in 2023. In 2022, INSW stock’s dividends were only $1.42 per share, so the increases have been impressive. (Source: Yahoo! Finance, op. cit.)

Based on the $1.20 payment in December, INSW stock’s forward dividend yield is 14.38%. The payout ratio is a reasonable 63.9% based on the consensus 2025 adjusted EPS estimate. I believe the dividend could increase to above $1.20 per share based on the company’s recent payment history.

| Metric | Value |

| Dividend Growth Streak | 4 years |

| Dividend Streak | 5 years |

| Dividend 3-Year CAGR | 197.0% |

| 3-Year Average Dividend Yield | 7.5% |

The Lowdown on INSW Stock

Institutional ownership in INSW stock is decent, with 364 institutions holding 67.5% of the outstanding shares. Insider interest is high at 18.3% of the shares. This incentivizes company insiders to deliver strong results. (Source: Yahoo! Finance, op. cit.)

International Seaways has also been buying back shares, which is a positive sign. The average Wall Street target price for INSW stock is $65.68, representing a potential gain of 95.9%.

I like the dividend structure for International Seaways and, based on what we have seen so far, I expect dividends to remain strong.