HRZN Stock: A High-Yield Monthly Dividend Stock with Upside Potential

HRZN Presenting a Great Opportunity as Uncertainty Looms

Right now, investors have very mixed feelings about specialty lenders and regional banks. There’s a lot of fear around potential risks, especially after the recent banking sector turmoil. On top of that, uncertainty surrounding interest rates has many income investors wondering where to put their money.

But know this: in times of uncertainty, great opportunities often emerge.

If you’re an income investor hunting for high yields, Horizon Technology Finance Corp (NASDAQ:HRZN) should be on your radar. This business development company (BDC) could be a cash-generating machine for income investors. Currently, investors are little sour on HRZN stock, but that’s great for anyone else who can be patient and who’s in it for the long term.

What Does Horizon Technology Finance Do?

With its corporate office in Farmington, Connecticut, Horizon Technology Finance offers venture loans to innovative companies in the technology, life sciences, health-care information, and sustainability sectors.

Why don’t these business just go to the banks?

The businesses to which this BDC gives loans often require substantial funding to develop new products and expand operations, but traditional banks may hesitate to lend to them due to the risks involved. That’s where Horizon Technology Finance comes in, offering flexible financing solutions tailored to these particular clients.

Since its inception in 2004, Horizon Technology Finance has directly originated and invested $3.5 billion in venture loans made to more than 340 companies. Collectively, the BDC’s team has originated and invested over $5.0 billion in venture loans made to thousands of companies.

As per the most recent data, Horizon Technology Finance’s portfolio includes loan investments in over 50 companies with total fair value of $638.8 million. (Source: “About Us,” Horizon Technology Finance Corp, last accessed March 20, 2025.)

Smooth Financial Sailing Ahead for Horizon Technology Finance

For those who own HRZN stock, it’s important to know that the company’s ability to sustain its high dividend depends heavily on giving a solid financial performance. Remember this: BDCs generate income primarily through interest payments on their loan portfolios and are required to distribute at least 90% of their taxable income to shareholders.

So, what about Horizon Technology Finance’s performance?

In the fourth quarter of 2024, the BDC reported net investment income (NII) of $10.4 million, or $0.27 per share. Its annualized portfolio yield on debt investments was 14.9% for the quarter.

Regarding business conditions, and explaining more in detail, Robert D. Pomeroy, Jr., the chairman and chief executive officer of Horizon Technology Finance, said, “We also further strengthened our balance sheet during the quarter, raising approximately $19 million through our ATM program and completing a private $20 million convertible notes offering, both of which provided us with additional capital to fuel our originations platform. Meanwhile, NAV per share was impacted in the fourth quarter by stressed investments, which we continue to actively manage and support in order to maximize their value. As we progress through 2025, we expect to grow our portfolio through new, high-quality venture debt investments while continuing to focus on improving our credit quality and seeking to increase our NAV.” (Source: “Horizon Technology Finance Announces Fourth Quarter and Full Year 2024 Financial Results,” Horizon Technology Finance Corp, March 4, 2025.)

Put simply, management is saying that things may have been a little rocky, but the there could be smoothing sailing ahead. This is great for HRZN stock.

Get a Monthly Dividend with HRZN Stock

The dividend that comes with HRZN stock is great, too. Shareholders could generate monthly income here.

Currently, HRZN stock has a dividend yield of 14.18%, paying $1.32 per share annually, split into monthly payments.

For the monthly dividend payments coming up in April, May, and June, investors who own HRZN stock will get paid $0.11 per share each month.

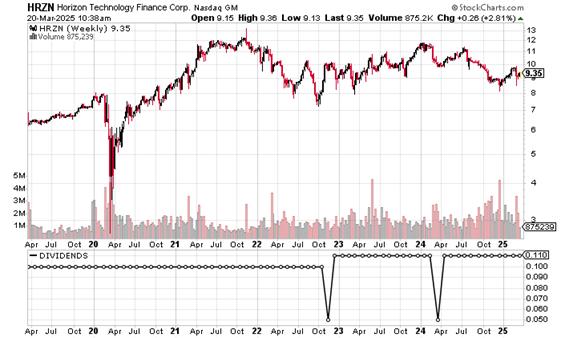

Over the years, the dividends paid to HRZN stockholders have increased. In 2020, its dividends amounted to $1.20 per share. The average five-year dividend yield is around 9.75%, so investors are getting a decent deal here with HRZN stock.

Chart Courtesy of StockCharts.com

The Lowdown on HRZN Stock

HRZN stock’s high yield and monthly payouts make it a tempting choice for income investors. As there have been some turbulence recently for Horizon Technology, its optimistic management makes the case that there could be smooth sailing in the coming quarters. This could mean an increase in investment income, and eventually higher income for those who own HRZN stock.

As it stands, the institutional ownership in HRZN stock is relatively low at about nine percent of the outstanding shares. However, this could change as the BCD’s financials turn around. The three biggest institutional holders of HRZN stock are Green Alpha Advisors, LLC, Legal & General Group PLC, and Truemark Investments, LLC. (Source: “Holders,” Yahoo! Finance, last accessed March 20, 2025.)